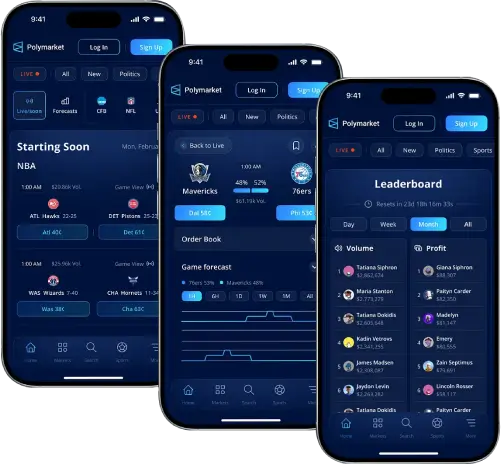

White Label Crypto Prediction Market Platform

Launch a revenue-driven decentralized prediction ecosystem that should be faster, smarter, and built for enterprise scale. Enter the $50B+ prediction market faster with enterprise-grade security and multi-chain scalability, without the cost or complexity of custom development.

- 3.5x faster platform launch

- 2x faster order matching

- 40% lower operational overhead

- Trusted by 250+ Clients

- 30–45% higher user retention

- Multi-currency and multi-chain support