What Is Hyperliquid DEX? Redefining On-Chain Perpetuals in the DeFi Era

Hyperliquid DEX is a next-generation decentralized exchange for on-chain perpetuals and crypto derivatives trading. It uses a fully on-chain order book, which makes trades fast and efficient while keeping assets secure and non-custodial.

Unlike AMM-based DEXs, it provides deep liquidity and a professional trading experience, running on the Hyperliquid blockchain, which delivers CEX-level speed with full DeFi transparency.

The platform supports cross-margin trading and isolated positions, so traders can manage risk more effectively. It also includes advanced derivatives, real-time price oracles, and automated risk management, which maintain system stability during high volatility.

According to data from DefiLlama, monthly trading volumes for perpetual DEXs hit an all-time high of $1.143 trillion in September 2025, a 49% increase from August's $766 billion.

For businesses, building a Hyperliquid-inspired platform creates a scalable, secure, and transparent DeFi ecosystem, and it can include tokenized governance, staking, and liquidity management for users.

Launch Your Fast & Secure Hyperliquid DEX - Trade perpetuals with zero compromise!

Why Traders Are Choosing Hyperliquid DEX?

Traders prefer the hyperliquid decentralized exchange model because it delivers sub-second execution without giving up asset control. The traditional crypto trading landscape often forces traders to compromise: centralized exchanges offer speed but require surrendering control of assets. In contrast, decentralized exchanges provide security but usually involve slower, costlier transactions.

Hyperliquid DEX eliminates this tradeoff by offering:

1. Sub-second trading speed: Execute trades almost instantly with sub-second finality.

2. True decentralization: Keep full control of your assets without custodial risk.

3. Cost efficiency: Optimized architecture reduces gas fees and transaction costs.

4. Advanced trading tools: Access a wide range of order types and perpetual futures options.

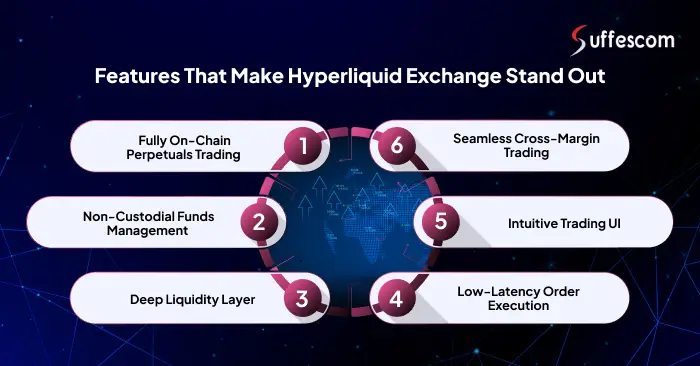

Features That Make Hyperliquid Exchange Stand Out

These powerful features combine to deliver a fast and secure trading experience, making Hyperliquid DEX a standout platform in the DeFi ecosystem.

1. Fully On-Chain Perpetuals Trading

Hyperliquid enables perpetual futures trading entirely on-chain. This ensures transparent trade settlement, immutable records, and real-time position tracking without relying on intermediaries. Traders can leverage positions safely while enjoying the speed and reliability of decentralized execution.

2. Non-Custodial Funds Management

Users maintain full control of their assets at all times. The platform uses smart contracts to manage collateral, margin, and settlements, reducing the need for custodial wallets. It enhances security, trust, and decentralization in the trading process.

3. Deep Liquidity Layer

Hyperliquid implements advanced liquidity algorithms and order book matching to provide low-slippage trades even for high-volume positions. Deep liquidity ensures traders can execute large trades efficiently, which is crucial for professional-grade crypto derivatives trading.

4. Seamless Cross-Margin Trading

The platform allows cross-margin functionality, where traders can use a single asset pool to manage multiple positions. This optimizes capital efficiency, reduces liquidation risk, and enables flexible margin strategies for on-chain perpetuals and derivatives.

5. Intuitive Trading UI

Hyperliquid combines user-friendly design with professional trading tools. Its dashboard, charts, and order placement modules are built to mimic the familiar experience of centralized exchanges, making it easy for both beginners and experienced traders to navigate.

6. Low-Latency Order Execution

With sub-second finality enabled by the HyperBFT consensus and optimized smart contract execution, trades execute almost instantly. This low-latency system is critical for high-frequency trading, derivatives strategies, and margin positions where timing is crucial.

Why Businesses Trust Hyperliquid DEX Trading Model?

Hyperliquid DEX empowers businesses and traders to access institutional-grade crypto derivatives while maintaining full control of their assets.

1. Decentralized Yet Scalable

Hyperliquid achieves CEX-level speed without compromising decentralization. Its HyperBFT consensus and custom blockchain architecture ensure sub-second trade finality even under heavy load. It is suitable for high-frequency crypto derivatives trading.

2. Institutional-Grade Crypto Derivatives Experience

The platform provides robust infrastructure for professional traders and hedge funds, including cross-margin trading, isolated positions, and leveraged perpetuals. Businesses deploy Hyperliquid-inspired DEX platforms with high liquidity and risk-managed derivatives execution.

3. Transparent Market Mechanics

Hyperliquid DEX offers full auditability and verifiable on-chain settlement proofs, ensuring trust and accountability. Traders and institutions can rely on immutable trade records, real-time analytics, and transparent order book operations.

4. High Liquidity & Market Depth

Custom liquidity algorithms and incentive mechanisms ensure sufficient market depth for large trades. This reduces slippage and enhances trading efficiency, attracting both retail and institutional participants.

5. Advanced Risk Management

Integrated automated risk controls, margin monitoring, and liquidation modules to maintain platform solvency. Businesses benefit from secure, non-custodial trading while offering users professional tools.

6. Interoperable & Cross-Chain Ready

Hyperliquid’s design supports cross-chain liquidity and multi-asset integration, enabling seamless trading across multiple EVM-compatible chains. This future-proofs the platform for the evolving DeFi ecosystem.

7. Governance & Ecosystem Incentives

The platform incorporates tokenized governance, staking rewards, and fee-sharing mechanisms. It enables businesses to engage their community and promote long-term platform adoption.

Build a Custom Decentralized Exchange with Precision

Develop a full-featured Hyperliquid-style DEX with smart contracts, order book, and derivatives support.

Key Advantages of a Hyperliquid DEX for Modern Crypto Trading

Hyperliquid DEX delivers fast, transparent, and fully decentralized trading experiences in numerous ways:

1. Regulatory-Ready Architecture

Compliant design enables smooth KYC/AML integration and transparent audits for institutional traders.

2. Lightning-Fast Transactions

Optimized blockchain and on-chain matching deliver near-instant trade execution with low latency.

3. Cross-Chain Asset Accessibility

Supports seamless trading and asset transfers across multiple blockchains for greater liquidity.

4. Scalable Infrastructure for Growth

Handles growing user demand, trading volume, and market pairs without performance issues.

5. Customizable Fee Structures

Allows flexible trading fees, rewards, and token incentives to attract and retain users.

6. Advanced Trading Analytics

Real-time dashboards provide traders with actionable insights on P&L, liquidity, and performance.

7. Community-Driven Growth

Governance mechanisms let users vote on upgrades, tokenomics, and platform decisions.

8. Enhanced User Experience

Intuitive interface ensures easy navigation for both retail and professional traders.

Introducing the HYPE Token : Powering the Hyperliquid Ecosystem

Hyperliquid’s native token, HYPE, plays a central role in the ecosystem. Its functions include:

1. Governance rights: Token holders can participate in key protocol decisions.

2. Fee benefits: Enjoy discounts on trading fees when using HYPE.

3. Staking rewards: Support network security while earning incentives.

4. Value growth: Token utility grows as platform adoption increases.

Core Features of Hyperliquid-Like DEX Development Solutions

1. Margin Trading and Cross Collateralization

Implement cross-margin and isolated positions for professional traders. With automated liquidation and risk controls, the margin trading platform remains stable even during volatile market conditions.

2. Real-Time Price Oracles

Integrate reliable price oracles like Chainlink to provide accurate asset pricing. This ensures that crypto derivatives and perpetuals trading is precise and trustworthy for all users.

3. Multi-Asset Wallet Integration

Grab the solutions that support multiple crypto assets in a single non-custodial wallet. Traders can manage collateral, payouts, and positions seamlessly, improving user experience.

4. Advanced Risk Management Tools

Consider automated margin checks, liquidation modules, and portfolio monitoring. These tools protect both the platform and traders, ensuring Hyperliquid DEX operates securely.

5. Analytics Dashboard

Real-time analytics dashboard offers trading metrics, liquidity insights, and on-chain data visualization. This allows admins and traders to make informed decisions, enhancing overall DEX performance.

6. Built-In Liquidity Management

Manage order book depth, liquidity pools, and token incentives automatically. This ensures smooth execution, stable trading conditions, and keeps the Hyperliquid DEX trading platform competitive in high-volume markets.

Our Approach to Building Hyperliquid-Inspired DEX Platforms

Our proven workflow ensures to build custom decentralized exchange platforms with enterprise-grade architecture and optimized trading efficiency.

1. Discovery & Product Strategy

We start with a comprehensive requirements analysis and feasibility planning, studying competitors such as Hyperliquid DEX and dYdX. This phase ensures your DeFi platform development strategy aligns with market trends and trader expectations while identifying opportunities for on-chain perpetuals and crypto derivatives trading.

2. Technical Architecture & Blockchain Selection

Our team works closely with you to select the ideal blockchain layer, whether EVM-compatible networks, Hyperliquid blockchain, or custom rollups. This step ensures scalable and secure decentralized exchange development.

3. DEX Design & Smart Contract Development

We design a user-friendly UI/UX similar to Hyperliquid exchange, featuring on-chain order books, analytics dashboards, and advanced trading modules. Our smart contract development ensures non-custodial fund management, low-latency order execution, and cross-margin trading functionality.

4. Integration of Margin and Derivatives Modules

We implement perpetuals trading, leverage logic, and automated liquidation modules to build a professional-grade margin trading platform. This ensures traders can execute crypto derivatives strategies securely and efficiently.

5. Automation with Trading Bots

We integrate AI-driven trading bots for market-making, strategy execution, and risk management, enhancing your DEX’s efficiency and liquidity. This module is a core part of our crypto trading bot development solutions.

6. Testing, Auditing & Deployment

Before launch, we conduct comprehensive security audits, scalability testing, and smart contract verification. This ensures your Hyperliquid-inspired DEX operates safely, reliably, and at CEX-level speed for on-chain perpetuals and derivatives trading.

Core Technologies Powering Hyperliquid-Inspired DEX

The technology stack that enables a Hyperliquid-inspired DEX that is fast, secure, and fully scalable for professional trading.

| Layer / Component | Technologies & Tools | Description / Value |

| Blockchain Layer | Ethereum, Polygon, Arbitrum, Custom L1 like Hyperliquid | High-performance, scalable blockchain networks for secure on-chain trading and low-latency execution. |

| Smart Contracts | Solidity, Rust, CosmWasm | Custom smart contracts for on-chain perpetuals, derivatives, AMM engines, and automated trading logic. |

| Front-End Development | React.js, Next.js, Tailwind | Intuitive and responsive UI/UX for seamless trader experience across devices. |

| Backend & APIs | Node.js, Web3.js, GraphQL | Robust backend architecture enabling fast API responses, data fetching, and blockchain integration. |

| Data & Analytics | The Graph, Chainlink, Dune Analytics | Real-time market data, price oracles, and analytics dashboards for traders and admins. |

| Security & Compliance | Multi-signature wallets, audit tools, KYC integrations | Ensures secure transactions, risk mitigation, and regulatory compliance for all platform users. |

| Additional Tools & Modules | Liquidity management engines, automated margin modules, trading bot integrations | Supports enhanced liquidity, advanced trading strategies, and automated execution for professional traders. |

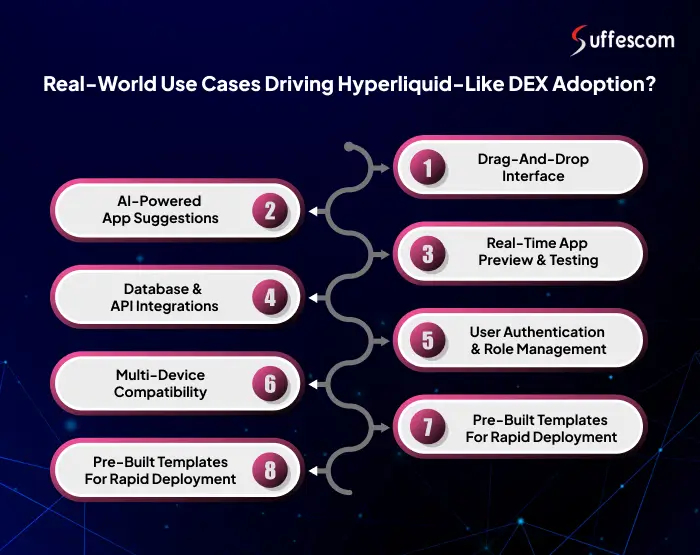

Real-World Use Cases Driving Hyperliquid-Like DEX Adoption?

These real-world implementations prove how Hyperliquid-style DEX platforms empower businesses to scale faster, trade smarter, and operate with decentralization.

1. Decentralized Cryptocurrency Trading

Hyperliquid-like DEX platforms allow users to trade cryptocurrencies directly from their wallets without intermediaries, offering enhanced security, privacy, and transparency.

2. Perpetuals and Futures Trading

Traders can engage in leveraged contracts, hedging strategies, and futures trading on multiple assets, all within a decentralized framework.

3. Automated Market Making (AMM)

Liquidity providers can earn fees by supplying liquidity to trading pools, ensuring seamless token swaps and market stability without a central order book.

4. Cross-Chain Asset Swaps

Advanced DEX platforms support multiple blockchains, enabling seamless swaps between tokens across different networks, reducing friction in trading.

5. Yield Farming and Liquidity Incentives

Users can stake or provide liquidity to earn rewards in native tokens or partner tokens, creating passive income opportunities.

6. Integration with DeFi Protocols

DEX platforms can connect with lending, borrowing, and staking protocols, allowing traders to leverage multiple DeFi services in a single interface.

7. NFT Trading and Fractionalized Assets

Some DEXs allow users to trade NFTs or fractionalize high-value assets for broader accessibility, enhancing liquidity in NFT markets.

8. Governance and Community Participation

Token holders can vote on platform upgrades, fee structures, and other governance decisions, making the DEX fully community-driven.

Transform Your DeFi Platform into a Trading Hub

Enable cross-chain trading, tokenized governance, and automated market-making for global users.

Future Outlook: The Evolution of Hyperliquid Blockchain and DEX Trading

The future of Hyperliquid DEX trading is shaping the next era of decentralized finance. Platforms are evolving to combine speed, transparency, and security, bringing the efficiency of centralized exchanges to DeFi. Innovations like on-chain perpetuals, cross-chain liquidity, and advanced risk management are setting new benchmarks. As the ecosystem grows, these platforms will enable scalable, professional-grade trading for both retail and institutional participants.

- The rise of on-chain perpetuals and decentralized derivatives

- Integration of AI for predictive risk models

- Cross-chain liquidity expansion and interoperable trading

Why Choose Us for Hyperliquid DEX Development?

We help you build a secure, fast, and reliable Hyperliquid-like DEX that meets the needs of modern traders and businesses.

1. DEX & Blockchain Expertise

We are a leading blockchain development company with deep experience in building decentralized exchanges. This means we understand trading protocols, on-chain order books, and network scaling, so your platform is fast, secure, and reliable.

2. In-House DeFi & Smart Contract Team

Our team includes DeFi architects and smart contract developers who handle perpetual trading, margin logic, and non-custodial fund management. They ensure your project is delivered as a complete, end-to-end solution.

3. Scalable Perpetual Trading Engines

We design trading engines that can manage high volumes and multiple assets. The system remains stable during peak traffic, while sub-second order execution keeps trades smooth and accurate.

4. Post-Launch Support & Governance

After launch, we provide continuous support, platform upgrades, and governance integration. This keeps your DEX platform up-to-date, compliant, and secure, while enhancing user experience.

5. Proven Crypto Derivatives Success

We have delivered DEX platforms and derivatives solutions for real clients. Our experience ensures your Hyperliquid-inspired exchange is robust, transparent, and scalable, giving traders and businesses confidence.

6. Security & Compliance

We implement audited smart contracts, multi-signature wallets, and compliance best practices. This ensures the platform is secure, trustworthy, and meets industry standards, safeguarding both users and your business.

FAQs

1. What makes Hyperliquid DEX different from other exchanges?

- Fully on-chain order book, not AMM-based

- Sub-second trade execution with low latency

- Deep liquidity layer and transparent settlements

- Non-custodial fund management for complete asset control

2. Is Hyperliquid DEX safe for beginners and professional traders?

Hyperliquid DEX ensures safety for all users. Funds remain fully under user control through non-custodial wallets, while automated risk management systems reduce liquidation risks. The interface is intuitive, making it easy for beginners to explore perpetuals, margin trading, and advanced derivatives securely.

3. Which blockchains are best for building a DEX like Hyperliquid?

- Ethereum Layer-2 networks (Arbitrum, Optimism)

- Polygon and Avalanche for low gas fees

- Custom Layer-1 options like Hyperliquid blockchain for full control

4. How does Hyperliquid ensure low transaction costs?

- Optimized smart contract execution reduces unnecessary on-chain computations.

- Custom blockchain architecture lowers gas fees compared to the Ethereum mainnet.

- Efficient transaction batching and order matching reduce network congestion.

- Traders can enjoy high-frequency trading with minimal cost per trade.

5. How transparent is trading on Hyperliquid DEX?

All trades are executed on-chain, providing verifiable and auditable records. Smart contracts are publicly viewable, while real-time dashboards track order execution, liquidity, and performance metrics, ensuring complete transparency.

6. Can a Hyperliquid-inspired DEX support cross-chain trading?

- Integrates multi-chain bridges to connect EVM-compatible networks.

- Enables cross-chain asset swaps and perpetual positions.

- Expands liquidity pools across multiple blockchains.

- Allows users to manage assets seamlessly without leaving the platform.