AI Financial Wellness App Development

The global market for AI in financial wellness is experiencing rapid expansion, with forecasts projecting growth from $12.8 billion in 2023 to $189.1 billion by 2033, at a compound annual growth rate (CAGR) of 30.9%.

The primary reason behind this growth is the consumers' expectations for financial apps to deliver tailored financial insights and advice. AI financial wellness app development aims to satisfy this requirement.

In this blog, we will explore everything about AI financial wellness applications, including their features, benefits, applications, and development process. This blog is a complete information package, so stay tuned!

Understanding AI-Powered Financial Wellness Apps

The name itself suggests that these apps aim to ensure financial wellness using the potential of artificial intelligence. AI-enabled financial wellness apps are transforming financial management practices. These intelligent solutions analyze your;

- Income

- Spending

- Financial behavior

Such analysis provides clear guidance on budgets, saving goals, and investments. Unlike traditional tools, they adapt quickly, offer personalized advice, real-time alerts, and proactive tips to keep users on track with their finances.

By incorporating features such as automated spending analysis, personalized recommendations, and predictive insights, AI apps for financial wellness help users avoid common money problems and make informed financial decisions.

Such apps ensure that users experience zero financial stress, develop improved savings habits, and achieve better investment outcomes.

As more companies develop AI-based financial wellness apps, they're setting a new standard for accessible and adequate financial support in the modern workplace. This technology marks a significant advancement in how businesses help people achieve financial well-being, offering simple, actionable, and tailored solutions for every user.

Get Started with AI Financial Wellness App Development Today!

Build your AI-powered financial wellness app - smart, secure, and personalized for future-ready success!

Features Incorporated During AI Financial Wellness Apps Development

Our expert team of developers leaves no stone unturned in ensuring that your AI-based financial wellness application is highly functional and resourceful.

1. Personalized Financial Insights

Higher personalization brings higher sales. AI-powered financial wellness software utilize AI to analyze user behavior, including spending patterns, and provide personalized, actionable recommendations that support individual financial goals.

2. Automatic Budgeting and Tracking

Users can manage budgets, categorize expenses, and prevent overspending. An AI financial wellness app utilizes simple dashboards to promote better money habits.

3. Smart Investments and Savings

Our AI-powered apps leverage smart algorithms to recommend personalized savings plans and investment strategies, as per every user's risk tolerance and life stage, for optimal growth.

4. Goal-Focused Financial Planning

With this feature, users can set savings or debt payoff goals, and the app dynamically adjusts recommendations to keep them on track, even if income or circumstances change unexpectedly.

5. Real-Time Alerts

Provides instant updates on suspicious transactions, upcoming bills, and budget progress, along with proactive reminders to guide timely actions and prevent financial setbacks.

6. Seamless Account Aggregation

Aggregates financial data across multiple accounts, cards, and investments. This provides users with a comprehensive financial view in one place, enabling smarter decision-making.

7. AI-Driven Virtual Assistance

Get exceptional virtual assistance with reliable AI chatbot development services. Delegate tasks and increase productivity with financial advice available 24/7.

8. Security and Compliance

Implements robust encryption, secure authentication, and compliance with global data privacy standards, ensuring all sensitive information remains confidential and protected.

9. Comprehensive Financial Education

We include interactive tutorials, explainer videos, and quizzes during AI financial wellness apps development. With such provisions, the users confidently understand and act on recommendations.

10. Collaborative Features for Families & Teams

Supports group financial planning by letting families or teams work together on shared goals, budgets, or investment decisions, increasing transparency across users.

The Use Cases of Our AI-Powered Financial Wellness Apps

We build AI-powered financial wellness apps that ensure multiple use cases. Let's explore!

1. Personalized Budgeting and Planning

The platform provides dynamic budgeting tools that recommend spending limits and suggest saving opportunities. AI tailors these insights to each individual's habits, increasing financial clarity and control.

2. Automated Expense Analysis

Users benefit from real-time tracking and categorization of expenses. The system flags unusual activity and helps users adjust their budgets automatically, reducing the risk of overspending.

3. Virtual Financial Coaching

Intelligent chatbots and virtual advisors provide round-the-clock support, answering questions and offering guidance on steps to achieve financial goals. This makes trusted guidance accessible anytime, without the need for human advisors.

4. Comprehensive Financial Overview

The platform aggregates all financial accounts, displaying everything from bank balances to investments on a single dashboard. This delivers a holistic view, simplifying financial management and planning.

5. Employee Wellness & Benefits Integration

For organizations, AI-powered financial wellness software can be integrated into benefits programs. They personalize support, improve employee engagement, and drive productivity.

6. Fraud Detection & Compliance Monitoring

Advanced algorithms continuously scan transactions to detect fraud and ensure regulatory compliance. This strengthens trust and reduces risk for users and businesses.

7. Predictive Cash Flow Management

Predictive analytics forecasts future cash flow, helping users plan for expenses and avoid liquidity problems. Businesses gain added assurance when offering financial support and guidance.

Build an AI-Powered Financial Wellness App with Suffescom!

Take control of your users' financial future with our smart, scalable, and secure AI wellness app solutions.

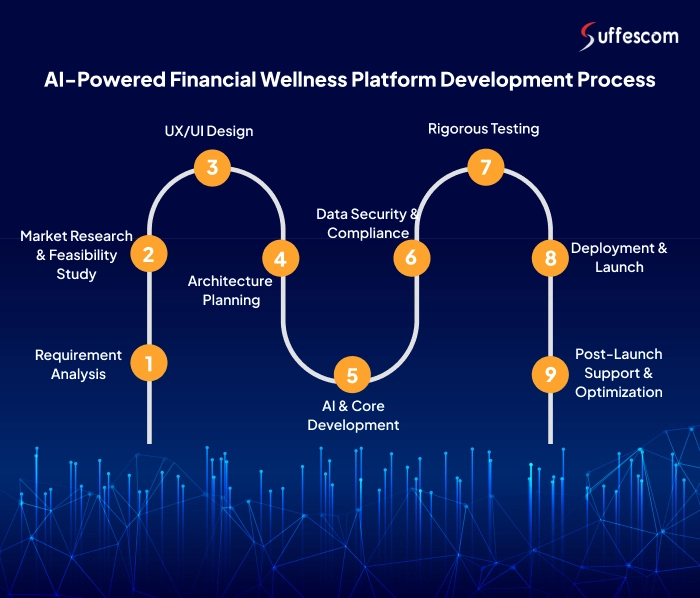

Our AI-Powered Financial Wellness Platform Development Process

Recent industry studies suggest that properly executed, structured app development can reduce project overruns by up to 35% and improve user retention by 50%. Hence, we follow standardized and agile development practices to build AI-powered financial wellness apps, which start with;

1. Requirement Analysis

We start by understanding your business needs, target users, and core objectives to shape the app's vision and feature set. Analyzing requirements initially sets the foundation for all technical and business outcomes, aligning stakeholder expectations.

The best practice is to engage stakeholders early and document requirements. Ineffective requirement analysis leads to misaligned features, budget overruns, or a product that fails to meet market needs.

2. Market Research & Feasibility Study

Our team analyzes market trends, competitor apps, and user pain points to find out what makes a successful financial wellness app. Such studies help identify opportunities and competitive differentiators for a scalable solution.

A professional AI development service always validates concepts with data-driven research and user feedback. Failing to consider this can result in the development of outdated or less relevant features, leading to poor app adoption.

3. UX/UI Design

We design intuitive and accessible user flows, along with wireframes and mockups that reflect your brand values. An appealing UI/UX design ensures ease of use and trust, which are critical drivers of engagement in financial applications.

The team tests early designs with real users; iterates for clarity and simplicity. Avoid any complacency, as poor design can confuse users, increase churn rates, and lead to negative reviews.

4. Architecture Planning

We craft a scalable and secure architecture using best-in-class frameworks suitable for developing AI-driven financial wellness apps. Effective architecture planning guarantees reliability and future scalability as your user base grows.

Weak architecture may lead to expensive rework or security vulnerabilities. Hence, we focus on modular, secure, and flexible back-end architecture.

5. AI & Core Development

Our experts design and integrate AI modules to deliver personalized insights, smart cost analytics, and predictive features. It adds real value for end-users and differentiates your app in the market.

Lacking AI-driven features can make your app less competitive and less valuable to users. Hence, our developers utilize trusted AI libraries and robust machine learning methodologies to achieve effective results.

6. Data Security & Compliance

To ensure the app complies with financial regulations, we deploy end-to-end encryption to protect sensitive user data and build customer trust, a crucial aspect in fintech. What are the right Practices? Regular audits, encrypted transactions, and compliance with laws like GDPR or CCPA.

7. Rigorous Testing

Our team conducts multi-level testing, including functional, security, usability, and performance testing, to remove bugs before launch. This practice prevents costly errors, downtime, or security breaches.

To ensure a smooth launch, our team performs both manual and automated tests, involving real target users. Avoiding testing can increase bugs that can damage reputation, increase support costs, and cause financial loss.

8. Deployment & Launch

We market the app in phases, starting with a controlled launch to monitor performance and user feedback. For effective deployment, we use continuous AI integration services and tools for swift, safe updates.

9. Post-Launch Support & Optimization

Our scope of services is not limited to market deployment; we deliver post-launch support and maintenance assistance as well. After deployment, we provide continuous monitoring, updates, and support to address user needs and keep the app up to date.

Our post-launch support services align regulations with dynamic marketing and technology. Our team regularly updates features and responds quickly to market and user feedback.

Why Suffescom Solutions?

There are various AI risk management software solutions available on the market, but what makes Suffescom Solutions stand out among the rest?

1. Years of Experience and Expertise

With over 13 years of extensive experience and expertise in AI-powered financial app development, we deliver innovative and market-ready solutions.

2. Ease of Personalization

We put a strong focus on personalization at scale by offering tailored financial guidance based on user behavior and goals.

3. Proven Track Record

Proven record of robust data security, compliance with global financial regulations, and end-to-end encryption.

4. Complete Support

We deliver consistent pre- and post-launch support to ensure higher scalability and flexibility, enabling rapid user growth and easy adaptation to evolving regulatory requirements.

5. On-Time Delivery

On-time delivery is our USP with demonstrated experience in delivering on time, within budget, and to high-performance standards.

6. Industrial Recognition

With multiple awards and a proven track record of client success, we have established ourselves as the premier AI development services.

Ending Note!

AI financial wellness app development isn't just a trend; it's a fundamental shift in how we manage finances. From personalized budgeting to predictive savings, these apps are reshaping financial well-being for individuals and organizations alike.

Businesses that embrace AI financial planning assistant apps today will lead the future of accessible and stress-free money management.

At Suffescom Solutions, we blend innovation with experience. Whether you need a full-scale financial platform or a custom finance chatbot development service, we deliver AI-powered apps that are secure, scalable, and truly personalized.

Ready to build the next-gen financial wellness app? Partner with a trusted team that knows how to turn financial goals into digital success stories.

FAQs

1. What is AI financial wellness app development?

As the term itself suggests, it is the process of developing AI-powered applications that assure the financial wellness of an individual or a business.

2. What are the features of an AI-powered financial wellness software?

An AI-based financial wellness application must feature personalized financial insights, automatic budgeting and expense tracking, smart investments and savings, goal-focused financial planning, real-time alerts & notifications, seamless account aggregation, AI-driven virtual assistance, security and compliance, comprehensive financial education, and collaborative features for families & teams.

3. How to build an AI-powered financial wellness app?

The process of developing an AI-based financial wellness application begins with requirement analysis, market research & feasibility study, followed by UI/UX design, architecture planning, AI & core development, data security & compliance, rigorous testing, deployment & launch, and concludes with post-launch support.

4. How much does an AI-powered financial wellness platform development cost?

Developing a scalable, fully functional, and market-ready AI-based financial wellness application costs between $10,000 and $30,000. This cost range includes every essential component, from development to market launch.

5. How to use AI to manage personal finances?

Artificial intelligence aids in various financial planning and management tasks. AI allows users to plan a budget, set payment reminders, track spending, and much more.

6. Can you use AI for enterprise financial planning?

Yes, as far as enterprise financial planning goes, AI is a significant help in ensuring effective financial management. AI assists businesses in automating daily tasks, enhancing forecasting accuracy, and providing financial insights for informed decision-making.