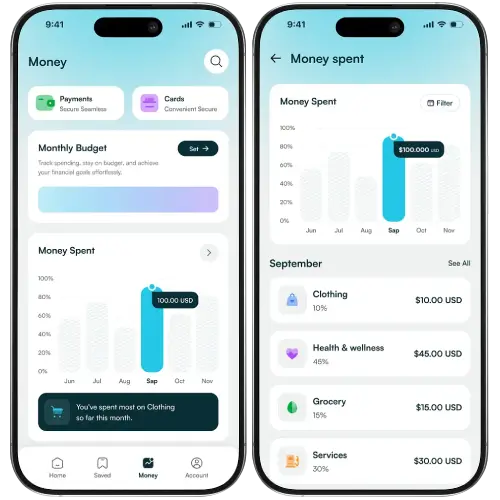

Smart Budgeting Tools

Users are able to set weekly or monthly budgets and immediately view how they're spending vs. the budget they set. The app allows easy tracking of spending categories, identifying patterns of overspending, and also makes sure you stick to your financial plans without anxiety.

Personal Finance Dashboards

A simple, personalized dashboard provides users with an instant screenshot of income, expenses, savings, and financial goals. It simplifies complicated financial information into easy-to-read charts and insights so that users can understand their finances at a glance.

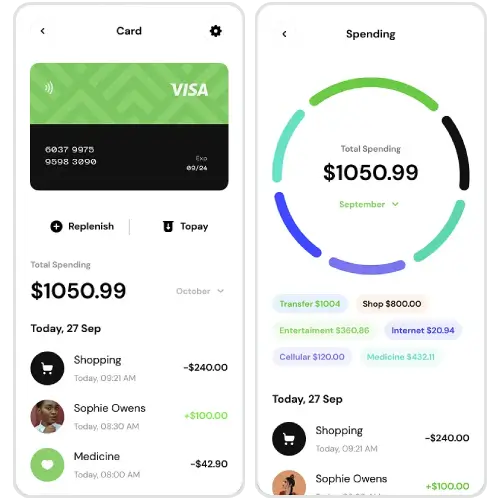

Multiple Accounts

Each user can link and monitor various bank accounts in a single app. Rather than logging into various apps, they have a single view of their finances in one secure location. This streamlines accounting and makes it easy to keep a check on your spending.

Multiple Wallets

For individuals who enjoy categorizing finances for a particular purpose, such as travel, bills, or personal savings, multiple wallets make it easy. This actually helps you plan well. Each wallet can monitor particular expenses, providing better control over spending.

Create Categories

Personal categories enable people to organize expenses based on what is meaningful to them. From "Groceries," "Fitness," or "Weekend Fun," they can tailor their spending perspective for increased clarity. This way, users can visualize and organize their preferred categories.

Automated Savings & Goals

People need not worry about some kinds of future expenses. These apps help people save money automatically towards their specific goals, such as a tour or an emergency fund. Also, progress monitoring keeps them encouraged to achieve milestones sooner.

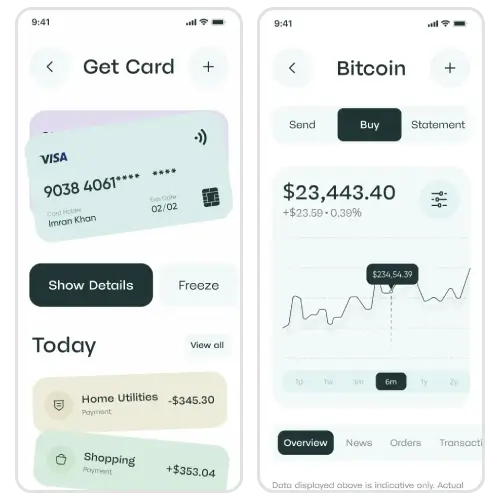

Track Debt

Customers can track loans, credit cards, or any pending payments all at once. This ensures they remember due dates, miss fewer payments, and work on paying down debt over time. Over time, this feature helps build a healthier credit score and lessens financial stress.

AI-Powered Insights

Intelligent AI features study spending patterns and offer recommendations to save more or shave unnecessary expenses. The app learns user patterns over time and gives personalized financial advice. It’s like having a personal financial coach with you every time.

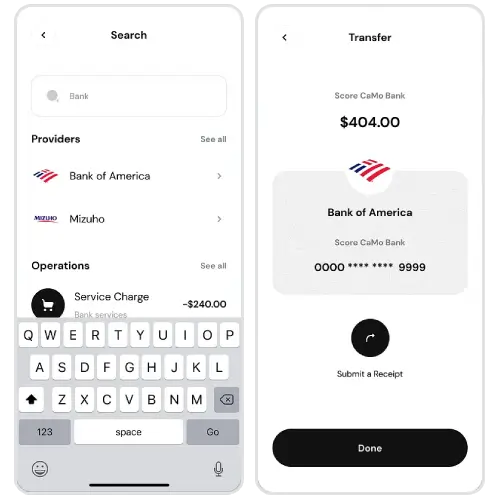

Bill Payments and Reminders

Never overlook a bill again. Users can automate payments and receive on-time reminders. This not only avoids late charges but also enhances overall money responsibility. It maintains a smooth run of finances and also builds a sense of financial discipline.

Bank & Card Integration

The app integrates with leading banks and credit cards, importing real-time transactions. This avoids manual entry and allows users to always view current financial information. By keeping everything in sync, users will be aware of the economic picture and have control over it.

Multi-Currency and Localization

For international users, the app handles multiple currencies and adopts local languages. Whether one is traveling or dealing with finances overseas, it's seamless. This makes the app truly global to make sure it seems relevant no matter where the users are.

Family Groups

Family members can coordinate through expense sharing, a budget, and savings objectives together. It's ideal for following household expenditures and educating children about money handling. This makes money management a transparent team effort, keeping everyone informed and in the loop.

Security & Compliance

With bank-standard encryption and regulatory adherence, user information is forever secure. Every level is secure with security integrated in, allowing users to trust their money. In today’s competitive world, businesses with regulatory compliance are a plus.

Light and Dark Themes

A comfortable interface with light and dark themes makes surfing easy. It provides the app with a pleasing look and comfortable readability at any time of day. Users can personalize the app as they wish, making the experience modern and more engaging.

Easy Export to Excel

For the detail-oriented, data can be exported to Excel with one click. Users can make reports, monitor spending patterns, or present facts to advisors with ease. It is perfect for professional and advanced analysis, providing users with extra flexibility beyond the app.

Multi-language Support

Our white label money management software includes built-in multilingual support, enabling users to manage finances in the language they are most comfortable with. It improves understanding and decision-making. Moreover, this feature also empowers businesses to serve clients across different regions without manual management.