Decentralized prediction markets are quickly turning into a mainstream financial technology. They allow traders to place bets on the outcome of real-world events such as politics, sports, and economic data using blockchain-based smart contracts.

Polymarket, one of the most popular decentralized prediction market platforms, has shown significant market growth. It has been adopted with monthly trading volumes of over $1 billion and hundreds of thousands of active users.

A Polymarket clone script is a pre-built solution for businesses and Web3 startups to quickly launch their own decentralized prediction market platform without investing 6-12 months in development. They can start operating event-based trading markets in weeks instead.

The growing interest in institutional investment and the global adoption of prediction markets make this an opportune time for crypto exchanges, Web3 companies, and fintech startups to enter this new market.

A Polymarket clone script is a ready-to-deploy software solution that enables businesses to launch decentralized prediction markets modeled after Polymarket's architecture. It comprises the complete technology infrastructure required to operate a prediction market platform, including:

Core Technical Components:

Market Categories Supported: The platform enables prediction markets across diverse real-world domains:

The solution supports automated market creation, dynamic odds calculation, cryptocurrency-based trading, and transparent on-chain settlement. With full white-label customization capabilities, businesses can rapidly deploy a branded prediction market platform aligned with specific business objectives.

| Feature | Polymarket Platform Details |

| Platform Type | Decentralized, blockchain-based prediction market enabling global event trading. |

| Sign-Up Bonus | $10 onboarding bonus available through promotional campaigns. |

| Minimum Deposit | No mandatory minimum deposit requirement for participation. |

| Market Settlement | Instant settlement after event resolution through smart contract execution. |

| Withdrawal Speed | Typically processed within minutes depending on network confirmation. |

| Mobile Accessibility | Dedicated mobile applications available for both iOS and Android devices. |

| 7-Day Market Volume | Approximately $1.7 billion in trading activity across prediction markets. |

| Liquidity | High liquidity across trending and major event markets. |

| Trading Fees | Around 0.01% (1 basis point) based on total contract premium on US platform. |

| Core Advantage | Transparent on-chain trading powered by blockchain infrastructure and automated settlement. |

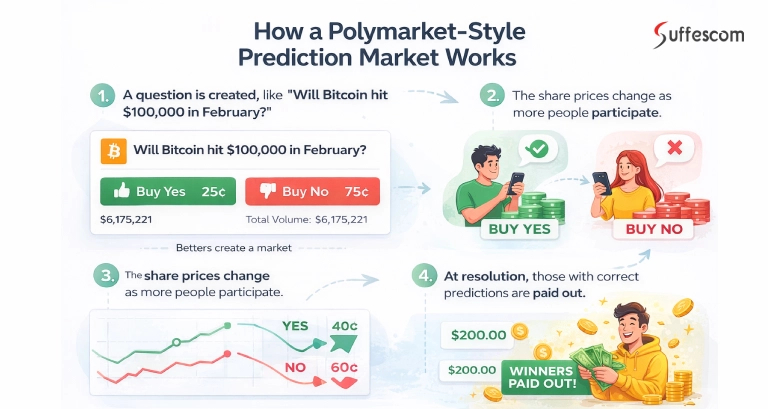

A Polymarket-style platform operates on blockchain-based smart contracts and real-world data feeds, allowing users to trade on the outcomes of future events. Every market is transparent, automated, and trustless eliminating the need for a central authority.

Platform administrators or approved market creators establish prediction markets with clearly defined binary (Yes/No) or multi-outcome events. Each market is deployed as an independent smart contract on the blockchain, embedding:

This smart contract architecture ensures transparent rules, immutable market conditions, and predetermined settlement logic that cannot be altered after deployment.

For each possible event outcome, the system mints corresponding outcome tokens (e.g., "YES" and "NO" tokens for binary markets). The market price of these tokens represents the implied probability of that outcome occurring, as determined by collective market sentiment.

Example: If YES tokens trade at $0.65, the market implies a 65% probability of that outcome.

As users buy or sell outcome tokens, prices adjust dynamically through the AMM algorithm based on:

The AMM serves as the algorithmic liquidity provider and price discovery mechanism, replacing traditional order book systems.

Core AMM Functions:

Users connect their crypto wallets, fund their accounts, and trade outcome tokens. Liquidity pools support continuous trading, while smart contracts securely handle all transactions.

Liquidity providers (LPs) deposit capital into market pools and earn:

All transactions are executed through smart contracts, ensuring secure, transparent, and non-custodial trading.

When an event concludes, the platform must determine the correct outcome through decentralized oracle networks that provide verifiable real-world data.

Oracle Resolution Process:

Oracle Security Measures:

Upon oracle confirmation of the event outcome:

Turn market demand into real revenue with a ready-to-deploy prediction market solution.

A Polymarket clone platform enables users to engage with decentralized prediction markets through an easy, secure trading process. The platform is built to facilitate smooth contract buying and selling with instant market execution.

Users can register or integrate their crypto wallets, such as MetaMask or WalletConnect, to securely engage with prediction markets without having to control their funds.

Users can fund their trading wallets with supported cryptocurrencies or stablecoins, such as USDC, to instantly engage with active markets.

The platform interface showcases trending, highly liquid markets across politics, crypto, finance, and international events.

Users can buy contracts based on market outcomes and probabilities calculated from real-time order-book data.

Before the market closes, users can sell their contracts using the built-in trading engine to lock in profits or limit losses.

After the successful verification of market outcomes using Oracle services, winning contracts are automatically settled, and users receive payouts in their wallets.

A well-developed Polymarket clone platform can compete with both decentralized and regulated prediction market ecosystems. Understanding how Polymarket differs from other platforms helps businesses define the right architecture, compliance model, and trading infrastructure during development.

A Polymarket clone operates on a decentralized blockchain, enabling crypto-based event trading with stablecoins such as USDC via smart contract settlement mechanisms.

Kalshi operates as a fully regulated event-trading exchange under regulatory supervision, supporting fiat-based USD transactions with structured compliance and tax reporting frameworks.

While Kalshi prioritizes regulatory transparency and institutional participation, a Polymarket clone emphasizes decentralized liquidity pools, faster market deployment, and permissionless global participation.

A Polymarket clone platform supports higher on-chain liquidity, automated settlement via smart contracts, and broader event categories, including crypto, geopolitics, finance, and entertainment markets.

PredictIt operates under a restricted regulatory exemption with position limits and slower withdrawal mechanisms.

Prediction market startups choosing a Polymarket clone benefit from scalable blockchain execution, cross-border accessibility, and tokenized contract trading models compared to PredictIt's limited market scope.

A Polymarket clone platform uses market-driven price discovery, where users trade outcome shares through peer-to-peer order execution and liquidity mechanisms.

Traditional sportsbooks rely on bookmaker-controlled fixed odds and centralized risk management systems focused primarily on sports betting.

Blockchain-powered prediction markets enable transparent settlement, decentralized custody, and crypto payments, whereas sportsbooks operate within jurisdiction-specific licensing frameworks.

Businesses building a Polymarket clone gain flexibility to launch multi-category prediction markets beyond sports wagering ecosystems.

| Feature | Polymarket Clone | Kalshi | PredictIt | Sportsbooks |

| Best For | Global crypto traders and decentralized market operators | US-regulated traders | Political forecasting users | Sports bettors |

| Regulatory Model | Decentralized or hybrid compliance architecture | CFTC-regulated exchange | Limited regulatory exemption | State-licensed operators |

| Trading Currency | USDC / Stablecoins | USD | USD | USD |

| Market Coverage | Global events, crypto, finance, and entertainment | Economic event contracts | US politics | Sports betting |

| Settlement | Smart contract automated settlement | Centralized clearing | Platform controlled | House settlement |

| Accessibility | Global participation | US users | US only | Region restricted |

| Technical Complexity | Medium (wallet integration required) | Low to medium | Low | Low |

Our Polymarket clone platform replicates essential Polymarket components while introducing enhancements for performance, regulatory compliance, and scalability:

| Component | Implementation |

| Decentralized Market Engine | Smart contract-based market creation with customizable parameters |

| Automated Market Maker (AMM) | Dynamic pricing algorithms for liquidity management and odds calculation |

| Oracle Integration | Multi-source data aggregation for trustless event resolution |

| On-Chain Settlement | Automated, transparent payout distribution via smart contracts |

| Multi-Wallet Support | Integration with major Web3 wallets and custody solutions |

| Stablecoin Trading | USDC, USDT, DAI support for stable trading denominations |

| Admin Dashboard | Comprehensive platform management and market oversight tools |

| Market Creator Tools | Permissioned or permissionless market creation interfaces |

| Governance Framework | DAO-compatible governance for community-driven platform decisions |

| Dispute Resolution | Multi-tiered challenge and appeal mechanisms |

Our Polymarket clone solution is engineered to deliver a secure, high-performance, and fully decentralized prediction market ecosystem. The architecture optimizes for scalability, liquidity, transparency, and regulatory compliance while maintaining the trustless characteristics essential to decentralized platforms.

The decentralized prediction market framework allows administrators and market creators to deploy outcome-based markets using smart contracts. This eliminates centralized control, ensuring trustless market execution and tamper-proof settlements.

Key Capabilities:

The Polymarket clone script supports live order execution, automated pricing, and continuous market updates. Odds are recalculated instantly using AMM logic and liquidity algorithms, enabling users to place trades and track market movements in real time.

Trading Features:

Our platform is compatible with leading blockchain networks including Ethereum for high-security smart contracts, Polygon for low-fee, high-speed transactions, and Solana for high-throughput prediction markets.

| Blockchain | Key Benefits | Use Case |

| Ethereum | Maximum security, largest DeFi ecosystem, institutional trust | High-value, long-term markets requiring maximum security |

| Polygon | Low transaction fees (~$0.01), fast confirmation (~2 seconds), Ethereum compatibility | High-frequency trading, retail users, mobile applications |

| Solana | Ultra-high throughput (65,000+ TPS), sub-cent fees, parallel processing | High-volume markets, programmatic trading, scalability testing |

| Arbitrum/Optimism | Ethereum security with L2 cost efficiency, growing DeFi integration | Balanced security-cost profile for general use |

The UI/UX layer is built using a mobile-first design approach. The responsive interface enables seamless navigation, real-time charting, and intuitive trade execution across all screen sizes, enhancing user retention and trading frequency.

Interface Features:

The solution includes:

Suffescom integrates professional-grade trading tools designed to maximize liquidity, user engagement, and transactional transparency.

While AMM-based markets don't use traditional order books, the platform provides order book-style visualization for traders familiar with centralized exchange interfaces.

Features:

The platform implements automated liquidity pools that fuel continuous trading without requiring counterparty matching.

Liquidity Pool Mechanics:

Users can manage funds, track positions, rebalance assets, and review transaction history within a unified dashboard, reinforcing trust in your decentralized prediction market clone.

The system enables platforms to launch their own utility token for trading discounts, staking, governance participation, and reward distribution. This creates a self-sustaining token economy within your Polymarket clone ecosystem.

Token Use Cases:

Administrators can restrict premium or private markets using token-based access controls. This enables exclusive prediction pools, VIP markets, and community-driven access models.

Built-in verification tools enable tiered identity checks, automated rule enforcement, and manual compliance reviews. This ensures your prediction market platform aligns with regulatory frameworks while maintaining user trust.

The system includes unique referral link generation, real-time commission tracking, and automated reward payouts. This drives organic user acquisition and accelerates platform growth.

Users earn points, cashback bonuses, streak rewards, and leaderboard rankings based on participation. This improves user retention and increases trading frequency across your prediction market ecosystem.

The platform supports fast-paced Yes/No outcome markets with instant price updates, automated settlement, and high-frequency trading logic. This enables rapid, real-time event-prediction trading.

Real-time timers, status indicators, and automated expiry flows create urgency-driven trading environments. This increases market activity and boosts liquidity before event closure.

The solution enables complete brand control with custom logos, domain configuration, color themes. This allows businesses to operate a fully branded Polymarket-style platform.

Enterprises can deploy the platform with full source code access, self-hosting capability, and unlimited customization. This ensures complete platform ownership without recurring licensing constraints.

The platform automatically adapts to desktops, tablets, and mobile devices, ensuring smooth navigation and fast performance across all devices.

Deliver a fully optimized mobile experience with high-speed, secure apps designed for both iPhone and Android users.

Users can access your platform anytime, anywhere, with consistent performance across regions and devices.

Enable users to interact in their preferred language, expanding adoption across international markets.

Your Polymarket clone platform can host prediction markets across a wide range of real-world industries and event categories. This multi-domain structure increases user engagement, trading volume, and liquidity by attracting diverse audiences with different interests.

| Domain | Event Types | Example Markets |

| Politics & Governance | Elections, policy outcomes, geopolitical events | Presidential elections, legislation passage, diplomatic agreements |

| Sports & Esports | Match results, tournaments, player stats | NBA playoffs, FIFA World Cup, League of Legends championships |

| Cryptocurrency & DeFi | Price movements, protocol upgrades, network metrics | Bitcoin $100K by year-end, Ethereum merge success, DeFi TVL milestones |

| Finance & Economy | Stock trends, interest rates, economic data | Fed rate decisions, company earnings, inflation reports |

| Technology & AI | Product launches, adoption rates, innovation | iPhone sales targets, ChatGPT user growth, autonomous vehicle approvals |

| Climate & Weather | Storms, temperature, natural disasters | Hurricane landfalls, record temperatures, El Niño predictions |

| Science & Healthcare | Clinical trials, drug approvals, research | FDA approvals, Alzheimer's treatment breakthroughs, vaccine efficacy |

| Entertainment & Culture | Awards, releases, celebrity events | Oscar winners, box office records, album release dates |

| Business & Corporate | IPOs, mergers, leadership | Acquisition completions, CEO appointments, bankruptcy filings |

| Energy & Commodities | Price movements, supply events | Oil price thresholds, natural gas shortages, metal price forecasts |

Benefits of Our Polymarket Clone Platform

Our Polymarket Clone Platform is designed to help enterprises, startups, and Web3 founders launch secure, scalable, and revenue-ready prediction marketplaces. With a fully customizable white-label solution, you can go to market faster, and build a competitive platform in the decentralized prediction market space.

Our pre-developed Polymarket clone script saves your time. This enables you to launch a fully functional prediction marketplace in weeks, not years.

The overall cost of our Polymarket clone solution is much lower than developing a similar platform from scratch. Our solution reduces development costs for blockchain, security audits, infrastructure, and quality assurance, ensuring maximum returns on investment for you.

The solution is backed by audited smart contracts, encrypted wallet services, and oracle-verified outcomes. This ensures trustless, tamper-proof, and transparent transactions for every single interaction.

Our solution is compatible with Ethereum, Polygon, and Solana, allowing you to optimize gas prices, transaction volume, and user experience.

The fully customizable white-label solution allows businesses to apply custom branding, configure tokenomics, and manage market categories effortlessly, enabling clear differentiation in a competitive marketplace.

With AMM-based trading, real-time odds, portfolio dashboards, and multi-category markets, the platform keeps users active, increases trading volume, and strengthens liquidity pools over time.

Our Polymarket clone solution supports trading fees, liquidity provider rewards, premium markets, and token-based incentives. It helps you to monetize from day one after you launch a prediction platform like Polymarket.

Free-to-play markets allow new users to explore prediction trading without financial risk, increasing sign-ups and long-term conversion into real-money participants.

KYC/AML modules, comprehensive audit trails, and admin controls ensure compliance readiness across different jurisdictions making your platform enterprise-viable from launch.

Deploy a fully customizable white label Polymarket clone and start engaging users globally.

We follow a structured, technology-driven development process to deliver a secure, scalable, and market-ready prediction market platform.

| Layer | Technology | Purpose |

| Blockchain Network | Polygon, Ethereum, Custom Blockchain | Supports secure, decentralized transaction processing and market settlement |

| Smart Contract Frameworks | Solidity, Hardhat, Truffle | Enables automated market logic, payouts, and governance rules |

| Consensus Mechanisms | Proof of Stake (PoS), Delegated PoS | Ensures network security, scalability, and fast confirmations |

| Frontend Frameworks | React.js, Next.js | Delivers fast, responsive, and SEO-friendly user interfaces |

| Backend Technologies | Node.js, Python | Handles market logic, user management, and real-time data processing |

| Databases | PostgreSQL, MongoDB, Redis | Stores user data, transaction logs, and market states |

| API Integrations | Web3.js, Ethers.js, Oracle APIs | Enables blockchain interaction, wallet connectivity, and real-time data feeds |

Explore the pros and cons of each approach to decide whether a ready-made clone, a white-label solution, or fully custom development is ideal for launching your prediction market.

| Option | Pros | Cons |

| Custom Development | Fully tailored to your business needs and branding | Very expensive |

| Unlimited scalability and future-proof architecture | Long development timeline (months to over a year) | |

| Unique, proprietary platform | Requires highly skilled developers and ongoing maintenance | |

| Complete control over security, features, and integrations | Higher operational and infrastructure costs | |

| Can integrate innovative features like AI odds modelling, NFT access, or cross-chain support | Risk of project delays or scope creep | |

| Polymarket Clone Script | Fast deployment; launch in weeks instead of months | Limited flexibility; major changes require deep customization |

| Cost-effective compared to custom builds | Provider lock-in; dependent on the vendor for updates | |

| Tried and tested core functionality | Potential legal/IP concerns if the clone is unauthorized | |

| Moderate level of customization (UI, some features) | Lacks uniqueness compared to fully custom platforms | |

| Lower technical risk; pre-audited smart contracts available | Scaling for very high user volume may need optimization | |

| White-Label Software | Fastest to market; pre-built solution | Limited to UI and branding customization |

| Low initial development and maintenance cost | Scaling can be constrained depending on vendor | |

| Tested, stable software | Licensing fees may apply (vendor lock-in) | |

| Custom branding options available | Fewer options to add innovative features | |

| Compliance-ready modules for KYC/AML integration | May not fully differentiate from competitors | |

| Ideal for small businesses or startups | Less control over backend or core logic |

The cost of a Polymarket clone depends on feature requirements, platform scope, blockchain selection, customization depth, and compliance needs. Compared to custom development, a clone-based approach offers significantly faster deployment, lower risk, and stronger ROI.

The following breakdown provides transparency on where your investment is allocated.

| Cost Factor | How It Impacts the Polymarket Clone Cost |

| Customization level | More UI branding, workflows, and custom modules increase development effort |

| Feature complexity | Advanced trading tools, analytics, governance, and AMM logic raise integration time |

| Third-party integrations | Payment gateways, Oracle APIs, KYC tools, and wallets add setup and licensing costs |

| Platform scope | Web-only is lower cost; web + iOS + Android increases UI and testing budgets |

| Blockchain network | Ethereum requires higher gas optimization; Polygon and Solana reduce transaction costs |

| Smart contract logic | Custom settlement rules, governance, and dispute systems require deeper audits |

| Regulatory readiness | KYC/AML workflows and compliance reporting add to development and legal overhead |

| Package | Price Range | Best For | What’s Included |

| Basic Package | $10K–$15K | MVP startups | Core prediction engine, smart contracts, web platform, basic admin panel |

| Professional Package | $15K – $25K | Growth-stage businesses | Multi-chain support, mobile apps, AMM engine, analytics dashboard, wallets |

| Enterprise Solution | $25K – $50K+ | Enterprises & large platforms | Full customization, governance, compliance tools, scalability modules, dedicated team |

Our revenue system is designed for free-to-play and real-money markets, helping to generate revenue from user engagement, liquidity, and premium interactions on the prediction market platform.

A small percentage is taken from every trade made on the prediction market platform. As trade volume grows, this becomes your most predictable and scalable revenue source.

Individuals or companies can pay to create custom or private prediction markets. This is a great way for brands, communities, and organizations to create exclusive prediction markets for special events.

The platform can generate revenue from the margin of liquidity pool participation and rebalancing. This ensures that the platform always generates revenue while keeping the markets active and liquid.

Users can pay to access high-value markets with better insights or higher rewards. This revenue model is great for creating VIP trading areas and exclusive event predictions.

Platform tokens can be used for staking, voting, or unlocking special features. Transaction and staking fees can generate recurring revenue while increasing demand for platform tokens.

Brands can sponsor prediction events or promote featured markets. This adds a non-trading revenue stream without disrupting the user experience.

Offer monthly or yearly plans for advanced analytics and portfolio tools. This generates predictable recurring income beyond transaction-based earnings.

Earn commissions by partnering with influencers, publishers, and community leaders. Each referred trader becomes a long-term revenue source for your platform.

Partner with our Polymarket clone script development company to launch your Polymarket clone app faster.

Our security framework is engineered to safeguard user funds, protect market integrity, and ensure transparent, tamper-resistant operations across every transaction.

All contracts are tested and verified to eliminate vulnerabilities before deployment.

Funds can only be moved with multiple approvals, reducing internal and external risk.

Multiple data sources ensure accurate and tamper-resistant event outcomes.

Advanced traffic filtering keeps the platform stable during high user activity.

The majority of assets are stored offline to prevent unauthorized access

Ethical hackers continuously identify and fix security gaps.

These enhancements position your prediction market platform to grow sustainably, engage users at scale, and remain aligned with emerging blockchain innovations.

Machine learning algorithms enhance the accuracy of odds predictions.

Voting system for market settings, fees, and upgrades, controlled by the community.

Common liquidity pools for multiple blockchains to increase trading volume.

Restricted markets for exclusive events using NFTs.

Traders can follow and replicate trades of top performers.

Instant notifications for market updates, trades, and results.

Choose Suffescom, a leading prediction market development company to build a secure, scalable Polymarket clone tailored to your business needs.

Our company has extensive experience in blockchain and Web3 product development, ensuring a secure and high-performance platform.

Adaptable and flexible processes that meet your business needs and speed up the process.

Smart contract audit, secure wallet integration, and security-compliant design for an unalterable platform.

Full support and maintenance services for your prediction market platform after its successful launch.

Easily customize and personalize your platform with a white-label crypto prediction platform, which enables fast and easy development.

Develop a secure, scalable platform that can scale with your growing user base and is fully compatible with new blockchain technology.

A Polymarket clone platform is a decentralized prediction marketplace where users trade on the outcomes of real-world events using cryptocurrency. It uses blockchain technology and smart contracts to ensure transparent transactions, automated settlements, and trustless operations. This model removes the need for a central authority and improves platform credibility.

The script automates the entire market lifecycle, including market creation, trade execution, odds calculation, liquidity management, and payouts. Smart contracts securely hold funds while oracle services verify real-world outcomes, ensuring accurate and tamper-proof results.

Yes, the core trading engine, settlement process, and fund management are handled on-chain. This decentralized structure increases transparency, reduces fraud risk, and gives users confidence that results and payouts cannot be manipulated.

Yes, the solution is fully white-label, allowing complete branding control. You can customize the interface, market categories, tokenomics, governance rules, and user experience to align with your business objectives and target audience.

The platform supports Ethereum, Polygon, and Solana, each offering different advantages in terms of security, speed, and transaction costs. Custom blockchain integrations are also available for businesses with specific technical or regulatory needs.

Depending on the level of customization, development typically takes between 6 and 10 weeks. This includes UI customization, smart contract deployment, testing, and security checks, enabling a much faster launch than with custom-built platforms.

The cost generally ranges from $10,000 to $50,000 or more, depending on features, the selected blockchain, and the platform's scope. White-label development reduces both upfront costs and long-term maintenance expenses.

Revenue can be generated through transaction fees, market creation fees, liquidity incentives, premium markets, and token-based rewards. These multiple income streams make the platform commercially sustainable.

Yes, compliance-ready modules such as KYC, AML, user verification, and reporting tools can be integrated based on your target regions. This helps your platform meet regulatory standards and operate with reduced legal risk.

Yes, ongoing technical support, performance monitoring, feature upgrades, and security updates are provided. This ensures your platform remains reliable, secure, and scalable as your user base grows.

Fret Not! We have Something to Offer.