White Label Digital Banking App & Platform Development

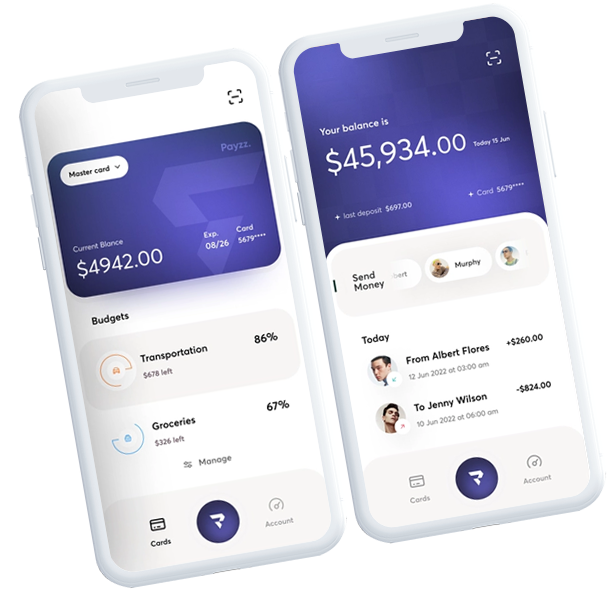

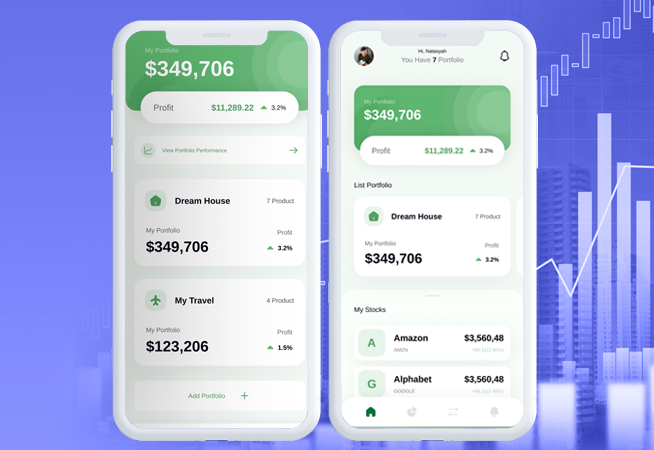

Launch a scalable white label digital banking platform designed for modern fintech growth. Our white label mobile banking app enables secure fund management, rapid deployment, and seamless customer experiences through a fully brandable, compliance-ready solution.

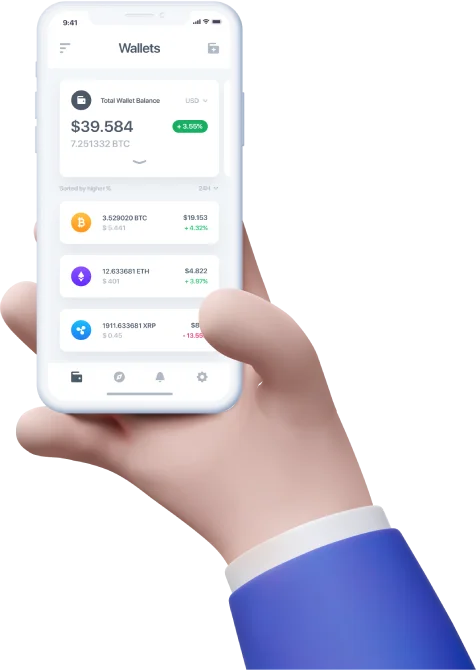

- Blockchain-powered banking

- On-chain & off-chain support

- Crypto-ready infrastructure

- Smart contract automation

- Multi-currency ecosystem

- Enterprise-grade security