DeFi DEX Aggregator Development: How to Build a Smart Swap Platform in 2026

The decentralized finance (DeFi) ecosystem is evolving rapidly, driven by innovative financial models, emerging technical challenges, and significant advances in blockchain technology. Creating a responsive, efficient, and user-friendly DeFi DEX aggregator platform now requires deep technical expertise and strategic development planning.

A DEX aggregator platform consolidates multiple decentralized exchanges (DEXs) under a unified interface, enabling users to compare prices across markets, access deep liquidity pools, and execute trades seamlessly with optimal routing. By consolidating trading operations through a single DEX aggregator platform, users benefit from significantly enhanced trading experiences and superior execution quality.

If you're planning to create a DEX aggregator platform, partnering with an experienced development company is crucial for success. Suffescom is a reputable blockchain development company providing comprehensive end-to-end decentralized finance development services with proven expertise in DEX aggregator architecture.

What Is a DEX Aggregator?

Unlike centralized exchanges (CEXs) that require users to deposit funds into custodial wallets, a DEX (decentralized exchange) enables peer-to-peer cryptocurrency trading without central intermediaries. Users maintain complete control over funds stored or traded on DEX platforms, a level of autonomy impossible with centralized exchanges. The technology powering decentralized exchanges relies primarily on blockchain networks (especially Ethereum) and smart contracts that automate trade execution and settlement.

A DEX aggregator does not replace individual DEXs. Instead, it aggregates liquidity, pricing data, and optimal trading routes from multiple exchanges simultaneously to identify the most efficient swap execution for users in real time. This aggregation significantly reduces slippage, improves pricing, and enhances overall capital efficiency.

How Well You Are Aware of The Aggregator in Finance?

The concept of aggregators is straightforward to understand. Their function resembles that of traditional financial intermediaries like central banks or commercial banks. Aggregators act as trusted intermediaries between lenders and borrowers, providing higher security levels and reducing counterparty risk.

Aggregators provide financial guarantees and risk mitigation for both lenders and borrowers. Interested borrowers can access loans for a nominal fee, from which the aggregator deducts a commission for providing intermediation services and infrastructure.

This represents a fundamental definition of aggregators that anyone even without extensive financial knowledge can grasp and apply to DeFi contexts.

DEX Aggregator Platform Development

Let’s shed some light on DEX platform and gather some information to make a smart move in DeFi DEX Aggregator Development.

What Is a DeFi Aggregator?

A DeFi aggregator represents one of the most impactful innovations in the decentralized finance ecosystem. A substantial portion of non-custodial trading now occurs through aggregator platforms, reflecting their rapid adoption and proven utility in optimizing DeFi user experiences.

A DeFi aggregator gathers data and liquidity from various DeFi protocols and provides them through a single interface. Instead of using traditional financial institutions, the DeFi aggregator facilitates the interoperability of various decentralized protocols.

Users can access dozens of DEXs, hundreds of liquidity pools, and multiple DeFi protocols using a single wallet connection, eliminating the friction of maintaining multiple accounts, managing separate interfaces, or tracking disparate transaction histories.

DeFi DEX Aggregator Platform Development

DeFi aggregator platform development represents a comprehensive roadmap for building a DeFi-based DEX aggregator. It involves a sequential set of technical and strategic steps designed to bring high-performing decentralized exchanges under one unified interface.

Most businesses entering the DeFi industry share one primary goal: providing users with efficient, intuitive trading experiences despite users' varying levels of blockchain knowledge. A DEX aggregator plays an essential role in simplifying the trading process through intelligent routing algorithms that automatically direct users to the best available trading routes across multiple liquidity sources.

Suffescom is a leading DeFi development company specializing in secure, scalable, and customizable aggregator platforms. The team develops platforms from scratch and also delivers white-label and clone-based solutions tailored to specific business requirements.

White-label DEX aggregator scripts provide ready-to-deploy foundational infrastructure while allowing extensive customization, feature expansion, and branding beyond the original reference platform.

Base Architecture of a DeFi DEX Aggregator

When building a DEX aggregator, emphasis is placed on its foundational architecture, which typically comprises the following components:

- User-Friendly Interface – Intuitive design enabling seamless navigation and trade execution

- Transaction History and Analytics – Comprehensive tracking of past swaps, performance metrics, and portfolio analysis

- Network and Protocol Listings – Display of supported blockchains, DEXs, and liquidity sources

- Available Trading Pairs – Real-time catalog of tradeable token pairs across aggregated exchanges

- Swap Execution and Routing Logic – Intelligent algorithms that optimize trade paths for best pricing and minimal slippage

DeFi DEX Aggregator Development Process

DeFi aggregators function as sophisticated search engines for decentralized trading. They operate on smart contracts developed by experienced blockchain engineers. Smart contracts automate and govern all user-platform interactions, ensuring trustless, transparent execution without intermediaries.

Developing a DeFi aggregator requires adherence to rigorous security protocols and industry best practices. Building a platform where users can identify the most suitable trading options across multiple DEXs is technically complex and demands expert blockchain developers.

Expert developers assist in building user-friendly, secure DEX platforms by carefully considering all client requirements, technical constraints, and market dynamics. To build a high-performance decentralized exchange aggregator, Suffescom employs proven technical expertise accumulated over years of blockchain development, following a strategic, methodical approach refined through dozens of successful projects.

5 Major Steps in DEX Aggregator Development

1. Analyze the Project

In the development process of the DeFi DEX aggregator, the development team first analyzes the project, its goals, competitors, requirements, etc. Further, they build a roadmap accordingly to perform all the operations smoothly and to develop a product that fulfills the expectations of clients and end-users. In this phase, the development team works collaboratively with the project owner to clearly define the scope of the work, timeliness, budget, and build a plan to carry out with development.

2. UI/UX Design

When everything gets planned and a roadmap is built, the team of designers comes into play. It is translucent that aggregators are built to improve the customer experience by offering a single interface for interaction with multiple protocols. So, it becomes necessary to build a platform that is easy to use and engage with customers. Hiring a skillful UX/UI design team can help you in incorporating incredible features into a user-friendly interface that the end users will enjoy.

3. Smart Contract Development

Then begins the development phase. The backend development of DEX aggregators requires the building of smart contracts. Smart contracts are the backbone of the platform, thus, hiring eminent developers with experience in creating smart contracts would do wonders. They will construct the platform according to your requirements and make sure that the dex aggregator development disintegrated with security protocols.

4. Front-End Development

The front-end development is highly imperative since this is the main part of the Dex development with which users interact directly. Developers need to ensure that all the interfacing elements are rightly positioned and users are eligible to interact with the platform more successfully. While doing front-end development, suitable frameworks and libraries are selected.

5. Testing and Auditing

The final part is the testing phase where the newly built platform is thoroughly tested. It ensures that the platform is working properly and all its features are also functioning in the exact manner they are supposed to be. Testing helps in finding any bugs or errors so that they can be resolved as soon as possible before deploying and making it public. As these involve the development of smart contracts, thus testing and auditing become essential.

By following these systematically structured steps, you can build a fully functional, secure, and market-ready decentralized exchange aggregator.

DeFi Aggregator Platform Development Services

Connect with our highly qualified DEX aggregator platform development solution providers. Start your own crypto exchange business with top-tier DEX aggregator platform development services.

How Does DEX Aggregator Work?

The operational mechanism of a DEX aggregator is elegantly simple yet technically sophisticated. Once the aggregator is implemented and integrated, users become eligible to choose the best available deal from dozens of DeFi trading platforms instead of being limited to a single DEX. Aggregators help users optimize trading fees, minimize slippage, and identify optimal token prices within their specified trading parameters.

The aggregator's routing algorithms compile ideal swap rates for end users in milliseconds by scanning multiple liquidity sources simultaneously. They help users avoid rejected transactions, reduce the impact of price slippage, and achieve superior execution quality compared to trading on individual DEXs.

For platform owners, DEX aggregator development helps attract a larger user base to the platform, which ultimately translates into substantial revenue generation through transaction fees and value-added services.

Why Invest in a DEX Aggregator?

While you may now have clarity on what a DeFi DEX aggregator is, you might still be wondering: Why should I invest in DeFi DEX aggregator development?

The high liquidity aggregation protocols used by DeFi DEX aggregators dramatically increase trading speed and execution quality across DeFi platforms. The ability to connect multiple DEXs simultaneously reduces price impact during trades (slippage), making swap operations more efficient and enabling users to execute more profitable trades. Lower transaction costs attract more users to the trading platform, creating positive network effects and increasing platform liquidity.

DeFi yield aggregator software simplifies the process of yield farming and token swapping. Crypto exchange aggregators enable users to automatically switch to high-yielding protocols, boosting returns for both individual users and platform operators.

Benefits of a DeFi DEX Aggregator

DEX aggregator development offers substantial advantages for users, platform owners, and the broader DeFi ecosystem. It delivers improved usability, security, and financial efficiency. Let's examine the key benefits in detail:

1. Increased security

The DEX outperforms CEX in terms of confidentiality and privacy. Additionally, DEX is also responsible for maintaining total control over possessions and avoiding the possibility of losing everything as a result of a hacker attack. Thus, the user doesn't keep any assets in the on-site wallet.

2. Better Liquidity

The extreme control and lack of decentralization seen at CEXs led to the development of DEXs. The DEX is decentralized; however, since it was only recently introduced to the blockchain industry, its liquidity pool is limited. Therefore, someone who wishes to purchase a large number of coins or tokens can easily or significantly change the price. It won't be capable of finishing the transaction. Therefore, consolidating multiple DEXs into a single aggregator enhances the liquidity situation.

3. Better Prices

Slippage is a problem with limited liquidity that can cause the price to fluctuate either upwards or downwards. It performs several substantial operations. Therefore, purchase and sell assets at a price that was not what you had predicted. Price slippage is less for large-scale orders with improved liquidity.

4. Better Trading Conditions

The operations that traders carry out within a single platform are limited. They, therefore, need current price assurance instead of overcoming the challenge of registering on other platforms. As a result, the decentralized exchange aggregator gives you access to the best price offer on numerous DEXs.

Core Functionalities of a DEX Aggregator

Are you all excited about the DeFi DEX platform? Get some goosebumps with some of its exclusive functionalities.

- Yield Farming and Staking – Integrated reward mechanisms for liquidity providers

- Liquidity Pooling and Management – Automated liquidity optimization across protocols

- Token Swaps and Exchange Functionality – Multi-path routing for optimal execution

- Asset Tokenization – Support for wrapped assets and synthetic tokens

- Governance Mechanisms – DAO-based decision-making and protocol upgrades

- Stablecoin Integration – Seamless support for USD-pegged assets

- Interoperability and Scalability Support – Cross-chain compatibility and Layer-2 integration

- Cross-Chain Swap Orchestration Engine – Unified interface for multi-blockchain trading

- Intent-Based Trade Execution Framework – User-defined trade preferences and automated routing

- Flash Liquidity Execution – Atomic transactions for large-volume swaps

- Yield-Aware Routing – Optimize capital efficiency through yield-generating paths

- Privacy-Preserving Transaction Routing – Zero-knowledge proofs for confidential swaps

- On-Chain Governance Execution Modules – Transparent, community-driven protocol evolution

Essential features of DeFi DEX Aggregator Development

DeFi DEX aggregators offer powerful features for platform owners and operators. Here's a comprehensive list of exclusive capabilities:

- Fully Configurable Architecture – Modular design allowing easy feature additions

- Access to Deep Liquidity – Aggregation of dozens of liquidity sources

- High Transaction Throughput – Support for thousands of swaps per minute

- Gas Optimization Mechanisms – Intelligent routing to minimize transaction costs

- Multi-DEX Integration – Seamless connectivity with leading exchanges

- Flexible Token Support – Compatibility with ERC-20, BEP-20, and other token standards

- Transparent Transaction Ledger – Immutable on-chain records for auditability

- AI-Powered Swap Optimization Algorithms – Machine learning for predictive routing

- Multi-Layer Security Framework – Automated audits and vulnerability detection

- Role-Based Admin Console – Comprehensive protocol management and oversight

- Real-Time Performance Dashboard – Live monitoring of platform metrics and risk indicators

Why Building a DeFi DEX Aggregator Makes Strategic Sense in 2026

Build a scalable trading ecosystem using DeFi DEX aggregator software that maximizes capital efficiency and minimizes market slippage.

Rapid Growth in DEX Activity

Weekly decentralized exchange trading volume averaged approximately $18.6 billion in Q2 2025, with unique DeFi wallets rising from ~6.8 million to ~9.7 million, demonstrating strong user adoption and sustained liquidity demand across the ecosystem.

High Routing Volume via Aggregators

Top DEX aggregators like 1inch and Matcha routed over $3.9 billion in weekly volume, proving that users strongly prefer platforms that optimize price discovery, liquidity access, and execution quality.

Deeper Liquidity & Lower Slippage

Aggregators intelligently split trades across multiple liquidity pools, substantially improving execution quality and reducing slippage by up to 90% compared to single-DEX swaps.

Cross‑Chain Reach & Interoperability

Modern aggregators increasingly support multi‑chain routing, enabling users to find the best price across several networks. It is a key advantage as DeFi becomes more fragmented but interoperable.

User Experience & Cost Efficiency

By automating optimal swap paths and gas-efficient routing, aggregators minimize transaction fees and failed transactions, attracting both retail traders and institutional participants seeking reliable, cost-effective execution.

Types of DEX Aggregators for Scalable DeFi Platform Development

Standard DEX Aggregator

Aggregates liquidity from multiple decentralized exchanges to deliver optimal pricing and seamless swap execution.

Cross-Chain DEX Aggregator

Enables asset swaps across multiple blockchains, providing interoperability and access to wider liquidity pools.

Layer-2 DEX Aggregator

Leverages Layer-2 networks to offer faster transactions, reduced gas fees, and improved scalability.

Intent-Based DEX Aggregator

Uses user-defined trade intent to dynamically optimize routing, slippage control, and execution efficiency.

Flash Swap DEX Aggregator

Executes complex or high-volume trades atomically using flash liquidity to minimize capital requirements.

Yield-Aware DEX Aggregator

Routes swaps through yield-generating protocols to maximize user returns alongside trade execution.

Privacy-Focused DEX Aggregator

Implements zero-knowledge or privacy-preserving mechanisms to enable confidential and non-traceable swaps.

Multi-Protocol Smart Aggregator

Integrates DEXs, liquidity pools, and DeFi protocols into a single interface for advanced composable trading.

Launch Your DEX Aggregator with Proven Market Architecture

Build a scalable, secure, and liquidity-optimized DEX aggregator inspired by top market players, engineered for faster swaps, lower slippage, and long-term growth.

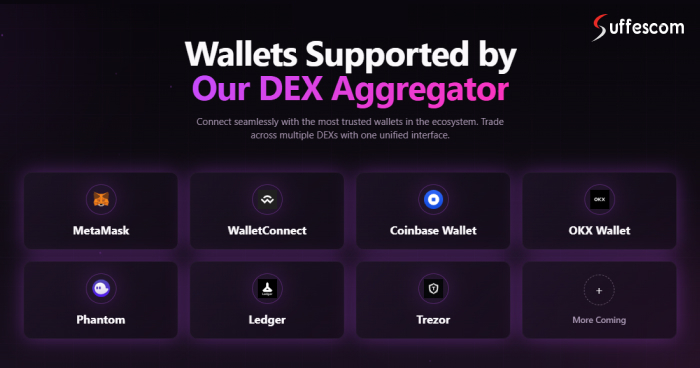

Wallets Supported by Our DEX Aggregator

Our DeFi DEX aggregator supports leading non-custodial wallets to ensure secure authentication, seamless asset management, and frictionless swap execution across multiple blockchain networks.

MetaMask – Enables secure browser-based and mobile wallet connectivity for EVM-compatible networks.

WalletConnect – Provides QR-based wallet connections with broad support for mobile and desktop wallets.

Coinbase Wallet – Supports self-custodial asset management with seamless dApp integration.

Trust Wallet – Allows mobile-first users to access DeFi swaps with multi-chain compatibility.

OKX Wallet – Delivers advanced DeFi access with built-in cross-chain support.

Phantom – Enables Solana ecosystem connectivity for high-speed, low-fee transactions.

Ledger – Adds hardware-level security for users managing high-value digital assets.

Trezor – Ensures offline key storage and enhanced protection for long-term holders.

Top DEX Aggregator Platforms Shaping the DeFi Market

Explore industry-leading DEX aggregator platforms that demonstrate proven liquidity routing, optimized trade execution, and scalable DeFi architectures.

| Platform | Description |

| 1inch | A leading DEX aggregator that uses advanced routing algorithms to source optimal liquidity across multiple decentralized exchanges. |

| Uniswap | A dominant AMM-based DEX offering deep on-chain liquidity and serving as a core liquidity source for aggregators. |

| dYdX | A decentralized trading platform focused on perpetuals and derivatives with high-performance Layer-2 infrastructure. |

| AirSwap | A peer-to-peer trading protocol enabling gas-efficient, RFQ-based token swaps with minimal slippage. |

| SwapZone | A crypto exchange aggregator that compares swap rates across multiple liquidity providers for optimal execution. |

| OpenOcean | A cross-chain DEX aggregator integrating liquidity from DeFi and CeFi sources for enhanced market coverage. |

| AtlasDEX | A cross-chain DEX aggregator leveraging Layer-2 scaling for fast, low-cost decentralized trading. |

| SimpleSwap | A non-custodial swap aggregator enabling instant crypto exchanges without user registration. |

| Matcha | A DEX aggregator powered by professional-grade routing to deliver competitive pricing and MEV-aware execution. |

| Tokenion | A multi-chain aggregation platform focused on simplifying token swaps and liquidity access across ecosystems. |

Technologies Used for Our DeFi DEX Aggregator Development

| Layer | Technology Stack | Purpose & Usage |

| Frontend | React.js, Next.js, Vue.js | Builds responsive, high-performance user interfaces for real-time swap execution |

| Backend | Node.js, Python, Golang | Handles routing logic, API orchestration, and trade execution workflows |

| Smart Contracts | Solidity, Vyper | Develops secure, gas-optimized contracts for swaps, routing, and liquidity access |

| Blockchain Networks | Ethereum, BNB Chain, Polygon, Arbitrum, Optimism | Enables multi-chain and Layer-2 compatibility for scalable trading |

| Web3 Libraries | Web3.js, Ethers.js | Facilitates blockchain interactions and wallet connectivity |

| Price Oracles | Chainlink, Band Protocol | Provides real-time, tamper-resistant price feeds for accurate trade routing |

| Liquidity Protocols | Uniswap, SushiSwap, Curve, Balancer | Aggregates liquidity from leading decentralized exchanges |

| Cross-Chain Infrastructure | LayerZero, Wormhole, Axelar | Supports secure cross-chain asset transfers and swaps |

| Wallet Integration | MetaMask, WalletConnect, Coinbase Wallet | Enables secure, non-custodial user authentication |

| Data Indexing | The Graph, Subgraphs | Indexes on-chain data for analytics, pricing, and transaction history |

| Security & Auditing | OpenZeppelin, Slither, MythX | Ensures smart contract safety, vulnerability detection, and compliance |

| DevOps & Hosting | Docker, Kubernetes, AWS | Supports scalable deployment, load balancing, and infrastructure reliability |

Advanced Security Mechanisms in DEX Aggregator Development

Multi-Signature Wallets

Require multiple cryptographic approvals for critical actions, reducing single-point-of-failure risks and preventing unauthorized access.

Smart Contract Audits

Identify vulnerabilities and logic flaws through comprehensive code reviews and automated security analysis tools from leading audit firms.

Anti-Front-Running and MEV Protection

Prevents transaction manipulation by optimizing order routing and mitigating miner-extractable value (MEV) risks through advanced techniques.

Penetration Testing

Simulates real-world attack scenarios to uncover infrastructure and application-level security weaknesses before deployment.

Gas Optimization for Cost-Efficiency

Implements efficient contract logic and intelligent routing strategies to minimize transaction fees for users without compromising security.

Business Models for DEX Aggregator Platforms

Transaction Fees

Generate sustainable revenue by charging a small percentage (typically 0.1–0.5%) on each completed swap transaction.

Premium Liquidity Services

Offer advanced routing capabilities, faster execution speeds, or priority liquidity access through subscription-based models.

Yield Farming Incentives

Encourage user retention and platform loyalty by integrating reward mechanisms tied to liquidity provision and active trading.

Token Listing Fees

Allow projects to pay for enhanced visibility, priority routing support, and featured placement within the aggregator ecosystem.

Turn DeFi Aggregation into a Revenue-Generating Platform

Partner with experts to develop a custom DEX aggregator that aligns with your business model, supports multi-chain liquidity, and is ready for real-world DeFi adoption.

Future Outlook of DEX Aggregators in Decentralized Finance

Cross-Chain Liquidity Expansion

DEX aggregators will increasingly unify liquidity across multiple blockchain ecosystems, enabling seamless asset swaps and broader market access without manual bridging or wrapped tokens.

AI-Driven Swap Optimization

Advanced machine learning algorithms will analyze market conditions in real time to optimize routing decisions, minimize slippage, and improve execution efficiency based on historical patterns

Layer-2 and Rollup Adoption

Wider integration of Layer-2 networks (Optimism, Arbitrum, zkSync) will significantly reduce gas costs and increase transaction throughput while preserving decentralized security guarantees.

Predictive Price Routing

Aggregators will leverage predictive analytics and on-chain signals to anticipate liquidity shifts and price movements, enabling smarter routing decisions before trade execution occurs.

Institutional-Grade Infrastructure

Future platforms will incorporate sophisticated MEV protection, compliance-ready modules, advanced analytics dashboards, and high-volume trading support to attract professional and institutional traders.

Why Hire Suffescom for DEX Aggregator Development?

When entering the blockchain-based aggregator business, Suffescom represents the optimal choice for comprehensive development services. As a renowned leader in DeFi smart contract development, we maintain a talented team of blockchain developers, UI/UX designers, QA testers, and business analysts. All business needs of your project will be fully addressed, with expert recommendations to improve every aspect of development.

Upon partnering with us, you'll work directly with our team of analysts who will carefully listen to your requirements and build a robust development plan to deliver exceptional results. We have a professional team of experts with extensive experience and deep technical knowledge of DEX aggregator architecture. To date, we have successfully delivered numerous high-quality solutions to clients worldwide.

What You'll Get With Suffescom:

- Top-quality services

- 24/7 technical support

- Team of blockchain developers

- Multiple token standards

- Improved security

Conclusion

Through extensive research and leveraging Suffescom's deep development expertise, we've created this comprehensive guide for those considering investment in DEX aggregator development. The information provided should clarify all concerns regarding DeFi aggregators and inspire you to develop a powerful platform with innovative features and competitive advantages.

With properly architected DeFi aggregators, new users can successfully implement sophisticated trading strategies without understanding the underlying complexities of DeFi infrastructure and smart contract interactions

Contacting Suffescom for decentralized application development services will pave the way for sustainable success in the rapidly evolving DeFi landscape. We will leverage our proven experience and technical expertise to deliver top-quality products using cutting-edge blockchain technology.

FAQs

1. Why choose a DEX development company for aggregator projects?

A professional DEX development company brings specialized expertise in smart contract development, blockchain integration, liquidity routing algorithms, and user-friendly UI/UX design, ensuring your aggregator is secure, efficient, scalable, and competitive in the market.

2. How long does it take to build a DEX aggregator?

The timeline depends on project complexity, feature requirements, and customization scope. A typical DEX aggregator takes 3–6 months from initial planning through design, development, testing, security audits, and deployment.

3. What are the costs of DEX aggregator development?

Development costs vary based on features, blockchain integrations, security requirements, and customization level. Contact Suffescom for a tailored quote based on your specific project requirements.

4. How does Suffescom ensure security in DEX aggregator development?

Suffescom employs rigorous smart contract audits, penetration testing, and industry-standard security protocols to protect your platform from vulnerabilities.

5. Which blockchain is best for building a DEX aggregator?

The choice of blockchain depends on factors like scalability, transaction fees, and liquidity. Ethereum offers high security and ecosystem support, while Binance Smart Chain and Polygon provide faster, low-cost transactions suitable for high-frequency trading and smaller swaps.

6. Can DEX aggregators support cross-chain swaps?

Yes, modern DEX aggregators can integrate multiple blockchains to enable seamless cross-chain swaps. This allows users to trade assets across different networks without needing multiple wallets or manual bridging.

7. How do DEX aggregators ensure price accuracy?

Aggregators scan multiple liquidity pools in real time and use advanced routing algorithms combined with oracle feeds. This ensures users receive the best swap rates while minimizing slippage and avoiding failed transactions.

8. What is gas optimization in DEX aggregators, and why is it important?

Gas optimization reduces transaction costs for users by batching swaps, leveraging Layer-2 solutions, or employing smart contract efficiency techniques. It enhances user experience and encourages higher trading volumes on the platform.

9. How does a DeFi DEX aggregator development company ensure platform security?

A professional DeFi DEX aggregator development company implements smart contract audits, MEV protection, encrypted API gateways, and penetration testing to safeguard transactions and user assets.

10. Can a DEX aggregator integrate yield farming and staking?

Absolutely, DEX aggregators can incorporate yield farming and staking modules. This allows users to earn additional rewards while trading, increasing engagement and creating multiple revenue streams for the platform owner.