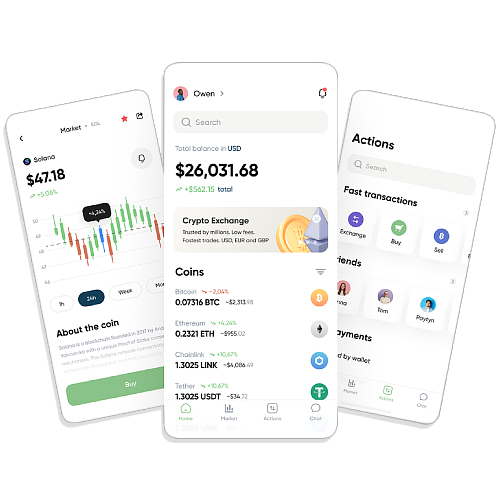

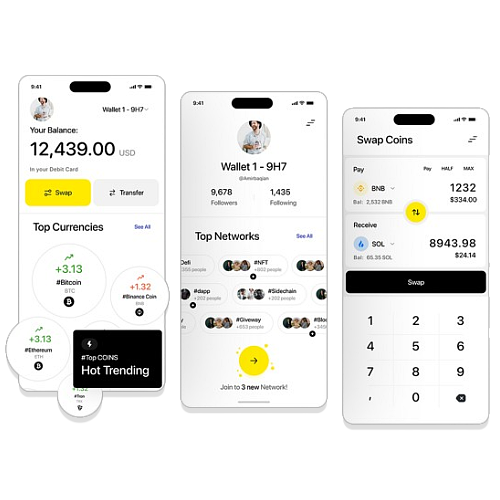

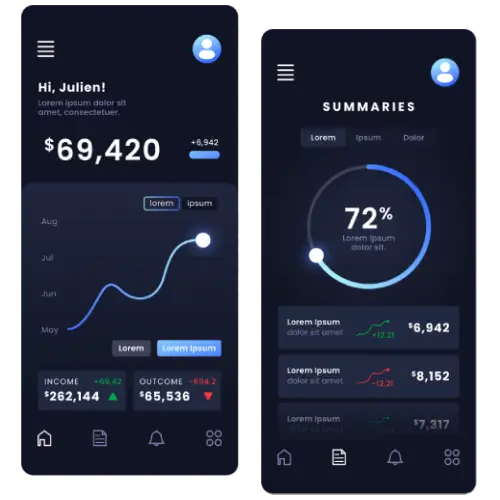

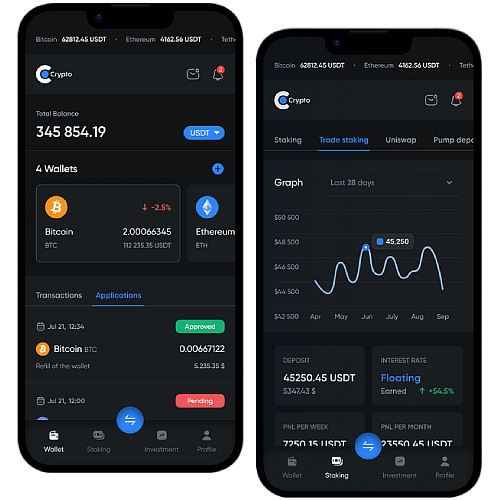

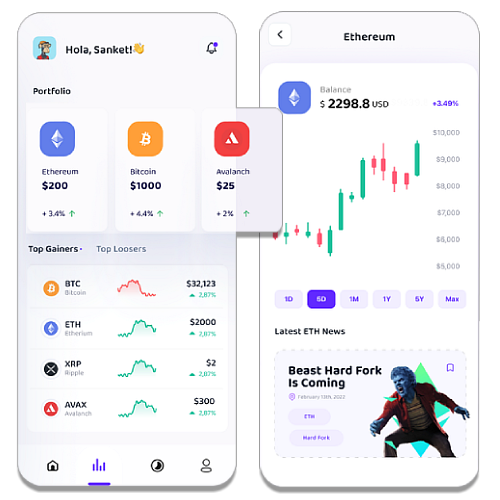

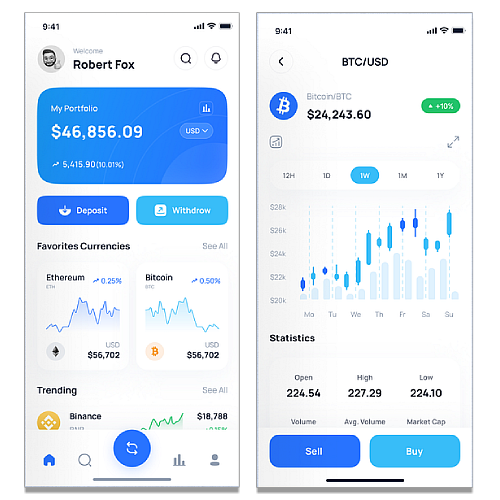

Crypto Trading Bot Development Company

Build AI-powered crypto trading bots that execute strategies 24/7 with precision. Suffescom delivers custom trading bot development services for arbitrage, market making, scalping, and grid trading. Our bots integrate seamlessly with major exchanges, process real-time market data, and automate high-frequency trades while maintaining institutional-grade security and compliance.