1inch Exchange Clone: How to Build a DEX Aggregator Like 1inch

The world is becoming increasingly decentralized, with the finance industry experiencing the most significant transformation. This shift has led to the rapid rise of DeFi (decentralized finance), which improves efficiency by reducing transaction fees and eliminating centralized control.

Unlike centralized systems, decentralized finance democratizes control and leverages blockchain technology to develop financial applications that function without intermediaries.

A DeFi ecosystem like the 1inch Network holds the spotlight. It is a decentralized finance aggregator that streamlines cryptocurrency trades by aggregating liquidity from multiple DEXs (decentralized exchanges), ensuring users receive optimal rates and minimal slippage.

But the real question is: Are 1inch Network-like DeFi platforms disrupting, transforming, or redefining business and financial ecosystems?

What Is a 1inch Exchange Clone Platform?

A 1inch-like platform is a multi-DEX liquidity aggregator that:

- Scans hundreds of decentralized exchanges for optimal pricing

- Splits trades across multiple liquidity pools for best execution

- Finds the most profitable execution route using advanced algorithms

- Reduces slippage and gas fees through intelligent routing

- Supports cross-chain asset swaps across 15+ blockchain networks

Rather than acting as a single exchange, it functions as an intelligent routing layer positioned above DEX protocols such as Uniswap, PancakeSwap, Curve, Balancer, and others.

How Our 1inch-Like DeFi Ecosystem Is Transforming Modern Financial Systems?

1inch-like DeFi platforms enable users to optimize trades across hundreds of DEXs on various blockchain networks. Let's explore how these platforms are fundamentally transforming financial system architecture.

1. Decentralized Liquidity Aggregation

DeFi platforms like 1inch extract liquidity from various DEXs, combining it from multiple sources to present the best possible trade prices. This reduces slippage by up to 90% and ensures superior rates for large-volume trades through advanced aggregation technology and intelligent routing mechanisms.

2. Smart Contracts & Automation

Enable trustless transactions and minimize counterparty risks by eliminating intermediaries. Smart contracts automate transactions without middlemen, and the assurance of transparent, immutable execution reduces manipulation risks and ensures protocol integrity.

3. Yield Farming & Staking

Platforms like 1inch clones allow users to earn rewards by staking tokens in DeFi protocols. Features include comprehensive risk and reward analysis, such as evaluating impermanent loss and APY (Annual Percentage Yield) fluctuations. Stakers can also participate in protocol governance, further democratizing the ecosystem.

4. Cross-Chain Interoperability

DeFi platforms enable seamless connectivity between multiple blockchain ecosystems for frictionless transactions. Layer 2 scaling solutions, optimistic rollups, and cross-chain bridges help optimize transaction costs and speed for enhanced cross-chain aggregation.

5. High Transparency and Security

Decentralized protocols offer robust security compared to traditional banking systems. Decentralization serves as the primary security model, reducing systemic risks by eliminating centralized control points. On-chain transparency and cryptographic verification mechanisms build complete user trust and auditability.

Develop DeFi DEX Platform With Tested 1inch Clone Script

Working Process of Our 1inch Clone Script

Our 1inch Clone Script follows a streamlined, decentralized workflow that ensures secure asset swaps, efficient liquidity utilization, and transparent yield generation. The process is divided into user operations and admin control modules to maintain scalability, performance optimization, and protocol governance.

User-Side Workflow

Web3 Wallet Integration

Users initiate the process by connecting a compatible Web3 wallet (MetaMask, WalletConnect, Coinbase Wallet). The platform supports secure wallet authentication using blockchain-based signature verification.

Order Type Selection

Users select their preferred transaction type based on current market conditions, such as instant swaps, limit orders, or routed trades to optimize pricing and execution.

Swap Pair Configuration

The system allows users to select from thousands of supported token pairs. Smart routing algorithms automatically identify the most efficient liquidity paths across multiple pools and DEXs.

Swap Execution and Confirmation

Once confirmed, the smart contract executes the swap using aggregated liquidity to minimize slippage, reduce gas costs, and ensure optimal pricing

Asset Settlement

After successful execution, the traded digital assets are instantly transferred to the user's connected wallet with on-chain confirmation and transaction receipt.

Liquidity and Farming Workflow

Liquidity Pool Participation

Users can contribute assets in predefined ratios to liquidity pools, enabling decentralized market making and improving overall protocol depth and stability.

Liquidity Pair Selection

Participants select liquidity pool pairs based on APY metrics, historical performance, and risk parameters displayed on the analytics dashboard.

Asset Locking Mechanism

Assets are locked in smart contracts following deterministic ratios (e.g., 50:50 or custom weights), ensuring pool stability and accurate pricing mechanisms.

LP Token Issuance

Liquidity providers receive LP (Liquidity Provider) tokens representing their proportional pool share, which can be used for yield farming or governance participation.

Yield Generation and Rewards

Users earn rewards from transaction fees and protocol incentive tokens, distributed proportionally to LP token holdings through automated smart contract execution.

Farming Module Operations

Farming Pool Access

Users access multiple farming pools to maximize returns on LP tokens through strategic staking across various reward programs.

Farming Pair Selection

Available farming pairs are displayed with real-time reward metrics, emission rates, and historical APY data for informed decision-making.

LP Token Staking

Users stake LP tokens in farming contracts to participate in reward distribution cycles and protocol incentive programs.

Reward Claim Process

Earned tokens can be claimed directly to the connected wallet through automated smart contract execution with minimal gas fees.

Admin-Side Control Workflow

Wallet Address Management

Admins manage user wallet records, implement blacklisting for malicious addresses, and ensure compliance with protocol policies and security standards.

Swap Pair Management

Admins can add or remove swap pairs based on liquidity availability, market demand, trading volume, and security considerations.

Revenue Configuration

The platform enables configurable fee structures, including protocol fees, liquidity provider incentives, and treasury allocations.

Liquidity Pool Governance

Admins monitor and manage liquidity pools to ensure capital efficiency, mitigate impermanent loss risks, and maintain healthy pool ratios.

Farming Pair Administration

Admins configure farming pools, reward emission rates, staking durations, and incentive mechanisms to maintain long-term ecosystem sustainability.

The Essentiality of DeFi Protocol Like 1inch dApp for Crypto Investing

Whether for novice or experienced crypto investors, 1inch exchange clone script solutions offer numerous advantages. From increasing blockchain efficiency to delivering higher returns, DeFi solutions like 1inch are ideal crypto investment tools.

1. Higher Efficiency and Returns

DeFi platforms like 1inch eliminate the need to manually search across various DEXs, saving essential time and effort. Additionally, their aggregation technology provides optimal rates for trades, maximizing returns by up to 5% compared to single-DEX trading.

2. Access to Various Liquidity Sources

Platforms like 1inch ensure a broad base of potential buyers and sellers by aggregating liquidity from 300+ DEXs. This increases trade execution rates and reduces the risk of encountering limited liquidity on any single DEX.

3. Reduced Slippage

Advanced routing algorithms minimize price impact during trades, especially for large-volume transactions, protecting investors from unfavorable price movements and reducing slippage by up to 90%.

4. Gas Fee Optimization

Intelligent routing and transaction batching mechanisms reduce transaction costs by up to 42%, making crypto trading significantly more cost-effective, particularly during network congestion.

5. Multi-Chain Accessibility

Support for 15+ blockchain networks provides access to diverse liquidity pools and investment opportunities across different ecosystems, including Ethereum, BSC, Polygon, Avalanche, Arbitrum, Optimism, and more.

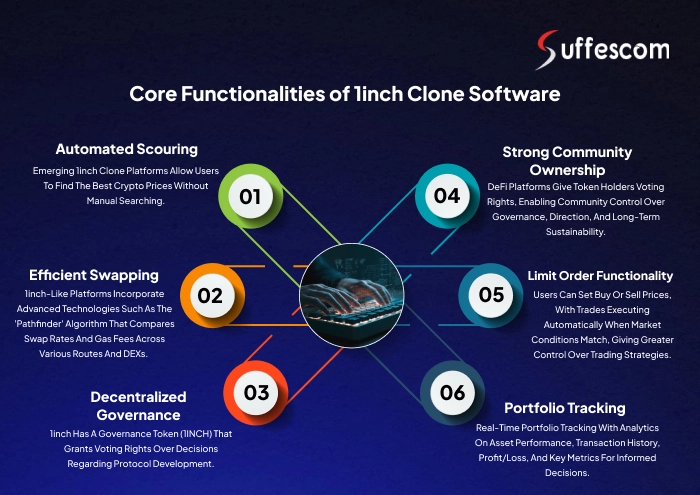

Core Functionalities of 1inch Clone Software

The real power lies in the functionalities offered by 1inch-like DeFi platforms, which maximize efficiency and usability. Let's explore the core functions that help us understand how these platforms transform financial ecosystems.

1. Automated Scouring

Emerging 1inch clone platforms allow users to find the best crypto prices without manual searching. These platforms act as intelligent personal assistants, automatically scouting for optimal rates by simultaneously searching through various decentralized exchanges (DEXs).

2. Efficient Swapping

1inch-like platforms incorporate advanced technologies such as the 'Pathfinder' algorithm that compares swap rates and gas fees across various routes and DEXs. It identifies the most efficient route for swaps, helping users save valuable cryptocurrency on transaction fees.

3. Decentralized Governance

1inch has a governance token (1INCH) that grants voting rights over decisions regarding protocol development. Voting rights include proposals for new features, strategic partnerships, treasury management, and fee structure modifications.

4. Strong Community Ownership

DeFi platforms grant voting rights to token holders, increasing community ownership and empowering users to guide the platform's evolution, strategic direction, and long-term sustainability.

5. Limit Order Functionality

Users can set specific prices at which they want to buy or sell tokens, with automatic execution when market conditions meet their criteria, providing more strategic control over trading strategies.

6. Portfolio Tracking

Real-time portfolio monitoring with detailed analytics on asset performance, comprehensive transaction history, profit/loss statements, and performance metrics for informed decision-making.

How Our Proven Strategies Help Users Maximize Returns on 1inch-Like DeFi Platforms?

Several strategies can improve returns on your cryptocurrencies when using 1inch exchange clone software for DeFi trading.

1. Understand and Maximize Slippage

Understanding slippage is crucial because it helps one grasp the dynamic nature of crypto markets. Slippage is the difference between the expected cryptocurrency amount during a swap and the actual amount received after trade execution. Mastering slippage dynamics helps maximize returns and minimize unnecessary losses.

2. Utilize Advanced Order Types

1inch clone script development platforms offer advanced order types for strategic trading:

- Limit Orders - Specify desired prices for buying or selling cryptocurrency, ensuring execution only at favorable rates that match your trading strategy.

- Stop-Loss Orders - Manage risk with automated order processing based on predetermined stop prices. Set stop prices below current market price (for selling) or above (for buying) current holdings. Orders execute automatically when market prices reach stop levels, protecting capital.

- Monitor Market Trends - Understanding market trends that influence crypto prices helps you buy low and sell high. Stay informed through technical analysis, news monitoring, and on-chain analytics.

- Choose Long-Term Investment - Long-term investment strategies often yield superior results, but thorough research of crypto projects, tokenomics, and team credentials is essential before committing capital.

3. Risk Considerations

Analyzing and understanding risks is the most crucial step in maximizing returns. Therefore, approach DeFi with a strong focus on comprehensive risk management.

- Liquidity Pools Risks - Consider yield opportunities with sufficient liquidity depth. Low liquidity makes withdrawals difficult, increases slippage, and can lead to major losses during market volatility.

- Smart Contract Risks - Smart contracts can contain vulnerabilities, bugs, or logical errors that may compromise funds or yield opportunities. Always verify third-party audits.

- Regulatory Risks - The evolving regulatory landscape around DeFi affects the legality, tax implications, and long-term profitability of yield farming activities across jurisdictions.

- Platform Risks - Your chosen platform for yield farming may experience operational issues, security breaches, oracle failures, or shutdowns that can result in permanent fund loss.

Witness the Best DeFi Protocol Like 1inch dApp Solutions

How 1inch-Like DeFi Platforms Are Reshaping Industries Beyond Finance

Undoubtedly, DeFi solutions have transformed financial systems across the entire industry landscape. Let's explore which other sectors have benefited from DeFi platforms like 1inch:

1. Banking and Finance

- Processes borderless financial transactions 24/7

- Reduces dependency on conventional banking infrastructure

- Lower transaction fees (60–90% reduction)

- Instant cross-border settlements without intermediaries

2. Commercial Lending

- Smart contract-based lending reduces intermediaries and overhead

- Faster collateralized lending with competitive, algorithm-driven interest rates

- Enhanced credit accessibility for underserved markets and emerging economies

- Automated loan processing, disbursement, and repayment trackin

3. Insurance

- Automated and transparent claims processing through smart contracts

- Trustless smart contract execution for secure transactions

- Reduced operational costs with decentralized risk pools

- Parametric insurance with instant, automated payouts based on verified events

4. Real Estate

- Fractional ownership with tokenization

- Enhanced liquidity with blockchain-based property transactions

- Significantly reduced intermediary fees and closing times

- Transparent, immutable property records and ownership history

5. Supply Chain

- Blockchain-based product tracking, provenance, and authenticity verification

- Minimizes fraud risks and counterfeit products

- Cross-border trade financing and invoice factoring

- Real-time inventory management and logistics optimization

6. Healthcare

- Easy access to medical services with decentralized payment solutions

- Secure, interoperable electronic health records (EHR) systems

- Decentralized medical insurance models and claims processing

- Transparent pharmaceutical supply chains and drug authentication

7. E-Commerce

- Lower payment processing fees with decentralized payment solutions

- Reduces fraud risks, chargebacks, and payment disputes

- Tokenized loyalty programs and reward mechanisms

- Direct peer-to-peer marketplaces without platform fees

8. Gaming & NFTs

- True in-game asset ownership and secondary market trading

- Play-to-earn economic models empowering players

- NFT marketplace integration for digital collectibles

- Cross-game asset interoperability and portability

Benefits of Choosing a 1inch Exchange Clone Script to Launch a Decentralized Exchange

Opting for a 1inch exchange clone enables businesses to launch a fully decentralized, high-performance trading ecosystem backed by proven DeFi mechanics.

Account-Free User Onboarding

The 1inch clone software eliminates traditional account registration processes. Users can access the platform directly via Web3 wallets, ensuring frictionless onboarding and true decentralized access without email verification or personal data collection.

KYC-Free Trading Architecture

Since the platform operates on a non-custodial model, there is no requirement for centralized KYC verification. This preserves user anonymity and privacy while maintaining protocol-level security and compliance where legally permissible.

Multi-Wallet Integration Capability

A white-label 1inch clone supports seamless integration with multiple cryptocurrency wallets (MetaMask, WalletConnect, Trust Wallet, Coinbase Wallet, Ledger, Trezor). It enables users to connect their preferred wallets without interoperability constraints.

Multi-Language Interface Support

The platform architecture supports multilingual UI implementation, allowing global user adoption and improved accessibility across different geographic regions and language preferences.

High Scalability and On-Chain Transparency

Built on scalable blockchain infrastructure, the 1inch exchange clone ensures transparent transaction execution, fully verifiable on-chain records, complete auditability, and immutable transaction history.

Optimized Transaction Speed and Security

Smart routing algorithms and gas optimization techniques ensure faster transaction settlement while maintaining industry-leading cryptographic security standards and protocol integrity.

Immutable Smart Contract Framework

All core functionalities are governed by immutable, audited smart contracts, preventing unauthorized alterations, ensuring protocol integrity, and building user trust through transparency.

Fully Decentralized Trading Ecosystem

The 1inch clone script operates without centralized control, offering permissionless access, trustless execution, decentralized liquidity aggregation, and censorship-resistant trading.

Modular Customization and Flexibility

Businesses can customize UI components, color schemes, branding elements, fee models, liquidity routing logic, and governance parameters to align with their specific business strategy and competitive positioning.

Proven DeFi Model with Market Validation

The 1inch exchange clone software is based on a well-established DeFi model that has already demonstrated scalability, liquidity efficiency, user adoption, and market product fit with billions in trading volume.

Enterprise-Grade Security and Reliability

Advanced encryption protocols, professionally audited smart contracts, multi-signature wallets, and decentralized execution make the platform highly secure, reliable, and trustworthy for large-scale operations.

How to Build a DEX Aggregator Like 1inch: Key Features & Considerations

Developing a DeFi platform like 1inch is streamlined with assistance from a reliable DeFi platform development company. Several features are crucial for achieving maximum efficiency when you create a 1inch clone platform.

1. Liquidity Aggregation Engine

Combines resources from multiple DEXs and channels funds into unified liquidity pools, scanning 300+ DEX protocols for optimal pricing, minimal slippage, and superior execution quality.

2. Multi-Chain DeFi Wallet

Creates a mobile and web wallet that operates across multiple blockchains, enabling users to manage assets and explore Web3 seamlessly through robust, secure DeFi wallet development with hardware wallet support.

3. Advanced Smart Contract Development

Smart contract development ensures security, gas efficiency, and optimal performance with professionally audited and battle-tested code that minimizes vulnerabilities and prevents exploits.

4. Portfolio and Asset Management

Tracking tools that provide precise, real-time information on crypto asset performance, enabling users to manage investments effectively with comprehensive analytics, historical data, performance metrics, and profit/loss tracking.

5. API Integration

Access the best prices on self-custodial asset swaps. Integrate wallets or dApps seamlessly with third-party API integration for connectivity with external platforms, data providers, and analytics tools.

6. Governance & DAO Integration

Implementing decentralized governance models enhances transparency and enables community-driven decision-making through token-based voting mechanisms, proposal systems, and on-chain governance execution.

7. Physical or Virtual Payment Card

A payment card solution allowing users to spend digital assets directly at millions of merchants worldwide, effectively reducing the gap between crypto holdings and everyday real-world transactions.

8. Decentralized Autonomous Organization (DAO)

Governs the network by enabling token holders to participate in decision-making processes, protocol upgrades, treasury management, and strategic governance through transparent, on-chain voting mechanisms.

9. Multi-Chain & Cross-Chain Capabilities

Expand DeFi access beyond a single blockchain with support for 15+ networks including Ethereum, BSC, Polygon, Avalanche, Optimism, Arbitrum, Fantom, Harmony, Gnosis Chain, and more.

10. User-Friendly Interface & Analytics

Enhanced user experience for seamless transactions with intuitive dashboards, comprehensive real-time analytics, responsive design across devices, and mobile-optimized interfaces.

11. Pathfinder Algorithm

Advanced routing mechanism that intelligently splits trades across multiple DEXs to achieve the best possible execution rates and lowest gas fees through optimized path calculations and liquidity analysis.

12. Limit Order Functionality

Allow users to set desired prices for token swaps with automatic execution when market conditions are met, providing more strategic trading control and advanced order management capabilities.

13. Gas Token Integration

Implement gas token mechanisms (Chi, GST2) to reduce transaction costs during network congestion periods, enabling users to optimize gas expenses during peak trading times.

14. Aggregation Protocol SDK

Provide developers with comprehensive tools, libraries, and documentation to integrate your aggregator into their applications, expanding ecosystem reach and enabling third-party integrations.

White Label 1inch Clone Solution: Ready-to-Deploy Platform

Our white-label 1inch clone solution provides a completely customizable, ready-to-deploy platform that you can brand as your own and launch within 2–4 weeks.

What's Included:

Complete Source Code

- Full ownership and customization rights

- Clean, documented, and audited code

- Modular architecture for easy updates

Multi-Chain Support

- Pre-integrated with 15+ blockchain networks

- Cross-chain swap functionality

- Easy addition of new chains

Smart Contract Suite

- Audited aggregation contracts

- Gas-optimized routing logic

- Upgradeable contract architecture

User Interface

- Modern, responsive web interface

- Mobile-optimized design

- Customizable branding and themes

Admin Dashboard

- Comprehensive analytics

- User management tools

- Fee configuration

- Protocol monitoring

Security Features

- Multi-signature wallet support

- Rate limiting and anti-bot measures

- Secure API endpoints

- Regular security audits

Documentation & Support

- Complete technical documentation

- Integration guides

- 24/7 technical support

- Training sessions

Our 1inch Clone Development Cost Breakdown

We develop high-quality DeFi protocols like 1inch dApps ranging from $10,000 to $30,000. This 1inch clone development cost includes every essential factor and component. Let's understand the detailed cost breakdown:

| Cost Component | Percentage Share | Estimated Cost ($) |

| Blockchain Development | 25%-35% | $2,500-$10,500 |

| Smart Contract Development | 20%-25% | $2,000-$7,500 |

| Frontend & UI/UX Design | 15%-20% | $1,500-$6,000 |

| Backend Development | 10%-15% | $1,000-$4,500 |

| Security & Audits | 10%-15% | $1,000-$4,500 |

| Third-Party API Integrations | 5%-10% | $500-$3,000 |

| Testing and Deployment | 5%-10% | $500-$3,000 |

| Maintenance & Support | 5%-10% | $500-$3,000 |

Factors Affecting Cost:

Complexity Level:

- Basic aggregator: $10,000-$15,000

- Standard features: $15,000-$25,000

- Advanced functionality: $25,000-$30,000+

Blockchain Networks:

- Single chain: Lower cost

- Multi-chain (5-10 networks): Medium cost

- Extensive multi-chain (15+ networks): Higher cost

Customization:

- White label solution: $10,000-$20,000

- Custom development: $20,000-$50,000

- Enterprise solution: $50,000+

Revenue Models for Your 1inch Exchange Clone

Transaction Fees

Charge a small percentage (0.1–0.3%) on each swap executed through your platform, generating consistent, scalable revenue proportional to trading volume.

Governance Token

Launch a native governance token that can appreciate in value as your platform grows, creating additional revenue streams through token economics, staking mechanisms, and ecosystem incentives.

Premium Features

Offer advanced features like enhanced portfolio analytics, advanced limit orders, priority routing, API access, and white-label solutions for premium subscribers through tiered subscription models.

API Licensing

Monetize your aggregator through API access fees charged to third-party integrations, institutional partners, and applications seeking programmatic trading access.

Staking Rewards

Generate revenue through staking mechanisms where users lock tokens for governance rights, with platform fees collected on staking rewards and yield generation.

Advertising & Partnerships

Partner with DeFi projects for featured token listings, sponsored content, banner placements, and promotional opportunities within the platform interface.

Technology Stack Used in Our 1inch Exchange Clone Script

| Layer | Technology Stack | Purpose |

| Frontend (Web) | React.js, Next.js, TypeScript | High-performance UI rendering, responsive design, and seamless user interactions |

| Mobile Application | Flutter, React Native | Cross-platform compatibility for Android and iOS with native-like performance |

| Backend | Node.js, NestJS | Scalable server-side logic, API handling, and business workflow management |

| Blockchain Networks | Ethereum, BNB Chain, Polygon, Arbitrum | Multi-chain support for decentralized trading and liquidity aggregation |

| Smart Contracts | Solidity | Secure, immutable, and automated execution of swaps, staking, and liquidity logic |

| Wallet Integration | MetaMask, WalletConnect, Trust Wallet | Secure Web3 wallet connectivity and transaction signing |

| Liquidity Aggregation | Custom Routing Algorithms | Optimized price discovery and minimal slippage across multiple DEXs |

| Database | MongoDB, PostgreSQL | Efficient data storage, transaction indexing, and analytics processing |

| Oracles | Chainlink | Reliable real-time price feeds and external data integration |

| Security | SSL Encryption, Smart Contract Audits, DDoS Protection | End-to-end platform security and threat mitigation |

| Cloud & Hosting | AWS, Google Cloud | High availability, load balancing, and infrastructure scalability |

| DevOps & Monitoring | Docker, Kubernetes, Prometheus | Automated deployment, container orchestration, and performance monitoring |

| APIs | REST, WebSockets | Real-time market data streaming and system communication |

| Compliance & Logging | Role-Based Access Control, Activity Logs | Administrative control, traceability, and system governance |

Our Strategic Methodology for Building a 1inch Exchange Clone Platform

At Suffescom, we follow a structured and agile-driven methodology to deliver a robust, scalable, and secure 1inch exchange clone tailored to your business objectives. Our development approach ensures seamless customization, rapid deployment, and long-term platform reliability.

1. Requirement Analysis and Discovery

We assess your business model, target audience, blockchain preferences, liquidity strategy, and competitive positioning to ensure precise platform alignment with market needs.

2. Strategic Planning and Architecture Design

A detailed exchange blueprint is created, covering system architecture, smart contract logic, liquidity routing algorithms, user workflows, and security protocols.

3. UI/UX Prototyping and Visual Modeling

An interactive prototype is shared to validate interface design, user journeys, trading flows, and branding consistency before full-scale development begins.

4. Custom Design and Platform Engineering

Approved designs move into full-scale development, including smart contract coding, aggregator logic implementation, backend system architecture, and comprehensive UI customization.

5. Quality Assurance and Functional Testing

The platform undergoes rigorous testing under real trading conditions to verify security, performance optimization, transaction accuracy, gas efficiency, and wallet compatibility.

6. Deployment and Go-Live Execution

After validation and security audits, the platform is deployed to the live blockchain environment, with optional support for mobile app launches on Android and iOS app stores.

7. Post-Deployment Support and Optimization

Ongoing support includes continuous performance monitoring, security updates, feature enhancements, protocol upgrades, and scalability optimization as user demand grows.

Why Suffescom Solutions for 1inch Network-Like DeFi Clone Development?

Choose the best! When discussing premier DeFi platform development services, Suffescom Solutions stands out as the ideal choice. Here's why:

1. Years of Experience and Expertise

We have provided best-in-class development solutions to clients across multiple industries for over 13 years, with 500+ successfully delivered projects and a 95% client satisfaction rate.

2. Advanced Blockchain Architecture

As a reliable DeFi platform development company, we deliver robust and scalable blockchain solutions on networks like Ethereum, BSC, Polygon, Avalanche, Arbitrum, Optimism, and more. Our blockchain architecture facilitates high-speed, low-cost transactions.

3. Robust Smart Contract Development

Our smart contract developers understand that smart contracts are the core of DeFi platforms. Our smart contract development services ensure:

- Gas optimization for cost efficiency

- Secure Solidity-based smart contracts

- Automated trade execution

- Third-party security audits

4. Multi-Chain Compatibility

Multi-chain compatibility is essential for scaling and improving DeFi platform efficiency. Our 1inch DEX aggregator clone integrates:

- Cross-chain swaps

- Interoperability between multiple blockchain ecosystems

- Quick and inexpensive transactions with Layer 2 solutions

5. Gas Fee Optimization Mechanism

Our high-quality DeFi aggregators apply advanced gas fee optimization techniques, including:

- GasToken mechanism for reducing transaction costs

- Optimizing transaction batching

- Smart order routing

- Chi gas token integration

6. Complete and Constant Maintenance & Support

Our services extend beyond application deployment with reliable customer support including:

- Bug fixes and security patches

- Updating protocols and feature enhancements

- Support for API integrations

- 24/7 technical assistance

FAQs

1. How much does a 1inch network-like DeFi platform development cost?

We charge between $10,000 to $30,000 to deliver a 1inch like DeFi platform development solution. The cost range includes various components such as blockchain selection, feature complexity, customization level, and security requirements.

2. What are the benefits of using a 1inch-like DeFi platform for crypto trading?

DeFi platforms like 1inch help execute trades at optimal prices, reduce slippage by up to 90%, optimize gas fees by 42%, ensure access to deeper liquidity, and provide decentralized, trustless multi-chain operability for superior efficiency.

3. Which is the best DeFi ecosystem like a 1inch network development company?

Suffescom Solutions is the ideal DeFi protocol development company. With 13+ years of experience, Suffescom has delivered cutting-edge solutions for maximum growth, serving 500+ clients across 45 countries with a 95% satisfaction rate.

4. How long does it take to develop a 1inch clone platform?

Development timelines vary based on project scope:

- White label solution deployment: 2-4 weeks

- Custom development: 3-6 months

- Enterprise solution: 6-12 months

The timeline depends on complexity, features, and customization requirements.

5. What blockchain networks does your 1inch exchange clone script support?

Our 1inch exchange clone script supports 15+ blockchain networks including:

- Ethereum

- Binance Smart Chain

- Polygon

- Avalanche

- Optimism

- Arbitrum

- Fantom

- Harmony

- Gnosis Chain

And more with easy addition of new networks.

6. Can I customize the 1inch clone to match my brand?

Absolutely! Our white label 1inch exchange clone solution offers complete customization:

- Logo and branding

- Color schemes and themes

- Domain and naming

- Feature additions/removals

- Fee structures

- Supported tokens and networks

7. What is the difference between a DEX and a DEX aggregator?

A DEX (Decentralized Exchange) is a single trading platform for cryptocurrency swaps, while a DEX aggregator like 1inch scans multiple DEXs simultaneously to find the best prices, lowest fees, and optimal liquidity across the entire DeFi ecosystem, ensuring superior execution for users.