White-Label Crypto-to-Fiat Software for Instant Global Payments

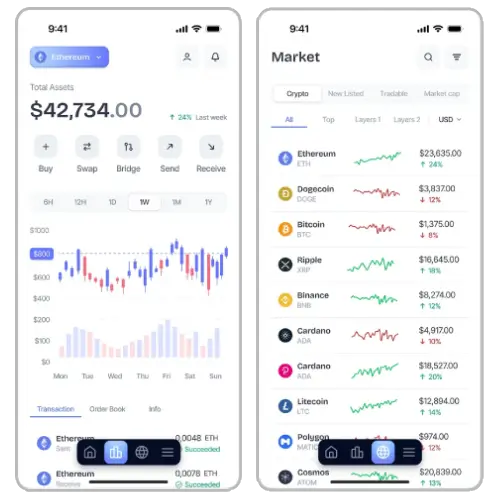

Suffescom offers a robust White-Label Crypto-to-Fiat Wallet Solution that helps businesses seamlessly connect cryptocurrencies to traditional currencies through a fully branded, ready-to-launch platform. Our solution supports secure crypto storage, instant fiat conversion, real-time rates, and compliant payment integrations. It enables fintechs, exchanges, and enterprises to go live faster while scaling confidently in a regulated digital economy.