Perpetual decentralized exchanges are becoming a core component of modern crypto trading infrastructure. According to recent market studies, crypto derivatives now account for over 70% of total trading volume, highlighting the growing demand for high-performance perpetual trading platforms. This shift has accelerated interest in Hyperliquid clone development, which combines the speed of centralized exchanges with the transparency of decentralized systems.

A Hyperliquid clone enables businesses to build a perpetual DEX with order book trading, low-latency execution, and non-custodial asset control. By leveraging a hybrid architecture with off-chain matching and on-chain settlement, enterprises can launch scalable perpetual decentralized exchanges that meet professional trading standards.

A Hyperliquid clone is a decentralized perpetual trading platform designed to operate like Hyperliquid but built as a customized solution for specific business needs. It focuses on fast order execution, professional trading experiences, and non-custodial asset control. Unlike basic decentralized exchanges, a Hyperliquid exchange clone is engineered for high-volume, leverage-based trading.

At its core, a Hyperliquid DEX clone uses an order book model rather than an automated market maker (AMM). This allows traders to place limit and market orders with superior price control and reduced slippage. A Hyperliquid decentralized exchange clone also combines off-chain trade matching with on-chain settlement, maintaining execution speed without sacrificing transparency or security.

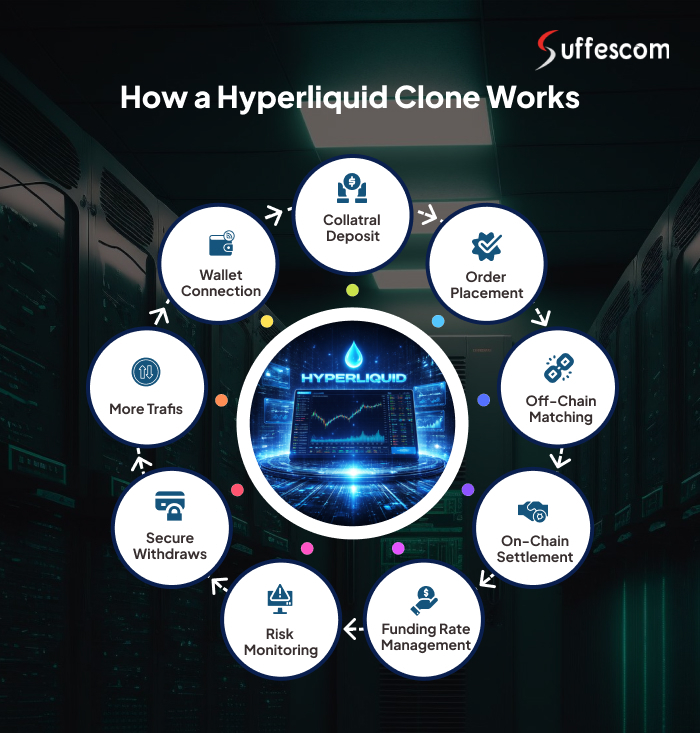

A Hyperliquid clone follows a hybrid trading workflow that combines fast execution with transparent settlement. This approach allows the platform to support professional perpetual trading without centralized custody.

Users connect non-custodial wallets to the Hyperliquid DEX clone. Funds remain on-chain, giving traders full control over their assets.

Traders deposit collateral into smart contracts to open leveraged positions. This setup supports secure and efficient perpetual futures trading.

Orders are placed through a real-time trading interface. The Hyperliquid trading platform clone allows limit and market orders with minimal delay.

Orders are matched through an optimized off-chain engine. This enables fast execution similar to centralized exchanges.

Matched trades are finalized on-chain for transparency. This ensures trust within the Hyperliquid decentralized exchange clone.

The platform tracks margin levels continuously. Liquidations are triggered automatically to maintain system stability.

Funding rates balance long and short positions. This keeps pricing fair across the Hyperliquid perpetual DEX clone.

Users can withdraw assets directly from smart contracts. No third-party approval is required in the Hyperliquid exchange clone.

A Hyperliquid DEX clone is built on carefully designed architecture that supports high-speed trading, deep liquidity, and secure perpetual contracts. Each component plays a critical role in ensuring the Hyperliquid decentralized exchange clone operates reliably under real market conditions.

The order book matching engine enables fast, accurate execution of limit and market orders. It ensures low latency, tight spreads, and reliable trade processing for a professional-grade trading experience.

The perpetual trading engine supports perpetual futures trading with configurable leverage, real-time funding rate calculations, open interest tracking, and seamless position settlement during high market volatility.

Risk controls are a defining feature of Hyperliquid clone development. The platform includes cross-margin and isolated margin models, real-time liquidation logic, and auto-deleveraging mechanisms to protect system stability and trader capital.

A Hyperliquid decentralized exchange clone uses off-chain order matching for speed and on-chain settlement for transparency. This hybrid structure delivers centralized-exchange-level performance without sacrificing decentralization principles.

Reliable pricing is critical for any Hyperliquid perpetual DEX clone. Secure oracle integrations (such as Chainlink) ensure accurate mark prices, fair liquidation triggers, and protection against price manipulation across all trading pairs.

A Hyperliquid DEX clone supports non-custodial wallet connections, enabling users to trade directly from their wallets (MetaMask, WalletConnect, etc.). This component strengthens trust and eliminates custody-related risks when businesses create a Hyperliquid-like exchange.

To sustain trading activity, a Hyperliquid trading platform clone should include liquidity incentives, maker-taker fee models, and professional market-maker integrations. These features are critical for achieving tight spreads and consistent trading volume.

Successful Hyperliquid clone development relies on scalable backend systems capable of handling high transaction throughput, peak trading hours, and real-time data indexing. This ensures platform stability as user demand grows.

Security is central to any Hyperliquid exchange clone. Smart contract audits, multi-signature controls, access restrictions, and continuous security monitoring protect the platform from exploits and operational failures.

An enterprise-ready Hyperliquid DEX clone includes a comprehensive admin panel for managing trading pairs, leverage limits, fee structures, risk parameters, and system health metrics. This allows businesses to operate and scale the platform efficiently.

Many enterprises connect their Hyperliquid clone to a white-label cryptocurrency exchange or advanced perpetual exchange development infrastructure to expand liquidity pools and product offerings.

Understand why businesses are adopting Hyperliquid clones for speed, transparency, and liquidity.

Choosing a Hyperliquid clone enables businesses to launch a high-performance perpetual trading platform without building complex systems from scratch. It offers a balanced combination of speed, control, and long-term scalability.

Hyperliquid clone development shortens development cycles by using a proven trading architecture. Integration with a white label cryptocurrency exchange ecosystem further accelerates launch timelines and market entry.

A Hyperliquid exchange clone delivers low-latency execution and an order book-based interface. This attracts experienced traders who expect centralized-exchange-level performance.

A Hyperliquid decentralized exchange clone allows users to retain control over their funds. This reduces custody-related risks and strengthens user trust.

A Hyperliquid perpetual DEX clone is designed to handle high trading volumes. Businesses can scale operations without significant infrastructure changes.

When you build a Hyperliquid clone, you can customize trading rules, leverage limits, and fee structures. This flexibility supports unique market positioning.

Efficient margin and funding mechanisms improve capital usage. This makes the Hyperliquid trading platform clone attractive for high-volume traders.

Trading fees, funding rates, and liquidity incentives create multiple revenue streams. This supports sustainable growth for businesses.

Hyperliquid clone development supports continuous upgrades and the development of new derivative products. This helps businesses adapt to evolving market cycles.

The Hyperliquid clone development process follows a structured approach to ensure performance, security, and long-term scalability. Each stage focuses on building a reliable perpetual trading platform.

Business goals, target users, and trading requirements are defined clearly. This helps shape the scope of the Hyperliquid exchange clone.

The platform architecture is designed with off-chain matching and on-chain settlement. This ensures speed and transparency in the Hyperliquid DEX clone.

A perpetual trading engine is built with order book logic and leverage support. This forms the core of the Hyperliquid perpetual DEX clone.

Margin rules, liquidation logic, and funding rate mechanisms are configured. These systems protect the platform during market volatility.

Smart contracts are designed to handle collateral, settlements, and withdrawals. Security best practices are applied throughout development.

A trading interface is created with real-time data and wallet connectivity. This ensures smooth user interaction with the Hyperliquid trading platform clone.

Functional, performance, and security testing are conducted. This validates platform stability under real trading conditions.

The Hyperliquid decentralized exchange clone is deployed on the selected network. Final checks ensure readiness for live trading.

Ongoing monitoring and performance tuning are carried out. This helps the platform scale and adapt to market demand.

Build a scalable, secure, and feature-rich perpetual trading platform tailored to your business needs.

| Layer/Component | Technologies & Tools |

| Blockchain Networks | Ethereum, Arbitrum, Optimism, Polygon Edge, Solana, Cosmos SDK |

| Smart Contract Languages | Solidity, Vyper, Rust, CosmWasm |

| Backend & Core Logic | Node.js, Go, Rust; Redis, Apache Kafka, PostgreSQL |

| Real‑Time Trading & APIs | WebSockets, gRPC, GraphQL, The Graph Protocol |

| Frontend & UI | React.js, Next.js, TypeScript, TradingView / Charting libraries |

| Wallet Integration | Web3.js, Ethers.js, WalletConnect, Coinbase Wallet |

| Price Feed & Oracle | Chainlink, Pyth Network, decentralized oracle networks |

| Security & Compliance Tools | Multi-signature wallets, audit tools, KYC/AML integrations |

| Monitoring & Analytics | Prometheus, Grafana, Elastic Stack |

| DevOps & Deployment | Docker, Kubernetes, CI/CD pipelines, cloud infrastructure |

The cost of a Hyperliquid clone script typically ranges between $15,000 and $20,000, depending on business objectives, feature depth, and overall platform complexity. This cost generally includes the core trading engine, smart contracts, risk management modules, admin controls, and essential security implementations.

Key factors that affect the cost:

A Hyperliquid clone offers multiple monetization channels built directly into its perpetual trading architecture. These revenue streams scale naturally with trading volume and platform adoption.

The primary revenue source comes from maker and taker fees. A Hyperliquid exchange clone generates consistent income as trading volume increases.

Funding rates paid between long and short positions create an ongoing revenue mechanism. Platforms can retain a small percentage of funding settlements.

When positions are liquidated, the platform earns fees from the liquidation process. This revenue increases during high market volatility.

Professional liquidity providers may pay access or incentive-related fees. This supports deeper order books on the Hyperliquid DEX clone.

Advanced tools such as high-leverage access or priority execution can be offered as paid features. This enhances revenue without impacting basic users.

Institutional traders may pay for high-performance APIs and data access. This monetizes algorithmic trading activity on the platform.

A Hyperliquid trading platform clone integrated with a broader exchange or perpetual trading ecosystems can earn referral or shared-volume revenue.

A Hyperliquid exchange clone is designed to evolve with market and technology trends. Its flexible architecture supports continuous innovation in performance, risk management, and trading reach.

Layer 2 integration (Arbitrum, Optimism, zkSync) helps a Hyperliquid clone process significantly more trades at lower costs. This improves scalability without compromising execution accuracy.

Cross-chain bridge integrations allow traders to use assets from multiple blockchain networks. This enhances liquidity depth and usability in a Hyperliquid perpetual DEX clone.

AI-driven risk engines improve liquidation accuracy, margin call predictions, and systemic risk monitoring. These upgrades strengthen platform stability during volatile market conditions.

Machine learning-powered analytics provide deeper insights into trading patterns, market sentiment, and liquidity dynamics. This helps platforms optimize performance and trader engagement.

Future Hyperliquid clone development will increasingly focus on enterprise compliance tools, reporting frameworks, and audit-ready infrastructure. This supports long-term adoption by institutional traders and regulated entities.

Schedule a free consultation to learn how a Hyperliquid DEX works and explore its potential for your trading platform.

As a specialized Hyperliquid clone development company, we focus on building performance-optimized perpetual trading platforms backed by secure smart contracts, scalable infrastructure, and real-market exchange engineering expertise.

Our team has hands-on experience in Hyperliquid DEX development, working with order book models, perpetual contract logic, and high-frequency execution systems used in live trading environments.

We architect platforms to efficiently build Hyperliquid clone solutions with low-latency matching, optimized data flow, and stable execution during peak trading activity.

Every platform is built on a hardened hyperliquid clone script, supported by audited smart contracts, strict access controls, and risk-isolation mechanisms.

Our approach enables businesses to build Hyperliquid-like exchange platforms that scale smoothly as liquidity, users, and trading pairs grow.

We design systems that support future network integrations, enabling multi-chain growth without reworking the core hyperliquid DEX development architecture.

Beyond deployment, we provide continuous optimization, monitoring, and upgrades to ensure the Hyperliquid clone remains stable and competitive.

We focus on sustainable growth by supporting ongoing enhancements, performance improvements, and ecosystem expansion rather than one-time project delivery.

A Hyperliquid clone is a decentralized perpetual trading platform modeled on Hyperliquid's architecture. Unlike standard AMM-based DEXs, it uses an order book system with off-chain matching and on-chain settlement, supporting high-volume, leverage-based derivatives trading with professional execution standards.

It operates through hybrid trading architecture: users connect non-custodial wallets, deposit collateral into smart contracts, place orders through the trading interface, and the system executes trades off-chain while settling on-chain. This combines speed, transparency, and security.

Yes. You can either build a custom Hyperliquid clone from scratch or deploy a pre-configured Hyperliquid clone script. The platform can include perpetual futures trading, advanced risk management, cross-chain support, and professional trading interfaces customized to your business model.

The cost to build a Hyperliquid clone script typically ranges from $15,000 to $20,000, depending on platform features, trading logic complexity, smart contract audits, compliance integrations, and post-launch support requirements. The overall project scope and scalability goals also influence final investment.

A complete Hyperliquid clone development generally takes 3–6 months, including requirement analysis, system architecture design, smart contract development, frontend/backend integration, comprehensive security audits, testing, and mainnet deployment.

Yes, it includes multiple security layers such as smart contract audits, formal verification, multi-signature controls, access restrictions, real-time risk monitoring, and optional KYC/AML integrations for regulatory compliance across jurisdictions.

Absolutely. Hyperliquid clone platforms are architected to support cross-chain bridge integrations, Layer 2 scaling solutions, and advanced features such as AI-based risk engines and predictive analytics, ensuring future-ready growth and adaptability.

Yes. Our services include continuous performance optimization, system monitoring, feature upgrades, security patches, bug fixes, and infrastructure scaling to maintain platform stability, security, and market competitiveness.

Yes. Businesses can fully customize trading rules, leverage limits, margin models, fee structures, UI/UX design, supported asset types, and compliance modules to align the platform precisely with their market strategy and target audience.

Fret Not! We have Something to Offer.