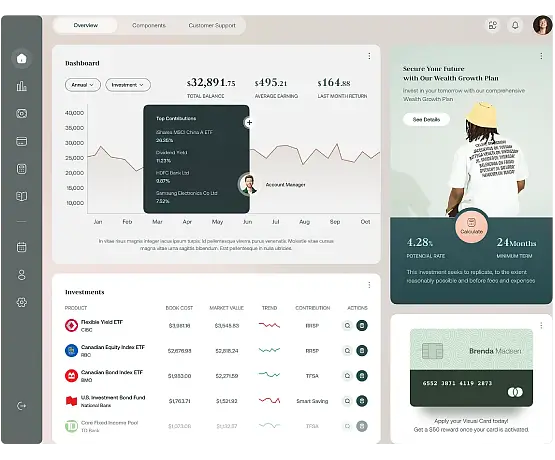

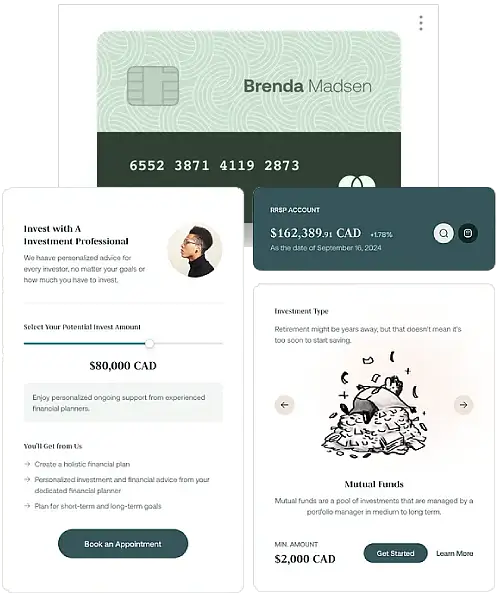

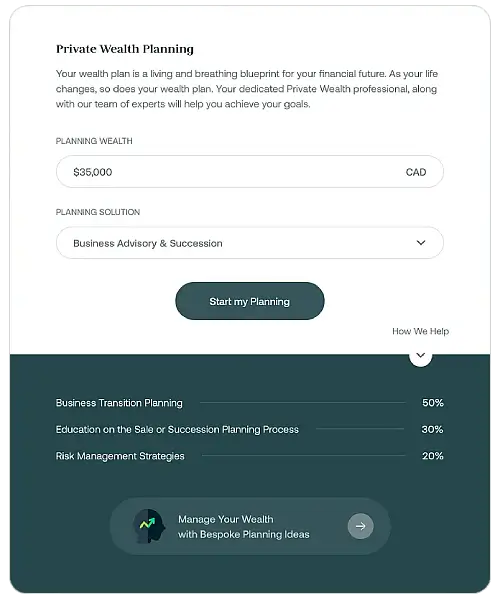

White Label Investment Platform

Suffescom Solutions empowers fintech and trading businesses with readymade investment platform that manage portfolio and engage investors effectively. Our AI-driven tools deliver real-time analytics, automated trading, and multi-asset support. We help enterprises build platforms for investment that are secure, scalable, and progressive.