AI-Powered Crypto Exchange Development: Build, Launch & Scale an Intelligent Trading Platform

The market for cryptocurrency exchanges is increasing at a historic rate, with daily global trading volumes frequently exceeding $100 billion. Consequently, the conventional exchange infrastructure is no longer adequate to support real-time data processing. It has led to a high demand for AI-driven crypto exchange solutions that can analyze market data in real time, automate trading processes, and improve platform performance through self-learning decision engines.

An AI-powered cryptocurrency exchange integrates machine learning, predictive analytics, and intelligent monitoring capabilities directly into its trading infrastructure. This enables exchanges to support smarter trading decisions, faster fraud detection, and personalized user experiences. By leveraging AI in cryptocurrency exchange development, companies can create highly adaptive trading systems that respond dynamically to market behavior and deliver a sustained competitive advantage.

For entrepreneurs, startups, and businesses looking to enter the crypto market, adopting AI-driven exchange solutions offers clear advantages and provides a competitive edge in this rapidly expanding industry.

Introduction to AI-Powered Crypto Exchange Platforms

AI-based crypto exchange platforms blend machine learning algorithms, data analytics, and automated trading engines to enhance performance in the crypto market. The platforms analyze real-time price feeds, order book data, and user activity to generate intelligent trading signals.

The platforms employ predictive models to identify market trends, minimize latency, and optimize trade execution. Smart algorithms dynamically adjust to market volatility and liquidity fluctuations. The integration of AI technology in crypto exchange platform development enables organizations to create scalable, secure, and high-performance trading environments that adapt to evolving market conditions.

Market Demand for AI-Powered Cryptocurrency Exchange Solutions

The crypto exchange industry is expanding rapidly, driving strong demand for AI-driven platforms capable of efficiently handling complex operations. Real-time market analysis and automated decision-making have become critical as trading volumes continue to surge.

Key Drivers:

- Daily global crypto trading volume often exceeds $100 billion.

- Traditional exchange systems struggle with real-time data processing and latency issues.

- AI solutions enable faster trade execution, smarter risk management, and fraud detection.

- Platforms leveraging AI achieve up to 40% operational efficiency gains.

Why Are Enterprises Shifting to AI in Crypto Exchanges?

Enterprises are adopting AI to stay competitive, improve user experience, and maximize profitability. AI provides predictive insights, automates trading workflows, and strengthens security measures.

Key Benefits:

- AI-based platforms can detect suspicious transactions instantly, reducing fraud by 30%.

- Predictive analytics help enterprises anticipate market trends and optimize liquidity.

- AI-driven automation reduces operational overhead and supports 24/7 trading.

- Companies using AI in exchanges report higher user retention and trading volumes.

Thinking About Launching a Smart Crypto Exchange Platform

We integrate AI models, trading bots, and analytics engines into enterprise-grade exchanges.

Why AI is Transforming Crypto Exchange Development

Leveraging AI in crypto exchanges delivers smarter trading capabilities, enhanced security protocols, and improved operational performance for businesses and users alike.

Benefits of AI in Crypto Exchanges

- Predictive market intelligence

- Automated trade surveillance

- Dynamic liquidity optimization

- Enhanced risk management

- Real-time decision-making

- Personalized trading recommendations

- Faster order execution

- Reduced operational costs

- Improved user experience

- Smarter portfolio optimization

- Predictive market intelligence

- Automated trade surveillance

- Dynamic liquidity optimization

Business Impact of AI Crypto Exchange Development

- Reduced operational latency

- Improved user retention

- Higher trading volume and ROI

- Enhanced decision-making with real-time analytics

- Automated risk management

- Smarter trading recommendations and personalized experiences

- Optimized liquidity and market efficiency

Key Features of AI-Powered Cryptocurrency Exchange Platforms

1. Intelligent Automation

AI-driven engines automate trade execution, order routing, and portfolio rebalancing using real-time market signals and predictive analytics, reducing latency and reliance on manual intervention.

2. Customizable Trading Strategies

Traders can configure algorithmic strategies using technical indicators, risk thresholds, and market conditions. The system continuously optimizes strategies through machine learning feedback loops.

3. Real-Time Market Analysis

The platform processes live price feeds, order-book depth, liquidity metrics, and volatility patterns to deliver actionable trading intelligence and predictive insights.

4. Proactive Risk Assessment

AI models evaluate user behavior, market anomalies, and exposure levels to detect risks early, trigger automated safeguards, and prevent potential losses.

5. Advanced Fraud Detection

Machine learning algorithms monitor transactions and trading patterns in real time to identify suspicious activities, prevent manipulation, and stop unauthorized actions.

6. Biometric Authentication

Secure access is enabled through facial recognition, fingerprint scanning, and device-based identity verification, ensuring only authorized users can access accounts.

7. Multi-Layered Authentication

The platform supports multi-factor authentication, role-based access controls, IP whitelisting, and session monitoring to provide enterprise-grade security.

8. Secure Asset Storage

Digital assets are protected using encrypted wallet infrastructure with hot–cold storage segregation and automated fund monitoring.

9. Smart Liquidity Management

AI optimizes order matching, spread control, and liquidity routing to maintain market depth and faster trade execution.

10. Compliance & Transaction Monitoring

Built-in AML/KYC automation, transaction screening, and audit logs help meet regulatory requirements and reduce compliance risks.

11. Personalized Trading Insights

AI delivers behavior-based trade suggestions, alerts, and portfolio analytics tailored to individual trading patterns.

12. Educational Resources & AI Support

Interactive learning modules, AI trading assistants, and automated support systems help users understand strategies and platform tools effectively.

13. AI Trading Bots

Automate trades in real time by analyzing market data and executing strategies with precision. These bots operate 24/7 to maximize trading efficiency and reduce manual errors.

14. Chatbots and Virtual Assistants

Provide instant support and guidance, answering user queries quickly. They enhance user experience and streamline platform interaction.

How AI Automate Core Operations in Crypto Exchange Development?

AI-driven automation helps crypto exchanges manage operations efficiently, improve accuracy, and provide a seamless trading experience for users.

AI-Based KYC & Identity Automation

AI accelerates user onboarding by verifying identity documents, facial data, and device behavior in just a few seconds. Automated identity validation minimizes approval delays while ensuring regulatory compliance.

AI-Driven Fraud Monitoring

Machine learning models continuously analyze trading behavior, transaction flows, and account activity to detect anomalies. It allows early risk identification and prevents fraudulent patterns from spreading across the platform.

Smart Market Making & Liquidity Control

AI adjusts bid-ask spreads and liquidity pools based on live demand, volatility, and order depth. It ensures balanced markets, minimizes price manipulation, and stabilizes trading conditions during high-volume periods.

AI-Powered Order Matching

Intelligent matching engines prioritize speed, fairness, and execution accuracy. AI optimizes order routing and pairing logic to reduce slippage and increase fill rates across trading pairs.

AI Virtual Support Systems

Natural language processing allows AI chat assistants to answer user queries, guide platform usage, and resolve common issues instantly. It reduces support workload while improving user experience.

Real-Time Security Alerting

AI continuously scans system logs, access behavior, and transaction anomalies. When abnormal patterns are detected, automated alerts notify administrators for immediate action.

Automated Compliance Rule Checks

AI engines validate transactions against regulatory requirements, flag suspicious activity, and automatically generate audit logs. This ensures transparent governance and lowers regulatory risk.

AI-Based System Performance Optimization

AI monitors server loads, transaction throughput, and system latency to dynamically tune performance. This keeps the platform responsive during peak traffic and supports long-term scalability.

Launch an AI-powered Crypto Exchange Platform Today!

We build secure, compliant, and scalable infrastructures to launch a crypto exchange with AI-driven trading, fraud detection, and intelligent order execution.

Technology Stack for AI-Powered Cryptocurrency Exchange Development

The right technology stack forms the foundation of a secure, scalable, and intelligent crypto exchange. It enables real-time trading performance and operational reliability across all functions.

| Layer | Technologies/Tools | Purpose |

| Frontend | React.js, Next.js, Vue.js, Flutter | Web and mobile UI development for users and admins |

| Backend | Node.js, Django, Flask, FastAPI | High-performance APIs and business logic |

| Database | PostgreSQL, MongoDB, Redis | User data, transactions, logs, and analytics storage |

| Blockchain Integration | Ethereum, Bitcoin, BNB, Polygon, Web3.js, Ethers.js, Solidity | On-chain payment validation, smart contracts, and DeFi features |

| Wallet Engine | HD Wallets, Web3 SDKs | Secure wallet management and transaction handling |

| Exchange APIs | Binance API, Coinbase API, Kraken API, KuCoin API | Integration with major exchanges for real-time trading |

| AI & ML Frameworks | TensorFlow, PyTorch, Scikit-Learn, XGBoost | Predictive analytics, trading signal generation, risk assessment |

| Order Execution Engines | CCXT, FIX Protocol, Custom Engines | High-speed order matching and execution |

| Cloud & DevOps | AWS, Google Cloud, Azure, Docker, Kubernetes, Jenkins | Scalable infrastructure, deployment, monitoring, and CI/CD |

| Security Frameworks | AES-256, JWT, OAuth2.0, Multi-Sig, HSM | Data protection, authentication, transaction security |

How to Launch an AI Crypto Trading Platform

We ensure your platform is secure, optimized, and designed to deliver a smooth trading experience for users.

1. Market Analysis

Study market trends, user needs, and competitor platforms. This helps identify opportunities and define the platform’s strategy.

2. Plan and Design

Create a roadmap, wireframes, and UI/UX designs for a seamless user experience. Proper planning ensures efficient development and scalability.

3. API Development

Build and integrate APIs for exchange connectivity, payment gateways, and data processing. This enables real-time trading and smooth system communication.

4. Platform Development

Develop the exchange core with AI modules for trading, analytics, and automation. Ensure secure, scalable, and reliable architecture.

5. Testing & Security

Perform stress, penetration, and performance testing while implementing robust security protocols. This guarantees a safe and stable trading environment.

6. Launch and Marketing

Deploy the platform and promote it to attract users. Strategic marketing ensures adoption, engagement, and growth.

AI-Powered Crypto Exchange Development Models

Custom AI Crypto Exchange Development

Build a fully tailored exchange with end-to-end full-stack platform engineering. Every feature, workflow, and AI module is designed to match your specific business goals. This approach enables maximum flexibility, scalability, and unique branding for your platform.

White Label AI-Powered Crypto Exchange Platform

Leverage a ready-made, white label crypto exchange solution for faster deployment. It enables you to launch a feature-rich trading platform quickly while maintaining full brand identity. This model reduces development time and costs without compromising performance, security, or core functionality.

Key AI Applications Transforming Crypto Exchanges

We leverage these AI solutions to enhance security, optimize trading, and deliver smarter, data-driven experiences for exchange users.

1. AI-Driven Trade Surveillance

AI analyzes trading activity to identify any suspicious or unusual patterns. This enables exchanges to avoid fraud and manipulation and ensure regulatory compliance.

2. AI-Assisted Market Prediction

Machine learning algorithms analyze past and current market data to predict price movements. This enables traders to make informed decisions and capitalize on market opportunities with greater accuracy.

3. Intelligent Portfolio Management

AI analyzes asset performance, risk, and market conditions to optimize portfolios. This enables traders to achieve greater returns with minimal exposure to high-risk trades.

4. Automated Risk Management

AI systems dynamically adjust risk factors, stop-loss levels, and exposure limits. This safeguards traders and exchanges from unforeseen market fluctuations.

5. Smart Order Routing

AI algorithms identify optimal trade routes across multiple exchanges. This enables faster trade execution, minimized slippage, and optimized liquidity usage.

6. Sentiment Analysis & News Feeds

Natural language processing analyzes social media, news, and community sentiment. Traders can use insights from this data to predict market movements before they occur.

7. Personalized Trading Advice

AI-driven systems provide personalized advice based on user behavior, trading patterns, and risk tolerance. This enhances user engagement and experience on the platform.

Leading AI Crypto Trading & Exchange Platforms in 2026

1. 3Commas

They provide smart trading bots, portfolio automation, and risk control tools.

2. TradeSanta

They offer rule-based AI bots for futures and spot markets.

3. Coinrule

They automate trading strategies without coding.

4. Shrimpy

They support AI portfolio rebalancing and automated asset management.

5. Altrady

They provide AI trade signals, smart orders, and analytics dashboards.

Advanced Algorithmic Strategies To Launch an AI Crypto Trading Platforms

AI-driven trading strategies help optimize execution, boost efficiency, and maximize profits in crypto markets:

Arbitrage: Bots quickly spot price gaps across exchanges, buying low on one and selling high on another, securing instant profits.

Grid Trading: Bots place buy and sell orders at set intervals around a base price, profiting from market fluctuations automatically.

Market Making: Bots provide liquidity by placing simultaneous buy and sell orders, earning from the bid-ask spread while stabilizing prices.

Dollar-Cost Averaging (DCA): AI automates regular crypto investments, reducing volatility risk and lowering the average cost per unit over time.

AI-Powered Crypto Exchange: Security, Compliance & Risk Management

AI-driven threat detection continuously monitors the platform for suspicious activity, helping prevent fraud and cyberattacks. Automated regulatory reporting ensures all compliance requirements are met efficiently without manual intervention.

Data encryption and strict access controls protect sensitive user information and transaction data. Together, these measures create a secure, trustworthy environment for both users and operators.

Need Clarity on Crypto Exchange Development Costs?

We map infrastructure, AI model integration, and compliance requirements to your business goals.

Cost Factors in AI-Powered Crypto Exchange Development

The overall cost depends on platform complexity, including the number of features, supported trading pairs, and scalability requirements. More advanced designs and integrations will increase development time and expenses.

AI model training, infrastructure, and implementation of security and compliance modules also affect pricing. Robust encryption, KYC/AML compliance, and regulatory adherence add to development costs but are essential for a secure and reliable exchange.

Key Challenges and Solutions in AI Crypto Exchange Development

By addressing security, fairness, and regulatory challenges, we create AI-powered crypto exchanges that are secure, compliant, and trusted by users and regulators alike.

Challenge: Data Security and Privacy

Crypto exchanges handle sensitive financial information, and AI can introduce vulnerabilities.

Solution: Implement strong encryption, strict access controls, and proactive risk management. Regularly review AI-generated outputs to ensure data integrity and maintain compliance.

Challenge: Fairness and Transparency

AI algorithms can inherit biases, affecting decisions and user trust.

Solution: Monitor AI systems continuously, foster collaboration between IT, security, and compliance teams, and provide clear explanations of how AI makes decisions to ensure ethical, accountable operations.

Challenge: Regulatory Compliance

Navigating KYC, AML, licensing, and tax regulations is complex and critical for legitimacy.

Solution: Secure necessary licenses, implement robust KYC/AML checks, audit smart contracts, comply with data protection laws, and educate users on regulations. Stay adaptable to evolving laws to remain ahead of compliance requirements.

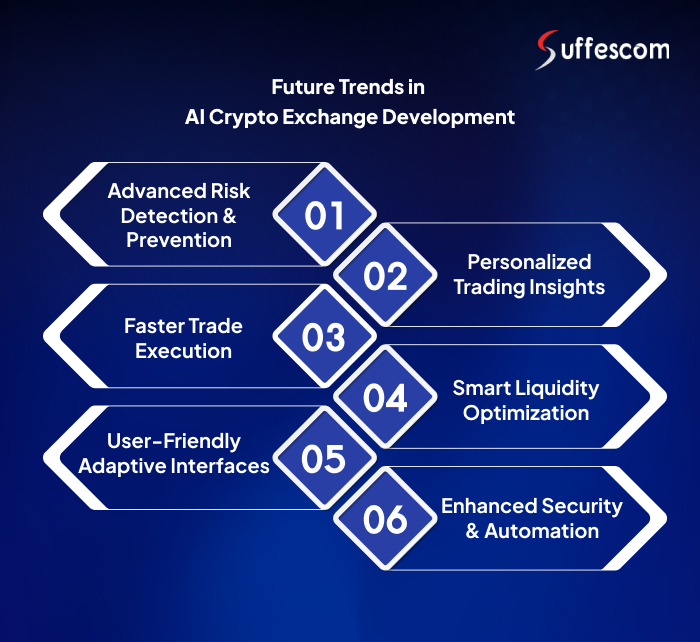

Future Trends in AI Crypto Exchange Development

We help you launch crypto exchanges that are faster, more secure, and built for scalable long-term growth.

Advanced Risk Detection & Prevention

AI engines scan transactional patterns in real time to flag anomalies and block threats before losses occur.

Personalized Trading Insights

Machine learning models analyze user behavior to deliver strategy-based trade signals and portfolio guidance.

Faster Trade Execution

Low-latency AI order routing reduces slippage and accelerates transaction finalization across exchanges.

Smart Liquidity Optimization

AI aggregates liquidity across markets to maintain tight spreads and stable order books.

User-Friendly Adaptive Interfaces

Behavior-driven UI systems adjust dashboards, alerts, and features based on trader preferences.

Enhanced Security & Automation

AI automates fraud monitoring, KYC validation, and compliance workflows for continuous protection.

Suffescom Solutions – Your Strategic Partner for AI Crypto Exchange Platforms

In the fast-growing digital asset economy, Suffescom Solutions stands as a trusted crypto exchange development company delivering intelligent, secure, and scalable trading platforms. We design advanced AI-powered crypto exchanges that seamlessly integrate with your existing ecosystem and adapt to real-time market behavior.

Our solutions empower your platform with smart trading algorithms, predictive market analytics, automated trading bots, fraud detection engines, real-time market surveillance, and AI-driven customer support systems. As we have industry expertise in AI-powered cryptocurrency exchange platforms. So every feature is engineered to enhance performance, reduce operational risk, and improve user engagement.

With deep industry expertise, enterprise-grade security, full customization, and continuous post-launch support, we ensure your exchange stays competitive in a rapidly evolving market. Experience the future of trading with Suffescom, where innovation, trust, and performance come together.

FAQs

1. What is an AI-powered crypto exchange?

An AI-powered crypto exchange uses machine learning, predictive analytics, and automation engines to analyze markets, execute trades, detect fraud, and optimize liquidity in real time.

2. How is an AI-powered cryptocurrency exchange different from a traditional exchange?

Traditional exchanges rely on fixed logic. AI-powered cryptocurrency exchange platforms adapt using real-time data, behavioral models, and self-learning algorithms to improve trading accuracy and system performance.

3. Can AI really improve trading performance?

Yes. AI analyzes market trends, order books, and sentiment data to generate accurate trade signals. It also reduces execution delays and improves decision speed.

4. Is AI in crypto exchanges safe?

Yes. AI strengthens security through real-time fraud detection and anomaly monitoring. It also supports biometric access, risk scoring, and automated compliance checks.

5. How long does it take to launch an AI crypto trading platform?

A custom AI-powered crypto exchange usually takes 4 to 6 months to build. A white label crypto exchange with AI can launch in 4 to 8 weeks.

6. What is the cost of AI-powered crypto exchange development?

Pricing depends on features, AI models, security layers, and system scale. White-label platforms cost less and launch faster than custom builds.

7. Can I customize the trading strategies and AI logic?

Yes. You can set indicators, risk rules, and execution logic. The AI engine continuously improves strategies using live data.

8. Does your platform support multi-exchange liquidity?

Yes. The AI-powered crypto exchange platform connects with multiple exchanges. This ensures better liquidity, tighter spreads, and faster order execution.