Luxury Asset Tokenization in 2026 – How Blockchain is Transforming High-End Ownership

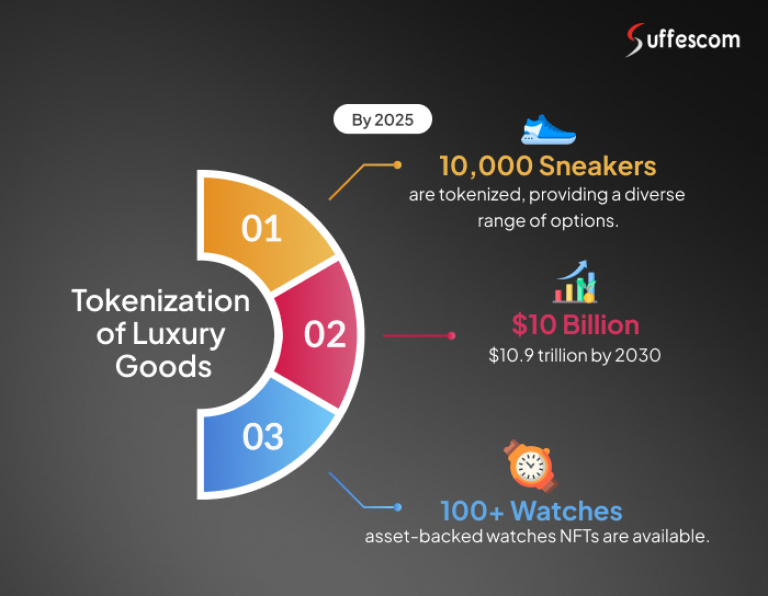

Luxury investing is no longer confined to galleries, vaults, or exclusive auctions; it’s moving on-chain. The global luxury asset tokenization market is projected to reach USD 13.53 billion by 2030, growing at a CAGR of 24.09% from 2022 to 2030 report by Grand View Research. This surge reflects how investors and brands are embracing tokenized luxury platforms to transform ownership, enhance liquidity, and authenticate assets with blockchain transparency.

We specialize in luxury asset tokenization platform development that bridges the gap between exclusivity and accessibility. From tokenized luxury goods and high-value real estate to fractional ownership of art and vehicles. Our solutions redefine luxury ownership, transforming rare collectibles into digital investment opportunities for a global audience.

Understanding the Concept of Luxury Asset Tokenization

Asset tokenization is about converting physical luxury goods into blockchain-based tokens. Each token represents a fraction of the asset's value, giving investors partial or fractional ownership of luxury assets without needing to buy the whole item outright.

This is an exciting concept that opens the door to a broader audience. Instead of having one buyer own an entire painting or other rare collectible, multiple investors can share ownership through secure, digital representation. Such ideas make access to luxury asset ownership broader, but they also increase liquidity in markets previously exclusive and illiquid.

Start Your Luxury Asset Tokenization Journey Today

Be part of the $13.53 billion tokenization market projected by 2030 and elevate your brand’s digital investment strategy.

How Luxury Asset Tokenization Works – From Valuation to Ownership

Step 1: Identifying and Valuing the Luxury Asset

Every journey of tokenization starts with asset selection. Whether it is Luxury Assets in Art, designer collectibles, or tokenized luxury vehicles, the selected item must undergo a verification process to ensure its authenticity and be appraised for its correct market value. This ensures total transparency before it goes into the blockchain ecosystem.

The valuation is then followed by recording the asset on a tokenized luxury platform where details regarding its provenance, ownership history, and condition are stored in safety.

Step 2: Token Creation and Blockchain Integration

The next step is the technical aspect: tokenizing luxury goods. Using blockchain, the asset's total value is divided into multiple digital tokens, each acting as a certificate of ownership. These tokens operate under smart contracts, which automatically enforce rules governing ownership, transfer, and royalties.

It means that the process will keep the tokenized asset transparent, immutable, and resistant to forgery. It is how luxury tokenization retains trust and authenticity on digital marketplaces.

Step 3: Trade and Fractional Investment Opportunities

When the tokens are created, they can then be traded or sold through a luxury asset tokenization platform. Investors can purchase tokens representing a portion of a painting, jewelry, or even a property. It's a modern take on luxury ownership-liquid, borderless, and flexible.

Furthermore, fractional ownership democratizes investment in luxury assets, enabling individuals to diversify their portfolios with high-end collectibles that were once reserved for the elite.

Step 4: Ownership, Returns, and Real-World Benefits

Once such tokens are issued, investors acquire the rights to respective proportions. Profits can be generated either through the appreciation of an asset or by secondary trading. Blockchain ensures that every transaction is permanently recorded. Hence, this guarantees transparent ownership of luxury assets without intermediaries. This setup works to everyone's advantage: brands tap into new sources of liquidity, and investors get a piece of the luxury action enabled through blockchain infrastructure.

Core Components of a Luxury Asset Tokenization Platform

These are the components that form the backbone of a reliable and future-ready luxury tokenization platform.

1. Blockchain Network

Forms the foundation for recording transactions and ownership securely. It ensures transparency, immutability, and traceability of every luxury asset.

2. Smart Contracts

Automate processes like token issuance, ownership transfer, and royalty distribution that remove the need for middlemen.

3. Asset Verification System

Links physical assets with digital records through certificates, QR codes, or digital twins, ensuring authenticity and provenance.

4. Token Management Module

Handles minting, burning, and transferring of tokens while supporting fractional ownership and multiple token standards.

5. Secure Wallet Integration

Enables safe token storage and transactions with encryption, biometric access, and multi-signature authentication.

6. Compliance & KYC Framework

Implements KYC/AML protocols to verify users, prevent fraud, and ensure legal compliance with global standards.

7. Trading & Marketplace Module

Allows users to buy, sell, or trade tokenized luxury assets seamlessly with real-time pricing and liquidity options.

8. Admin Dashboard

Provides complete control over users, transactions, and analytics for better monitoring and platform management.

9. AI Valuation Engine

Uses AI to assess asset value, predict trends, and improve investment decisions with real-time insights.

How Blockchain Enables Secure and Transparent Tokenized Luxury Platforms?

At the top of every luxury asset tokenization platform is blockchain, which provides the guarantee of trust, transparency, and traceability. It's not only about digital record-keeping; it's really what gives all tokenized assets their credibility, proving ownership and authenticity beyond any manual verification.

Here's how blockchain empowers secure and transparent tokenized luxury platforms step by step:

1. Immutable Ownership Records

The ownership details of every high-end item, whether it be fine art, collectibles, or tokenized luxury vehicles, are permanently recorded on the blockchain every time they are tokenized. These records cannot be tampered with or forged; hence, every transaction leaves a digital footprint that is fully traceable.

This immutability protects both brands and investors from counterfeit risks, a significant issue in the market for tokenizing luxury goods.

2. Smart Contracts for Automated Trust

Smart contracts represent self-executing agreements inscribed into the blockchain. They automatically confirm and execute actions, such as transfers, payments, or royalties, whenever certain predetermined conditions are met.

In tokenization platform development for luxury assets, these smart contracts make middlemen redundant and reduce errors to ensure that each investor receives exactly what they are entitled to instantly and transparently.

3. Real-Time Transparency and Traceability

The greatest advantage of a blockchain is its transparency. Every transaction occurring on a tokenized luxury platform is publicly verifiable, whereby participants have full clarity on the history, valuation, and movement of the asset.

Real-time transparency builds investor confidence and reinforces trust in the ownership of luxury assets-something that traditional systems often lack.

4. Enhanced Security through Decentralization

Unlike centralized databases, blockchains operate on a multi-node network, making it nearly impossible to hack into or manipulate. What this decentralized structure does is ensure the security of tokenized luxury assets even if one part of the system is compromised.

It is indeed what makes tokenization of luxury safer and more reliable in managing digital representations of real-world assets.

5. Authenticity Verification Included

Every token created on the blockchain possesses unique metadata related to its original asset. As such, stakeholders can ensure authenticity in a matter of seconds, with no third-party verification or physical inspection required. This reduces counterfeiting risks for brands and gives investors confidence in the legitimacy of their holdings on a Luxury Asset Tokenization Platform.

6. Frictionless Global Trading & Compliance

Blockchain enables global operations on tokenized luxury platforms through regulatory compliance via KYC/AML integrations and programmable smart contracts. Investors from around the world can now buy, sell, and trade tokenized luxury assets seamlessly within secure and compliant frameworks, sans borders and traditional banking barriers.

7. Building Trust in the Digital Luxury Economy

It transforms the concept of luxury ownership from being exclusive to inclusive, offering data-driven opportunities. Combining tokenization of luxury goods with decentralized security, it enables brands, collectors, and investors to create transparent, borderless trading ecosystems.

The Evolution of Luxury Tokenization Platforms

The luxury market has always thrived on exclusivity, but that very exclusivity often limited access to only a handful of investors. Today, blockchain and Luxury Asset Tokenization Platforms are rewriting that rule. Through digital transformation, the ownership of luxury goods, whether it’s art, watches, or real estate, has undergone significant changes. It is becoming more inclusive, transparent, and investment-friendly.

This new wave of tokenized luxury platforms doesn’t just change how assets are owned; it reshapes how value is perceived and exchanged. Let’s examine why investors and brands alike are shifting toward tokenized luxury assets and how fractional ownership of luxury assets is opening up entirely new doors in high-end investing.

Build Your Own Luxury Asset Tokenization Platform Today

Join the 75% of luxury brands embracing RWA tokenization development to secure transparency and long-term asset growth.

Fractional Ownership of Luxury Assets – A Game-Changer for Modern Investors

The concept of fractional ownership of luxury assets has opened an entirely new investment class for modern investors. Instead of purchasing a $1 million artwork outright, for instance, one can own digital shares of it, each representing a verifiable fraction of the asset.

Through advanced luxury asset tokenization platform development, blockchain enables these fractionalized shares to be issued as digital tokens, allowing investors from different regions to participate collectively. It democratizes luxury investing, reduces risk exposure, and offers liquidity in markets that were once static and exclusive.

Fractional ownership represents the bridge between traditional asset investing and digital innovation. It is a model already proving its potential across other sectors like real estate fractional ownership platform.

Key Token Standards and Protocols Powering Luxury Asset Tokenization

When it comes to developing a luxury asset tokenization platform, understanding the underlying token standards is crucial. These standards define how digital tokens represent real-world assets like art, fashion, or exotic cars on the blockchain.

- ERC-20: Standard for fungible tokens used in most tokenized asset platforms.

- ERC-721: Non-fungible token (NFT) standard for unique luxury collectibles.

- ERC-1155: Hybrid standard supporting both fungible and non-fungible assets.

- BEP-20: Token standard for Binance Smart Chain–based assets.

- TRC-20: The Tron-based token standard, known for its low transaction fees and fast confirmation times, is ideal for scalable tokenized asset solutions.

- ST-20: A security token standard built on Ethereum that ensures compliance with regulations while maintaining transparency and investor protection.

Business and Technical Aspects of Luxury Tokenization

In developing a luxury asset tokenization platform, there are two very important components: business strategy and technical architecture. While brands work on increasing their level of exclusivity and appeal to investors, the developers work behind the scenes building a secure, compliant, and highly scalable digital infrastructure.

Business Aspects

1. Revenue Models: Luxury brands can monetize through fractional ownership, limited-edition token drops, and resale royalties.

2. Market Expansion: Tokenization allows global participation, bringing in investors previously restricted by geography or asset price.

3. Brand Differentiation: This makes the brand appear innovative, future-ready, and offering tokenized luxury assets.

4. Compliance & Regulation: Businesses should ensure that tokenized luxury platforms conform to financial and data privacy regulations.

Technical Aspects

1. Selection of Blockchain: The usual blockchains on which NFT minting happens include Ethereum, Polygon, or Tron, chosen based on scalability and preference for gas fees.

2. Smart Contracts: Automate ownership transfers, dividend distribution, and compliance checks.

3. Digital Wallet Integration: Allows for secure custody and transactions of tokenized luxury goods.

4. Data Security: End-to-end encryption coupled with KYC/AML verification provides a secure user environment.

5. API Connectivity: Integration with external marketplaces, payment gateways, and identity systems strengthens platform usability.

How to Build and Launch a Tokenized Luxury Asset Platform?

Creating a luxury asset tokenization platform is not just a technical exercise. I’s a strategic process that blends blockchain innovation with user experience design. Here’s how the journey unfolds step by step.

1. Market Analysis & Concept Validation

State which of the luxury segments-art, fashion, cars, and jewelry-has the most tokenization potential. Validate demand through investor insights and competitor benchmarking.

2. Tokenomics Design

Define token structure, supply, ownership percentage, and utility. Whether it's ERC-20 or ERC-721, the goal is to ensure each token represents real-world luxury assets transparently.

3. Platform Architecture & Development

Establish the foundation with blockchain development services, ranging from user dashboards to the integration of smart contracts and secure trading modules.

4. Compliance & Security

Implement legal frameworks for AML/KYC, investor accreditation, and data privacy. A compliant RWA tokenization development service ensures investors' trust.

5. Go-Live and Investor Onboarding

The platform gets launched after rigorous testing and audits. Investor education and marketing campaigns help to create awareness and early adoption.

Tech Stack to Build a Luxury Asset Tokenization Platform

Building a scalable and compliant tokenization ecosystem requires a blend of blockchain protocols, backend infrastructure, and user-facing technologies. Below is a sample tech stack commonly used in luxury asset tokenization platform development.

| Category | Technologies / Tools | Purpose / Use |

| Blockchain Protocols | Ethereum, Polygon, Binance Smart Chain, Avalanche | Token creation, smart contract execution, and decentralized asset management |

| Smart Contract Development | Solidity, Rust, Web3.js, Hardhat, Truffle | Designing, auditing, and deploying token standards (ERC-20, ERC-721, ERC-1155) |

| Backend Frameworks | Node.js, Python (Django/Flask), Go | Managing APIs, wallet integrations, and transaction logs |

| Frontend Development | React.js, Next.js, Angular | Building interactive dashboards and investor portals |

| Database | MongoDB, PostgreSQL, IPFS, Firebase | Storing user data, transaction metadata, and off-chain documents securely |

| Wallet Integration | MetaMask, WalletConnect, Trust Wallet | Enabling secure asset transfer and investor onboarding |

| Token Standards | ERC-20, ERC-721, ERC-1155, BEP-20 | Representing fungible and non-fungible assets digitally |

| Security Tools | OpenZeppelin, Slither, MythX, Fireblocks | Smart contract auditing and digital asset custody |

| Compliance & KYC | Chainalysis, Civic, Sumsub, Onfido | Ensuring AML/KYC verification and regulatory compliance |

| Cloud & Hosting | AWS, Google Cloud, Microsoft Azure | For hosting APIs, databases, and dApp nodes securely |

| Analytics & Reporting | Dune Analytics, The Graph, Tableau | Tracking investor performance and transaction data |

Key Tokenization Models Transforming Luxury Assets

1. Security Tokens

Security tokens represent ownership in real-world assets, such as real estate, stocks, or bonds. STOs are blockchain-based tokens that comply with securities regulations and let people have fractional ownership in them.

2. Utility Tokens

Utility tokens provide access to certain features or services within a blockchain ecosystem to the user. They incentivize engagement and participation without granting ownership.

3. Platform Tokens

The blockchain ecosystems are powered by platform tokens, which allow staking, governance, and processing transactions. They play an essential role in the support of decentralized applications and smart contract execution.

4. Fungible Tokens

Fungible tokens include interchangeable digital assets of equal value, like Bitcoin or Ethereum. They ensure liquidity and stability, making them crucial in the context of any payment and trading system.

5. Non-Fungible Tokens (NFTs)

These are unique digital or physical assets, such as art or collectibles. They represent ownership and facilitate open trading of tokenized real-world assets.

6. Governance Tokens

Governance tokens grant their holders voting rights over specific decentralized platforms or DAOs. They foster democratic decision-making, aligning users with the project development goals.

7. Reward Tokens

Reward tokens are provided as part of incentives given to users for participating in staking or loyalty programs. Rewards incentivize community activities and drive long-term ecosystem growth.

8. Stablecoins

Stablecoins are digital tokens pegged to fiat currency or commodities, with an underlying goal of minimizing volatility. They offer a stable medium for payments, remittances, and DeFi trading in general.

9. Asset-Backed Tokens

Asset-backed tokens represent ownership of real-world assets such as real estate, art, or commodities. They allow high-end investments to become more accessible by the power of fractionalized value.

10. Privacy Tokens

Privacy tokens maintain users' anonymity by encrypting transaction information on public blockchains. They can ensure secure and private transfers for investors concerned with privacy.

Exploring the Tokenization of Luxury Goods and Collectibles

Tokenization of Luxury Goods is reshaping how people perceive and own premium items. From luxury watches and high-end fashion to exclusive collectibles, blockchain technology ensures authenticity, traceability, and secure digital ownership. Each item is represented by a verified token, allowing brands to maintain transparency while giving collectors and investors seamless access to luxury assets across borders.

The same transformation extends to Luxury Assets in Art and exotic cars, where tokenization enables fractional investments in rare and high-value creations. Through an art tokenization platform, investors can own a portion of fine art or rare vehicles which makes luxury investment more liquid, inclusive, and digitally accessible than ever before.

Real-World Use Cases of Luxury Asset Tokenization

1. Fine Art Tokenization

Fractionalize high-value paintings or sculptures into digital shares. With tokenization platform, investors own fractions of masterpieces while artists retain authenticity and royalties.

2. Tokenized Luxury Real Estate

The development of real estate tokenization can be considered ideal for global investors looking for secure, fractional ownership in luxury villas, resorts, and penthouses, which are divided into blockchain-backed tokens.

3. Designer Fashion and Jewellery

The embedding of blockchain-based certificates into each tokenized item helps luxury brands ensure authenticity and fight counterfeits, improving traceability and consumer trust.

4. Exotic and Vintage Cars

Tokenization will, therefore, enable shared ownership of rare or collectible vehicles. On the other side, investors get exposure to appreciating assets over time at a lower cost of full ownership.

5. Rare Collectibles and Watches

The digitization of limited-edition timepieces and collectibles ensures that provenance remains transparent, unlocking secondary trading opportunities.

Let’s Redefine the Future of Luxury Ownership

Partner with a leading Asset Tokenization Development Company to launch your tokenized luxury platform

How Luxury Item Tokenization Services Empower Brands and Investors?

For Brands : Enhancing Value, Traceability, and Authenticity

- Luxury item tokenization services help brands protect their reputation by verifying authenticity through blockchain.

- Every product token includes immutable details like origin, ownership, and production history.

- Brands gain transparency and build customer trust while adding digital value to physical assets.

For Investors : Enabling Fractional and Global Ownership of Rare Assets

- Investors can purchase fractions of high-value assets such as art, jewellery, or rare cars.

- Tokenized luxury goods make it possible to invest in global markets without geographic or financial barriers.

- It creates new opportunities for portfolio diversification through tokenized luxury assets.

To unlock such opportunities and create a seamless ecosystem for both brands and investors, businesses can build an RWA tokenization platform designed to ensure transparency, liquidity, and trust.

Fractionalization of Assets-Driving Liquidity and Price Discovery

The fractionalization of traditionally illiquid assets creates new trading opportunities and enhances price discovery in luxury markets, leading to greater accuracy. Assets such as fine art, real estate, and collectibles can be divided into digital shares through tokenization, allowing for broader participation and real-time valuations.

Tokenization removes geographical and financial barriers while improving the speed, transparency, and security of transactions. Institutions and investors are increasingly embracing asset tokenization for three primary reasons:

- Improved Liquidity & Accessibility: Increases the speed of trading, reduces transaction costs, and ensures better market reach.

- Fractional ownership allows several investors to jointly own high-value luxury assets, opening up more investment opportunities.

- Blockchain Transparency: Guarantees secure, immutable ownership records to engender trust in markets the world over.

Real-World Use Cases of Asset Tokenization Across Industries

These examples highlight how global leaders are adopting asset tokenization to create liquidity, transparency, and inclusivity in markets worth over $900 trillion combined.

| Use Case | Example Company | Addressable Market Size (2023) | Key Highlights | Benefits | Quote |

| Real Estate Tokenization | Leading hotel chain | USD 337 Trillion | Implementing blockchain-based programs to innovate property ownership and expand operations. | Increased accessibility and transparency; blueprint for future real estate tokenization. | “Our tokenization platforms’ smart certificates can be fragmented without affecting property value, ensuring automated dividends for each owner.” — Founder, US Tokenization Platform |

| Digital Bonds | German industrial player | USD 314 Trillion | Issued a €60M digital bond on Polygon, directly sold to institutional investors — no intermediary bank. | Paperless process, lower costs, faster settlements. | “By moving away from paper and toward public blockchains, we execute transactions faster and more efficiently.” — Corporate Treasurer, German industrial player |

| Investment Funds | Major US PE firm | USD 155 Trillion | Tokenized a portion of its $4B healthcare fund on Avalanche, offering fractional access to smaller investors. | Expanded investor base; greater fund accessibility. | “Blockchain digitizes inefficiencies and improves access for individual investors in private markets.” — Managing Director, Major US PE Firm |

| Public Equity | Swiss private bank | USD 123 Trillion | Tokenized its own shares under Swiss DLT standards — first of its kind. | Increased investor reach; reduced middlemen; liquidity for SMEs. | “We enable clients to fully leverage efficiency gains that distributed ledger technology offers.” — Deputy CEO, Swiss Private Bank |

Tokenizable Asset Classes and Real-Life Examples

From fine art and real estate to gaming assets and financial data, tokenization is expanding access to markets worth over $1 quadrillion globally. It is opening the doors to a new digital investment era.

| Asset Class | Examples | Real-Life Examples |

| Financial Assets | Public & private equity, debt, investment funds, commodities | Major US PE firm tokenized its $4B healthcare-oriented fund. |

| Real Estate | Commercial & residential properties, real estate funds, land, development projects | Leading hotel brand tokenized its luxury resort in Aspen, offering fractional ownership. |

| Infrastructure | Energy, transport (airports), oil & gas, water, communications | Renewable energy marketplace tokenized clean energy projects to fund expansion. |

| Collectibles & Art | Fine art, cars, jewelry, handbags, rare coins, watches | Germany-based platform democratized investment in luxury goods via blockchain. |

| Entertainment & Gaming | In-game assets, NFTs, event-based tokens, royalties | NFT marketplace enabled tokenization of digital art and eSports IPs. |

| Data & Digital Assets | Personal, financial, IoT, weather, and energy data | Decentralized data exchange platform enabled secure token-based data trading. |

Best Practices for Implementing Tokenization in Luxury Goods

Bringing tokenization to luxury goods is a strategic move that redefines how brands manage authenticity, ownership, and customer trust. To make the transition smooth and impactful, it’s essential to follow a structured approach backed by the right tools and industry collaborations. Step-by-Step Guide to Tokenization Integration :

1. Assess Feasibility

Begin by analyzing whether tokenization aligns with your brand vision and audience expectations. Identify where digital ownership can add value, whether it’s luxury watches, art collectibles, or designer fashion.

2. Choose the Right Blockchain

Select a blockchain platform that delivers scalability, interoperability, and high security. For luxury asset tokenization platform development, Ethereum, Polygon, or Hyperledger are among the top choices for their reliability and ecosystem support.

3. Develop Smart Contracts

Collaborate with expert developers to design smart contracts that automate key functions from verifying product authenticity to enabling secure ownership transfers.

4. Tokenize Products

Assign each product a unique digital identity in the form of a token. This digital certificate records details like origin, ownership history, and authenticity. It ensures complete transparency for buyers and investors.

5. Educate Stakeholders

Train internal teams and educate your audience about how tokenization of luxury goods enhances security, resale potential, and traceability. Knowledge creates confidence — and confidence fuels adoption.

6. Launch Pilot Projects

Test tokenization through pilot projects to refine your process and collect user feedback before scaling full deployment.

7. Scale Up Strategically

Once validated, expand tokenization across your product range. Use insights from pilot testing to enhance smart contract logic, platform performance, and user experience.

Tools and Resources for Asset Tokenization Success

1. Blockchain Platforms

Ethereum, Hyperledger, and Tezos are leading choices for building scalable, secure tokenized luxury platforms.

2. Tokenization Software

Tools like Tokeny and Securitize simplify token creation, compliance management, and investor onboarding.

3. Consumer Apps

Develop user-friendly mobile apps that allow customers to verify authenticity, view asset details, and track ownership in real time.

4. Industry Collaborations

Join alliances like the Aura Blockchain Consortium to stay up-to-date on luxury tokenization standards, interoperability, and sustainable practices.

Why Choose Suffescom for Luxury Asset Tokenization Platform Development?

Suffecom builds tokenization solutions and designs cutting-edge digital ecosystems that redefine the experience of luxury ownership in the modern world. As a leading asset tokenization development company, our mission is to help luxury brands, investors, and enterprises transition seamlessly into the decentralized economy with confidence and innovation.

With years of proven expertise in blockchain development services and real-world asset (RWA) tokenization, we deliver scalable and compliant platforms that ensure transparency and traceability. Our approach to developing a luxury asset tokenization platform combines deep technical expertise with industry insight. We empower clients to enhance trust, unlock new investment models, and embrace the digital future of high-value assets.

FAQs

Q1. What is tokenization of luxury assets, and what is the reason behind its increasing popularity?

Luxury asset tokenization means the process of transforming high-value items, such as art, jewelry, cars, or real estate, into digital tokens on the blockchain. It finds increasing popularity now because it allows secure, fractional ownership and global trade of luxury goods without traditional barriers.

Q2. How do tokenized luxury platforms ensure authenticity and security?

Ownership history, provenance, and other important information of each tokenized asset are stored on the immutable blockchain ledger. Smart contracts independently perform verification to make it a trustworthy and transparent process for brands and investors alike.

Q3. Can luxury tokenization be applied to real estate or vehicles?

Yes, luxury tokenization encompasses premium real estate and high-end vehicles. Real Estate Tokenization Development offers investors the opportunity to purchase fractional shares of exclusive properties or collectibles while still providing liquidity and secure asset tracking.

Q4. What is the usual cost of the luxury asset tokenization platform development?

The development cost of asset tokenization depends on the complexity of the platform, blockchain integrations, smart contracts involved, and compliance features. Normally, it starts from $50,000 onwards, depending upon customization requirements and scalability.

Q5. Why should I choose Suffescom for my luxury tokenization project?

Suffescom integrates blockchain experience with profound domain expertise in luxury markets. As a trusted asset tokenization company in the industry, we focus on developing secure, compliant, and investor-friendly platforms for high-end assets.

Q6: Which blockchain does Mintology run on?

Mintology is built on the Ethereum mainnet, ensuring smooth compatibility with leading digital wallets and major tokenization platforms.

Q7: Are there any legal concerns associated with asset tokenization?

Yes. Tokenization involves several legal considerations, such as regulatory compliance, intellectual property rights, and jurisdictional differences. It’s important for brands to work with legal professionals to ensure every tokenized asset meets the required legal standards.

Q8 What Factors Influence the Asset Tokenization Development Cost?

The asset tokenization development cost varies based on asset type, blockchain network, compliance, and features like KYC, smart contracts, and wallets. On average, it ranges from $20,000 to $50,000, depending on platform complexity and scalability. Partnering with an expert asset tokenization development company ensures cost efficiency and higher ROI.