Fractional ownership platform development is transforming the way people invest in real estate. Instead of buying entire properties, investors can now own a share, making high-value assets more accessible than ever.

This trend is picking up fast, with real estate leading with 30.50% of the asset tokenization market share in 2024, and this number is expected to rise exponentially.

For real estate developers, tech companies, and financial institutions, this presents a promising opportunity. Whether you're looking to attract modern investors, digitize your offerings, or tap into potential revenue streams, fractional ownership platforms offer a scalable solution.

As traditional investment barriers break down, more investors are seeking simplified and secure entry points into the real estate sector.

In this blog, we'll walk you through what fractional ownership platforms are, how they work, and why developing one today could position your business at the forefront of a booming market.

Think of a real estate fractional ownership platform as a dedicated application that splits the cost of a property amongst a group of people - everyone contributes and receives a share.

Similarly, these platforms allow multiple investors to jointly own a property, each holding a portion based on their investment.

This shared ownership model enhances the appeal of property investment app development for businesses seeking to serve investors who desire access to premium properties without requiring substantial capital.

With real estate prices increasing in prime locations, fractional ownership offers a lower-risk entry point. Instead of one person owning an entire commercial building or luxury condo, several people co-own it.

They share not just ownership, but also rental income and property appreciation. These platforms handle everything, from legal compliance to digital documentation, making the process seamless and transparent.

Partial real estate ownership platform development, anchored by the shared investment model, is emerging as a robust business model for both real estate firms and tech startups.

As demand for flexible investment options grows, these platforms are opening new doors for property buyers, investors, and developers.

Collaborate with seasoned professionals to turn your vision into a real estate fractional ownership platform that supports future growth.

Let’s understand the social, political, and economic reasons behind the rising popularity of real estate fractional ownership platforms.

Growing urban populations and the rise of remote work trends are increasing demand for second homes and flexible investments. Various platforms, such as Pacaso, offer shared vacation property ownership catering to such a trend.

Community initiatives are on the rise, and with changing generations, this phenomenon is taking shape and becoming a norm. From co-working spaces to fractional real estate ownership, community investment is a key driver behind the growth of these platforms.

The United States' policies, such as bonus depreciation benefits, incentivize blockchain-based real estate investment and increase demand for platforms providing tax-benefitting fractional shares.

Tax deductions and other favorable governmental incentives indirectly support fractional platforms by facilitating real estate investment.

Property prices are rising; in June 2025, U.S. home prices increased by 1.1% compared to the previous year. This is driving demand for fractional shares with low entry points.

Fractional ownership offers higher returns than REITs due to tax benefits and zero annual fees, making the partial real estate investment model attractive to investors seeking passive income.

Blockchain and real estate tokenization software enhance transparency and liquidity, making platforms appealing to global investors. Various fractional ownership platforms are already available in the market, and many are still in progress.

Our fractional property investment app development process adds essential and resourceful features. Let's explore!

Our platform incorporates AI algorithms to automate investment decisions. Machine learning models analyze market trends and investor preferences to provide personalized investment recommendations.

Liquidity pools facilitate the instant buying and selling of property shares. This technical setup ensures that investors can access their funds quickly, enhancing the platform's overall liquidity.

Smart contracts automatically calculate and distribute rental income to investors. This feature ensures timely and accurate payouts, improving cash flow management for investors.

Our platform is designed with flexible smart contracts that eliminate mandatory holding periods, allowing investors to buy and sell shares at their convenience without restrictions.

We integrate decentralized governance mechanisms, enabling investors to participate in property-related decisions through secure voting systems. This feature fosters community engagement and decentralized management.

The platform is optimized for fractional ownership of commercial properties. We tailor our platform to incorporate technical frameworks that address the unique requirements of commercial real estate investments.

We reduce the minimum investment threshold by leveraging fractionalization technology. It makes real estate investing accessible to a broader audience without compromising on security or functionality.

Our platform supports various investment structures, including individual accounts, LLCs, and Self-Directed IRAs (SDIRAs), through customizable technical configurations that cater to different investor needs.

We develop a built-in secondary market where a robust trading engine powers the trading of property shares, ensuring secure and efficient transactions.

Investors can borrow against their tokenized shares through integrated DeFi (Decentralized Finance) protocols. This ensures additional financial flexibility while maintaining asset security.

The platform includes specialized modules for managing single-family rental properties, optimizing for high-demand markets, and ensuring efficient property management.

We automate property management tasks, from tenant screening to maintenance, using IoT and AI technologies, allowing investors to enjoy a truly passive investment experience.

Our platform allows tenants to invest in the properties they rent, aligning their interests with property upkeep using integrated investment options and tenant portals.

The technical architecture supports a wide range of property types, including residential, commercial, and industrial, providing investors with broad market exposure.

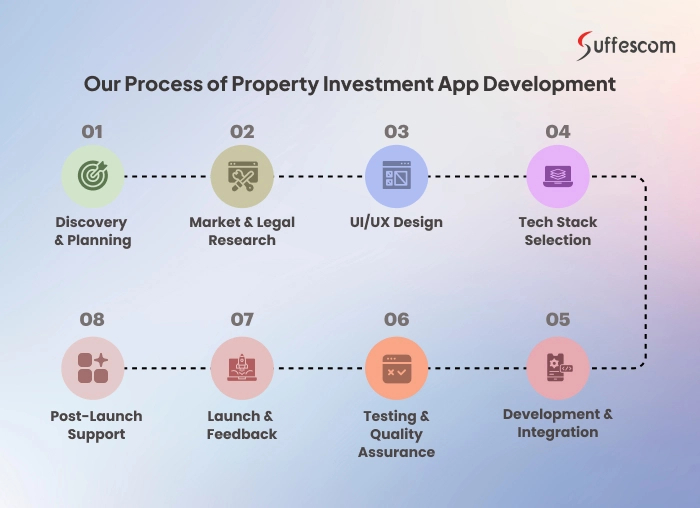

Developing a real estate fractional ownership platform involves more than coding. It’s about building a secure, trusted, and scalable product that supports the partial real estate investment model, while offering a seamless user experience.

Here's how we guide our clients through the process step by step:

The first step is defining what you want your platform to achieve. We help you identify your

Planning before development reduces the scope of errors and ensures a lower asset tokenization development cost by minimizing the need for rework. Skipping this step could result in a poor product-market fit. We visualize user journeys and wireframes, which saves time and money later using tools like Miro and Figma.

We ensure your platform aligns with property laws and securities regulations. We collaborate with legal advisors to shape your platform's ownership model and ensure it meets the compliance regulations.

Failure to adhere to legal compliance may result in legal complications. Research tools like LexisNexis and consultation frameworks streamline the process.

A clean, simple interface helps attract and retain investors. We design intuitive layouts using tools like Adobe XD and Sketch. The right UX increases user satisfaction and trust, which is essential for financial platforms. Missing this step leads to lower conversions.

Your platform must be secure, fast, and scalable. Focusing on selecting the right tech stack brings the desired results. We use React.js for the frontend and either Node.js (JavaScript) or Django (Python) for the backend, depending on project needs, and PostgreSQL or MongoDB for the databases.

We build RWA tokenization platforms with a modular architecture. We integrate APIs for KYC (e.g., Onfido), payments (Stripe or Razorpay), and document storage (AWS or Firebase). This approach improves reliability and makes future updates easier.

We follow agile development methodology, which helps us develop in a way that our clients desire and achieve high accuracy.

Thorough testing using tools like Selenium and Postman ensures the app performs under pressure. It helps spot security gaps, payment bugs, and compliance errors. We implement various testing practices to ensure system integrity.

After deployment, we monitor usage patterns with tools like Google Analytics and Hotjar. We gather early feedback to fine-tune features. A soft launch helps avoid PR risks and ensures real-world readiness.

We provide ongoing updates, regulatory compliance, and user support to ensure that we build a real estate crowdfunding platform that remains competitive and compliant.

Inspire confidence and unlock new opportunities for your investors through intuitive, reliable, and expertly crafted tokenized real estate investment solutions.

Choosing a partner for fractional ownership platform development is a major business decision. Suffescom Solutions stands out for its expertise, reliability, and future-ready approach, making it the best choice.

“We're making it easier for companies to shift from conventional ownership models to secure blockchain systems. Our tailored platforms are built to evolve with clients' needs and regional regulations,” says the CEO of Suffescom Solutions.

Our portfolio covers over 50+ tokenization and NFT marketplace projects, demonstrating impactful launches, modern UI/UX, and a strong history in asset tokenization for homes, offices, rentals, and more.

We deliver robust blockchain platforms designed for secure fractional ownership and smooth transactions. With over 13 years of hands-on experience in blockchain solutions, Suffescom's track record shows proven success in real-world projects.

Complex financial regulations are a frequent challenge in the real estate market. To address this, our real estate tokenized investment platforms feature built-in KYC/AML tools, ensuring seamless compliance with global, federal, and local regulations.

Our development team implements industry-leading safeguards, including end-to-end encryption, two-factor authentication, and regular smart contract audits. These measures protect investor data and build trust on your platform.

Whether working with single assets, portfolios, or developing a white label tokenization platform, Suffescom ensures scalability and quick deployment. We build a real estate crowdfunding platform with modular structures, tailored for diverse property types and investment models.

Our blockchain-based systems are built for scalable performance, leveraging layer-2 blockchain solutions. It ensures smooth operations, even as your user base and transaction volume increase.

With a compliance-first approach, our legal team supports projects through all regulatory stages in every region. The team assists with legal structuring, documentation, and provides clarity on token regulations. Such a provision is advantageous in the USA, UK, and UAE markets.

Our services do not end at market launch; the scope extends to post-launch support. Choose us for ongoing 24/7 technical support, maintenance, user onboarding, and training.

Suffescom delivers timely updates as laws change, keeping every aspect of your platform legally sound and trouble-free.

The real estate tokenization market is projected to grow to approximately $16.5-$19.4 billion by 2033. This indicates that the future of real estate investment lies in shared ownership.

Fractional ownership platforms are not just changing how people invest, but also opening up new business opportunities. With growing interest in shared property models, now is the ideal time to launch your platform.

Suffescom Solutions offers a readymade and white label fractional ownership platform that helps businesses enter the market quickly and confidently. Our solutions are easy to customize and built to scale with your business.

As a trusted asset tokenization development company, we've helped startups and enterprises unlock new value through modern real estate solutions.

If you're a real estate firm, tech startup, or investor looking to ride this wave of change, the moment is now. Let's build the future of real estate together.

The platform enables users to fractionally invest in real estate properties and enjoy significant returns.

Yes, they let you invest in high-value assets with less money and shared ownership risks. The functionality of this platform increases if you opt for professional fractional ownership platform development.

Some top tokenized real estate investment platforms include RealtyMogul, Arrived Homes, Yieldstreet, and Myre Capital. Another platform can be the one that you are about to develop.

The cost of developing a real estate partial property investment app ranges between $15,000 and $30,000, inclusive of all components, from development to market launch. Please note that the cost depends on various factors, including project scope, complexity, infrastructure, and others. It is advisable to contact the development team to obtain exact prices.

Essentially, a real estate tokenization platform includes automated investing, liquidity pools, rental income distribution, no lockup periods, community voting, commercial real estate focus, flexible investment management, secondary market integration, diverse investment options, and many more.

The process of partial real estate ownership platform development starts with discovery & planning, followed by market & legal research, UI/UX design, tech stack selection, development & integration, testing & quality assurance, and ends at market launch.

Fret Not! We have Something to Offer.