Closed-Loop Crypto Wallets: The Future of Secure, Scalable Digital Payments

Closed-loop wallets power private payment ecosystems by combining internal ledger accounting, real-time authorization, and policy-driven transaction controls. Industry data show that over 65 percent of digital wallet transactions in platform-based environments use closed-loop models.

It is primarily due to zero external network fees, sub-second settlement, and deterministic transaction execution. This architecture enables enterprises to circulate value securely within their own ecosystem without relying on public blockchain congestion or third-party processors.

For platforms operating at scale, closed-loop crypto wallet development delivers measurable efficiency gains. Businesses using closed-loop wallet systems report 30–40 percent higher repeat transaction rates and up to 50 percent lower processing costs, achieved through off-chain balance management and restricted asset mobility.

These technical foundations make closed-loop wallets ideal for high-volume merchant networks, loyalty platforms, and controlled digital economies. It provides predictable costs, faster transactions, and enhanced operational control.

What Are Closed-Loop Crypto Wallets?

Closed-loop crypto wallets are restricted digital wallet systems designed to function within a predefined platform or merchant ecosystem. They operate on an internal ledger and use permission-based transaction execution, ensuring that digital value can be transferred only between authorized users and approved merchants. This architecture enables controlled fund movement, predictable settlement, and platform-level governance.

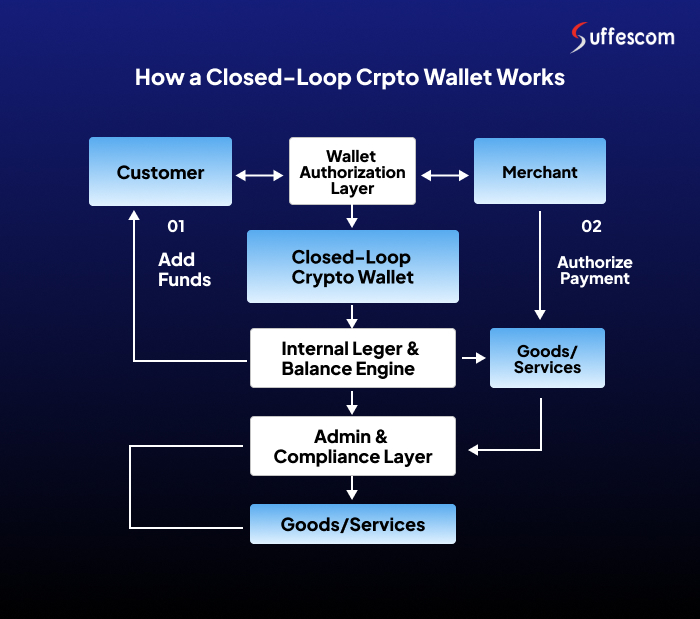

Step-by-Step Working of a Closed-Loop Crypto Wallet

1. User Wallet Initialization

Users create a wallet on the platform, and balances are maintained in internal ledger records rather than via public blockchain addresses.

2. Transaction Authorization

Each transaction is validated through permission-based rules, wallet limits, and platform-defined policies before execution.

3. Internal Ledger Settlement

Funds are debited and credited instantly using off-chain ledger reconciliation, enabling sub-second transaction finality.

4. Merchant Wallet Credit

The merchant or platform account receives the value directly within the same ecosystem, with no external network routing.

5. Governance and Monitoring

All transactions are logged in audit-ready records, enabling real-time monitoring, compliance enforcement, and reporting.

Closed-Loop Crypto Wallets vs. Open-Loop Crypto Wallets

| Comparison Parameter | Closed-Loop Crypto Wallets | Open-Loop Crypto Wallets |

| Transaction Flow | Transactions are processed through internal ledger accounting with centralized authorization and instant settlement | Transactions are executed on public blockchain networks and require on-chain confirmation |

| Settlement Mechanism | Off-chain balance reconciliation with real-time updates | On-chain settlement is dependent on network congestion and block finality |

| Asset Movement Scope | Value circulation is restricted to a predefined ecosystem, such as a merchant or platform network | Assets can be transferred freely across external wallets, exchanges, and dApps |

| Accessibility | Access is limited to authorized users and approved merchants within the ecosystem | Open access to any compatible blockchain address or external platform |

| Network Dependency | No reliance on public blockchain networks for routine transactions | Fully dependent on public blockchain infrastructure |

| Transaction Fees | Predictable, platform-controlled fee structure or zero external fees | Variable gas fees based on network demand |

| Performance & Latency | Sub-second transaction execution suitable for high-frequency use cases | Latency varies based on network load and consensus time |

| Operational Control | Full control via policy engines, transaction limits, and role-based permissions | Limited administrative control once transactions are broadcast on-chain |

| Network Limitations | Limited to the platform’s internal ecosystem by design | Exposed to blockchain scalability constraints and congestion |

| Primary Use Cases | Merchant payments, loyalty systems, marketplaces, internal value circulation | DeFi participation, cross-platform transfers, and decentralized applications |

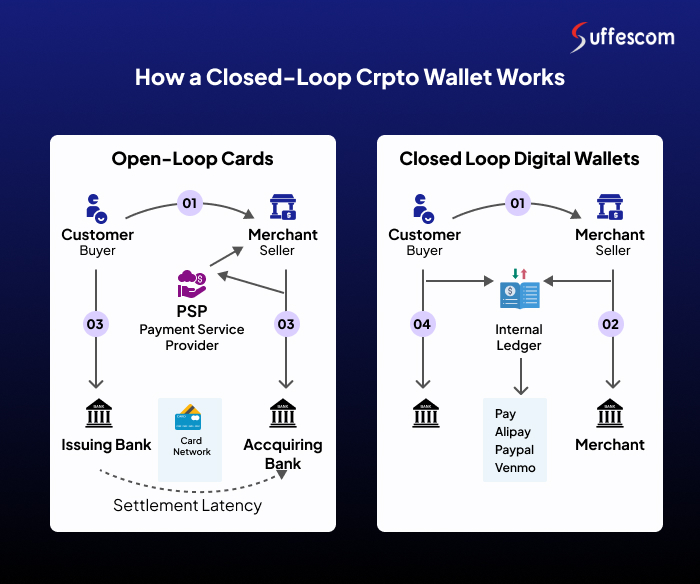

Open-Loop vs. Closed-Loop Payment Flow Architecture

This visual illustrates the fundamental architectural difference between open-loop card payments and closed-loop digital wallet systems.

- Open-loop payment flow relies on multiple intermediaries such as payment service providers, card networks, issuing banks, and acquiring banks. Each transaction passes through external networks, introducing settlement latency, variable processing fees, and limited operational control for platforms.

- Closed-loop wallet flow operates within a controlled internal ledger. Transactions move directly between users and merchants inside the ecosystem, enabling real-time authorization, instant settlement, predictable costs, and full governance over transaction rules.

Core Feature Set for Closed-Loop Crypto Wallet Development

1. Wallet Creation & Onboarding Flow

Enable users to quickly create wallets with secure KYC/AML verification, multi-device registration, and streamlined onboarding to enhance user retention.

2. Transaction Processing Engine

Process real-time crypto and fiat transfers with batch processing, cross-currency settlement, and high-speed transaction reliability.

3. Token Management Dashboard

Issue, track, and manage proprietary tokens or stablecoins with a centralized dashboard that provides detailed analytics and controls.

4. Multi-Layer Security & Encryption

Protect wallet assets using two-factor authentication, biometric verification, and end-to-end encryption against cyber threats.

5. Integrated Payment Gateway

Facilitate crypto-to-fiat and in-wallet payments seamlessly, allowing merchants and users to transact within a closed-loop ecosystem.

6. Loyalty & Reward Points Integration

Implement tokenized rewards, cashback programs, and loyalty points to drive user engagement and retention.

7. Smart Contract Automation

Automate transactions, recurring payments, and programmable financial operations using secure blockchain-based smart contracts.

8. Real-Time Analytics & Reporting

Provide actionable insights into user activity, wallet balances, and transaction trends to support better decision-making and management.

9. Merchant & Partner Integration

Allow businesses to accept closed-loop tokens, manage payments, and integrate inventory systems within the wallet ecosystem.

10. Regulatory Compliance & Audit Trails

Ensure full compliance with legal standards while maintaining transparent and auditable transaction records.

11. Push Notifications & Alerts

Keep users informed with instant updates on transactions, rewards, and security events to enhance engagement and trust.

Cut Payment Processing Costs by Up to 50%

Streamline transactions with instant internal settlements and reduce operational overhead across your platform.

Additional Features to Enhance Closed-Loop Crypto Wallets

1. Peer to Peer Transfers

Facilitate crypto transactions directly within the closed system to enable low-cost, rapid transfers. This aspect enhances consumer convenience without compromising control over money circulation.

2. Multi-Currency Support

Enable support for multiple cryptocurrencies, stable currencies, as well as fiat currencies within a single closed-loop cryptocurrency wallet. This enables a seamless exchange of value.

3. QR Code Payments

Enable fast, secure payment transactions for merchants and consumers via QR codes. The use of the QR code method for cryptocurrency payments increases the efficiency of these transactions.

4. Card & Banking Integration

Provide support for integrating debit and credit cards, as well as banking accounts, to enable smooth fiat on-ramps and off-ramps. The Card & Banking Integration fills the gap between banking systems and closed-loop payment systems in crypto.

5. In-Wallet Exchange

Allow instant conversion of tokens, stablecoins, and fiat in the wallet. This reduces reliance on third-party providers and improves the closed-loop system’s liquidity.

6. Budgeting & Expense Tracking

Offer integrated functionalities that help users track their personal expenditures, as well as token usage, in real-time. This will help users better manage their finances and use their wallets sensibly.

7. NFT & Digital Asset Wallet

Store, display, and manage NFT & digital assets safely within the cryptocurrency wallet. This extends wallet capabilities beyond payments to include asset ownership and management in the digital space.

8. Customizable User Roles

Provide role-driven dashboards for administrators, merchants, and end users that administrators can control to ensure secure, manageable functionality within the closed wallet environment.

9. API & Third-Party Integrations

Seamlessly integrate with Point of Sales applications, ecommerce sites, ERP applications, and business applications utilizing APIs.

10. Offline Transaction Support

Enables transaction processing in low-connectivity scenarios, with blockchain synchronization occurring later. This increases wallet usability without blockchain connectivity at all times.

11. Gamification & Incentives

Use badges and activity rewards to engage users. Wallet gamification will increase wallet retention and transaction volume within the wallet network.

12. AI-Powered Fraud Detection

Use machine learning algorithms to watch transactions for behavioral irregularities. This improves the service's security by preventing crypto wallet-related fraud.

13. Cross-Platform Access

Offer a unified closed-loop crypto wallet experience across mobile, web, and desktop. Cross-platform support will ensure the maximum possible accessibility.

Why Closed-Loop Crypto Wallets Are a Game-Changer for Businesses?

There are numerous benefits of closed loop crypto wallets, including instant internal settlements, up to 50% lower transaction costs, and a 30–40% higher customer retention rate.

1. Regulatory Compliance

Closed-loop cryptocurrency wallets support KYC/AML workflows, audit trails, and internal reporting. This ensures controlled governance and compliance across Closed Loop Wallet operations.

2. Low-Cost Transactions

Closed-loop crypto wallets enable instant internal transfers without external blockchain fees. This reduces transaction costs and improves overall payment efficiency.

3. High Security

Closed-loop cryptocurrency wallets restrict asset movement within the ecosystem. This minimizes fraud exposure and strengthens Closed Loop crypto Wallet security.

4. Revenue Retention

Closed-loop crypto wallets keep funds circulating within the internal network. This increases merchant profitability and ecosystem value retention.

5. Better User Experience

Closed-loop wallet platforms deliver frictionless onboarding and fast transactions. This improves adoption and ongoing user engagement.

6. Scalable Control

Closed loop cryptocurrency wallet solutions provide complete control over token economics and scalability. This enables predictable growth for closed-loop crypto wallets.

Enterprise-Grade End-to-End Closed-Loop Wallet Solution

Suffescom delivers a comprehensive closed-loop wallet solution that enables enterprises to launch and scale secure, high-performance digital payment ecosystems with full operational control.

1. Tailored to Your Business Model

Our white-label closed-loop crypto wallet is fully configurable, allowing businesses to customize workflows, transaction rules, and feature sets to align with evolving market and operational requirements.

2. Ready-to-Deploy Architecture

Launch a production-ready e-wallet or integrate closed-loop asset accounting directly into existing platforms. Enable exclusive in-network transactions without dependency on external payment rails.

3. Customizable Asset and Currency Management

Issue and manage multiple currencies, proprietary tokens, rewards, and bonuses from a centralized control layer, supporting flexible token economics and loyalty strategies.

4. Effortless Enterprise Integrations

Connect seamlessly with payment gateways, loyalty engines, POS systems, and third-party services using a robust API framework designed for closed-loop cryptocurrency wallet solutions.

5. Built for High-Volume Scale

The platform is engineered to support enterprise throughput, handling millions of transactions per day with low latency and consistent performance as the ecosystem grows.

6. Seamless Data Migration

Ensure smooth onboarding by integrating existing user, balance, and transaction data across diverse database formats without service disruption.

Closed-Loop Wallet Solutions for Merchants and Ecosystems

Enterprise and Retail Use Cases

Merchant Loyalty Programs

Enable tokenized rewards, cashback, and prepaid balances that remain usable within the merchant ecosystem.

Internal Token Ecosystems & Revenue Recirculation

Keep transactional value circulating inside the platform to improve margin retention and settlement efficiency.

Prepaid and Stored-Value Wallets

Support gift cards, vouchers, and prepaid balances for controlled spending and predictable cash flow.

Multi-Merchant Acceptance Networks

Allow authorized merchants to accept closed-loop balances under a unified settlement and governance model.

Customer Retention & Engagement Strategies

Behavior-Driven Rewards

Trigger incentives based on purchase frequency, wallet activity, or transaction volume.

First-Party Data Insights for Targeted Campaigns

Leverage internal transaction data to run personalized offers without reliance on third-party platforms.

In-Ecosystem Promotions and Offers

Launch time-bound discounts and wallet-exclusive benefits to drive repeat usage.

Lifecycle-Based Engagement Flows

Use wallet activity signals to activate onboarding, reactivation, and loyalty campaigns.

How to Build a Closed-Loop Crypto Wallet in 7 Strategic Steps?

1. Business Objectives and Wallet Rules

First, itemize the intended use cases for the closed-loop crypto wallet, including acceptance, partner merchants, and typical use scenarios such as loyalty rewards, gift cards, refunds, and subscription services.

Clearly articulate rules governing wallet recharges, spends, refunds, expiration rules, and rules governing KYC levels to ensure controlled wallet operations.

2. Choose the Right Architecture & Payment Rails

Select a choice of either a secure APIs-enabled central ledger system or a permissioned blockchain.

Plan how the on and off ramps for fiat and crypto will interface with the wallet.

3. Design Security and Compliance Frameworks

Ensure that robust systems for authentication, encryption, key management, and fraud protection are in place right from the onset.

Make KYC, AML, Data Residency, and Reporting compliant with the requirements of the specific region.

4. Develop Core Wallet Services

Develop functional components of a wallet, like balance, top-up, spend, refund, ledger, reconciliation, and batch settlement.

Ensure these services are reliable, scalable, and designed to handle high transaction volumes.

5. Integrate User Experience and Merchant Touchpoints

Integrate the wallet in online checkout systems, mobile applications, point of sales, and merchants’ interfaces. Emphasize intuitive interfaces, visibility of balances, quick payments, and simplified top-up processes.

6. Implement Loyalty and Programmable Logic

Add rewards with tokenization, level-based reward structures, campaign engines, merchant-driven rewards, and more. Ensure all loyalty logic is fully integrated with the wallet ledger to enable atomic transactions.

7. Test, Pilot, and Optimize for Scale

Conduct controlled pilots with selected users and merchants. Track success rate, latency, fraud, and user feedback on the transaction before moving on to production scaling.

Technology Stack for Closed-Loop Crypto Wallet Development

| Layer | Technologies |

| Frontend | React.js, Next.js, Flutter, Swift, Kotlin |

| Backend | Node.js, Java, Python, Spring Boot |

| Blockchain / Ledger | Ethereum, Polygon, Hyperledger Fabric, permissioned ledgers |

| Smart Contracts | Solidity, Vyper |

| Database & Caching | PostgreSQL, MongoDB, Redis |

| Security | JWT, OAuth 2.0, multi-factor authentication, HSM |

| Payments & Banking | Banking APIs, fiat on-ramp and off-ramp integrations |

| Cloud Infrastructure | AWS, Google Cloud, Docker, Kubernetes |

| Compliance & Monitoring | KYC/AML tools, transaction monitoring, audit logs |

| Analytics & Reporting | Elasticsearch, Kibana, reporting dashboards |

Cost of Closed-Loop Crypto Wallet Development

Understanding how to build a closed-loop crypto wallet also involves evaluating the overall development cost. Pricing depends on whether you choose a white-label Closed Loop Wallet solution or a fully custom build. Partnering with a white label crypto wallet development company helps reduce development costs, accelerate launch, and maintain enterprise-grade reliability. Core cost drivers include wallet features, security and compliance requirements, merchant integrations, and scalability needs. White-label closed-loop cryptocurrency wallet solutions provide a cost-effective approach while ensuring robust, enterprise-ready performance.

Cut Payment Processing Costs by Up to 50%

Optimize your transaction efficiency and reduce overhead with instant, internal settlements.

Compliance Considerations for Closed-Loop vs. Open-Loop Crypto Wallets

Closed-loop systems offer stronger regulatory control compared to open-loop wallets. They limit exposure to external networks and uncontrolled asset flows.

1. Regulatory Advantages of Closed-Loop Systems

Controlled participation simplifies compliance implementation. This reduces regulatory uncertainty.

2. Risk Management and Legal Considerations

Restricted transaction environments lower operational and fraud risks. Legal accountability remains centralized.

3. Jurisdiction-Specific Operational Guidelines

Wallet rules can be adapted to local regulations. This supports compliant expansion across regions.

Enterprise-Ready Closed-Loop Wallet Solutions for Every Industry

At Suffescom, we help enterprises build branded closed-loop wallet ecosystems tailored to industry-specific operational and customer engagement needs. Our closed-loop wallet solutions enable secure, in-network transactions while improving cost efficiency, loyalty, and user experience across diverse sectors.

1. Retail Closed-Loop Wallets

Enable faster in-store and online payments while eliminating third-party processing fees. Integrate loyalty programs, gift cards, and vouchers into a unified retail wallet ecosystem.

2. Corporate Benefits and Expense Wallets

Simplify meal, travel, and reimbursement workflows through dedicated employee wallets. Centralize expense tracking, rewards, and bonuses within a controlled internal ecosystem.

3. Telecom Wallet Solutions

Support seamless bill payments, prepaid top-ups, and subscription management. Enable mobile money payments and cross-platform transactions through a single wallet interface.

4. Hospitality Wallets

Deliver an integrated booking and payment experience for hotels and resorts. Allow cashless in-property services along with reward points and tier-based guest benefits.

5. Food and Beverage Wallets

Power digital wallets for restaurants, cafes, and cloud kitchens. Facilitate prepaid meal plans, subscriptions, and personalized offers based on purchase history.

6. Gaming Wallet Ecosystems

Enable secure in-game transactions and virtual item purchases. Support player accounts, gamified loyalty programs, and in-app reward mechanisms.

7. Event and Entertainment Wallets

Facilitate cashless payments at concerts, festivals, and theme parks. Support reloadable wristbands, digital event cards, and bundled ticketing with rewards.

8. Mobility and Ride-Sharing Wallets

Enable payments for ride-sharing, ticketing, and micromobility services.It supports frequent rider programs and incentives for sustainable travel behavior.

9. Healthcare Wallet Solutions

Offer prepaid wallets for medical services and recurring treatments. Integrate appointment scheduling, payments, and loyalty discounts into a single platform.

Trends and Outlook for the Future of Closed-Loop Crypto Wallet

The next generation of Web3 crypto wallet development focuses on modular, API-driven platforms that integrate loyalty programs, in-app currencies, and controlled interoperability

1. Tokenized Digital Ecosystems

Closed-loop cryptocurrency wallets are now being developed into in-app economies on the back of in-app currencies and reward tokens. Such ecosystems facilitate the controlled flow of value while enhancing interactions among users.

2. Controlled Interoperability

Future versions of the Closed Loop Crypto Wallet will support fractional connectivity to public blockchain networks. It enables compliant asset movement and off-ramping access without undermining internal controls.

3. Compliance-First Architecture

The regulatory requirement is getting increasingly integrated with the wallet flows. This methodology simplifies governance and enables scalable launch scenarios in regulated markets.

4. Data-Driven Intelligence

Transaction and usage data is being utilized to better monitor risk as well as make operational decisions. Analytically inferred insights improve system efficiency without affecting user experiences.

5. Beyond Payments

Closed-loop crypto wallets are expanding beyond transactions to support loyalty programs and digital assets. This transforms wallets into long-term engagement platforms rather than standalone payment tools.

6. Modular Enterprise Infrastructure

Wallet platforms are being built with modular, API-based architectures. This enables easier customization, integration, and future scalability.

Boost Platform Efficiency by 40% with Closed-Loop Wallets

Unlock instant settlements, reduce transaction costs by up to 50%, and enhance user retention with a secure internal ledger ecosystem.

Why Suffescom Is the Top Choice for Closed-Loop Crypto Wallet Development

Suffescom is a leading cryptocurrency wallet development company that helps businesses transform their payment and loyalty ecosystems with custom-built closed-loop crypto wallets. Our solutions streamline transactions, enhance customer engagement, and turn rewards into long-term retention.

1. Expert Wallet Architecture: Scalable and modular design to support millions of transactions daily.

2. 24/7 Dedicated Support & Maintenance: Expert guidance to ensure uninterrupted wallet performance and operational reliability.

3. Programmable Token & Rewards Systems: Drive engagement with tokenized loyalty, cashback, and reward campaigns.

4. AI-Powered Risk Protection: Proactively detect anomalies and secure assets within the ecosystem.

5. Seamless POS and App Integrations: Enable smooth payment experiences across web, mobile, and in-store platforms.

6. Compliant Settlement Management: Manage multi-currency, fiat, and crypto settlements with audit-ready transparency.

FAQs

1. What is the main difference between closed-loop and open-loop crypto wallets?

Closed-loop crypto wallets operate within a restricted ecosystem using internal ledger accounting, while open-loop crypto wallets allow unrestricted transfers across public blockchain networks and external platforms.

2. Are closed-loop crypto wallets built on blockchain?

Closed-loop wallets may use permissioned blockchains or centralized ledgers. Many solutions combine off-chain ledger systems with blockchain anchoring for auditability and compliance.

3. Can closed-loop wallets support fiat and crypto together?

Yes, closed-loop cryptocurrency wallet solutions can support both fiat and crypto through integrated on-ramps, off-ramps, and internal asset accounting.

4. Is KYC and AML mandatory for closed-loop wallet solutions?

KYC and AML requirements depend on jurisdiction and use case, but most enterprise-grade closed-loop wallet solutions include built-in compliance frameworks.

5. How scalable are closed-loop crypto wallets for high transaction volumes?

Closed-loop wallets are designed for high throughput using off-chain settlement and internal ledger reconciliation, making them suitable for large merchant networks and frequent transactions.

6. Can a closed-loop wallet be customized for industry-specific use cases?

Yes, white-label closed-loop crypto wallets allow customization of features, workflows, loyalty logic, and UI to match industry-specific requirements.

7. How long does it take to launch a closed-loop wallet solution?

White-label solutions significantly reduce time-to-market, while custom closed-loop crypto wallet development timelines vary based on features, integrations, and compliance scope.

8. Are closed-loop wallets more secure than open-loop wallets?

Closed-loop wallets reduce exposure to public blockchain risks by restricting asset movement, enforcing policy controls, and using centralized security and monitoring systems.

"