How Much Does It Cost To Build a Mobile Banking App Like Monzo?

People want to manage their finances conveniently without any headache. They are looking for a simpler way to open a new account or make payments. No one wants to stand for long hours in the bank and do the paperwork. Mobile banking apps are making everything possible with a single click. The users can keep a watch on how much they are spending. They can borrow money and make investments with advanced features. Anyone can now get affordable banking services while relaxing at home. AI apps are providing suggestions to keep the users engaged. You can build a mobile banking app like Monzo to help people in overcoming their financial challenges. This is the right time for your business to enter the market.

This blog will help you to learn more about a mobile banking app like Monzo. Find out how this app works and its business model. Get useful information about the cost of building these apps.

Make a Banking App for a Swift Entry into the Market

We ensure a quicker launch and make your revenue model a success.

Why is Monzo a Top Player in Digital Banking?

Monzo is turning out to be a better choice than traditional approaches. It allows the users to know how much money is going out from their pocket. The app comes with advanced features and an engaging design.

Want to know what is unique about Monzo? These are some aspects of Monzo that make it the most loved app:

Notifications and Alerts

Monzo provides instant messages and alerts in real-time. The users can see all the details of their spending. They can fix a limit on how much to spend according to the different categories. The app provides a brief information about the user’s spending and saving.

Unique Features

The users can divide the payment of the bill with their friends. The app also offers benefits to the users, like discounts and deals. The app has payment gateways that protect the user data while they pay for the services.

Options to Customize

The users can customize the home screen as per their preferences. They can decide how to view the transactions. The app adapts to the user’s needs. It allows users to control their debit cards to prevent any fraud.

Convenient to Use

The app allows users to keep a check on their accounts from anywhere. There is no need to spend time in personally visiting a branch. Monzo allows everyone to choose from a wide range of banking services.

How Does Monzo Make Money? A Deep Dive Into Its Revenue Model

Monzo adopts a business model that aims for a better user experience. You can make a banking app like Monzo to provide security and reliability to the users. This is how an app like Monzo generates revenue:

Wide Range of Products

Monzo allows users to explore different products. This includes savings, lending options and investment. It helps in enhancing the user experience.

Premium Services

The users can get basic services for free. But Monzo requires users to pay for the premium banking services. These include advanced tools and insurance options.

Tailored Features for Businesses

The app allows businesses to open their accounts. A business owner can get virtual cards. They can allow different users to control the account.

Partnerships

Monzo works together with service providers. It provides services to customers and earns money through revenue sharing.

Key Aspects to Consider for a Next-Gen Banking Experience

Do you want to develop a banking app like Monzo that stands out? You can utilize advanced technologies to create a smart app. No need of the hassle of traditional banking methods. A modern app can make everything stress-free for the users.

API integration

API integration feature allows you to link your app with other financial institutions. It helps the users to compare their products and services. They can choose from different solutions as per their requirements.

AI for Insights

AI can keep track of the spending habits of users. It can look into the future to tell about the possible expenses of the user. It can provide tailored suggestions on how to reduce the cost. The user can get advice about where to invest for higher earnings. It enables users to make informed decisions for managing their finances.

Elements for Games

Adding interactive games can make the users come back for more. It helps in developing good habits for saving money. Earning points makes the process enjoyable. They can get badges for completing quizzes. Users can take part in fun challenges to spend less.

Blockchain Technology

It is used to build an app like Monzo. Blockchain technology ensures security when the user makes an online payment. Fintech blockchain use cases can help prevent any loss of money. The users can manage their currencies and digital assets in the app.

Banking through Voice Assistance

The users can do all the banking functions by sending a voice command. They can view the balance and make transfers with ease. Voiceprint technology can help in creating a secure app. It identifies the users through their unique voice tone.

Features for Investment

The app can suggest the assets that the user can own. The users can learn effective ways to earn higher revenue. They can pay for a small amount in costly stocks. The users can go through resources to know how to grow investments.

How to Make a Banking App that Safeguards the User’s Data?

You might want a secure mobile app to win the user’s trust. It is crucial to maintain security at every stage of the development. Let us know how to make a banking app that keeps data secure and protects against frauds:

Storing of Data

The best Fintech software development company utilizes technologies to protect the user data. Data should be encrypted with advanced security measures.

Practices for Coding

Write clean and secure code for building an app. Following the security guidelines can reduce any harm to data.

Regular Monitoring

Keep regular checks on the overall security of the app. Identify and fix any issues in the security. Take note of who is using the app and their activities. This can help to find out if anyone else is opening the app.

Make Updates

The app's operating system should be updated. This can help prevent any misuse of the user data.

Protecting the User’s Details

Build a banking app like Chime and Monzo that allows users to add fingerprint and facial identification. This helps to protect the sensitive information of users.

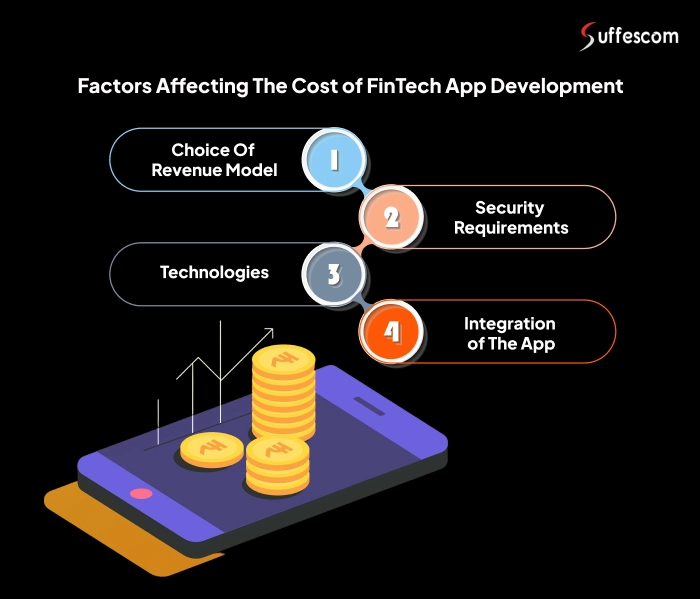

Factors Affecting the Cost to Develop an App Like Monzo

Want to know how to cut down the Monzo-like app development cost? Preparing a plan can help reduce the cost of developing and launching an app. The cost of building this app depends on these factors:

Choice of Revenue Model

There are different ways to make money from a FinTech app. The AI banking app development cost will depend on how complex the model is. You can earn revenue with subscription plans or advertising.

Security Requirements

Building a secure app can help to satisfy the users. Security measures are used for Monzo-like banking application development. There is also a need to comply with regulations for the financial sector.

Technologies

Technologies and frameworks are used for building an app. You might need to spend money on training the employees. This enables them to learn how to use the new technologies.

Integration of the App

The app can be integrated with services and payment gateways. API integration can also add to the development cost.

A Quick Look into the Cost of Financial Application Development

The cost range of financial application development usually starts from $5,000. But it also depends on your business goals. You can build an affordable app by understanding the digital bank app development cost:

Estimated Cost Range Based on Revenue Model:

- Less Complexity in Model: $5,000- $10,000

- More Complexity in Model: $10,000- $20,000

Estimated Cost Range for Security:

- Less Requirements: $5,000- $10,000

- Higher Requirements: $10,000- $20,000

Estimated Cost Range Based on Technologies:

- Basic Technologies: $5,000- $10,000

- AI and Blockchain Technologies: $10,000- $20,000

Estimated Cost Range Based on Integration:

- Less Number of Integrations: $5,000- $10,000

- More Number of Integrations: $10,000- $20,000

Develop a Banking App for an Unforgettable User Experience

Create an app that provides efficient banking services and captivates users.

Build a Fully Customized Banking App with Suffescom Solutions

Developing a banking app requires the use of advanced technologies and best practices. Adopting the security measures can help to protect the user’s data. Suffescom Solutions is a top mobile application development company for readymade solutions. We create a secure and customized app for the financial needs of users.

Build an AI app that handles the routine tasks and improves efficiency. Our team ensures a faster deployment and better integration. We provide a cost-effective app that brings higher revenue. Increase your reach and get ready to make your business shine. Hire us for your app development today!

FAQs

1. What is Monzo's Competitive Advantage?

Monzo doesn’t require users to visit a bank. This app can make faster payments and manage their spending. You can develop a banking app like Monzo to stay ahead of competitors.

2. Is It Safe to Keep All Money in Monzo?

Monzo keeps the money safe. It comes with advanced security features. This protects the users from any loss of money or misuse of information.

3. What are Monzo Advanced Tools?

Monzo has advanced payment gateways and custom categories. These tools improve efficiency and result in a better user experience.

4. What is the Alternative to Monzo?

Starling Bank, Revolut and Wise are some top banking apps. These are the best alternatives to Monzo.

5. How to Develop a FinTech App?

You can follow these steps for custom AI app development for fintech:

- Be clear about the type of app and user needs

- Know how you will earn revenue

- Adopt measures for security

- Decide features to include

- Launch and make improvements in the app