Revolut’s Business Model Explained: How Revolut Makes Money

The financial sector is going through a shift to provide greater convenience to customers. People don't need to wait in long queues to open an account or resolve their concerns. Traditional banks require a lot of paperwork and huge fees.

Neobanks like Revolut make it hassle-free to choose from a wide range of banking services. Revolut is a smarter way to manage money without the need to visit a physical branch. The users can keep an eye on spending and make international money transfers through the app.

An app like Revolut has innovative features for a seamless user experience. It allows users to get cost-effective services from anywhere around the world. Everything comes at their fingertips, whether it’s applying for a loan or investing money.

Creating a FinTech app like Revolut can be the right move for your business. It allows you to solve the financial troubles of the users while earning big gains. Revolut has made total earnings of around 3.8 billion U.S. dollars in 2024 - 2025. But how does Revolut make money?

There are different ways to make money from an app like Revolut. It can be through subscription plans and transaction fees. Neobank app solutions can help your business to win the users’ trust. It allows you to build a strong position among the other FinTech players. Let’s get started to know how Revolut works.

Learn about Revolut business model and how it earns revenue. Find out how this app is painting a bright picture for the financial sector.

How Does Revolut Make it Effortless for Users to Take Control of Money?

Revolut was founded in 2015. This leading company provides banking and investment services around the world. It is making way for a bright road ahead.

The app allows users to exchange their currency faster and securely.

The app interface enables users to explore the banking services with ease. This is how Revolut goes one mile ahead in providing value to the users:

Easier Opening of Accounts

The users don't need to do any paperwork while using the Revolut app. This makes it easier and stress-free for users to open their accounts online. No need to wait for reaching out to the bank staff. This saves time and money that is often exhausted in traditional banks.

Tools for Managing Money

Revolut business model allows the users to keep a watch on how much they are spending and saving. They can classify their spending in the app. This helps to create a list of the electricity, grocery and education expenses.

The app provides suggestions to develop the right spending habits. They can exchange their currency at competitive exchange rates.

Protects the User’s Details

The app utilizes artificial intelligence to keep the user’s information safer. The users can adjust the security of the app as per their preferences.

They can add their location and protect their card details. Virtual cards and single use cards enable users to make secure payments from anywhere.

Provides Cost-Effective Services

The users can pay a low or no fees on the transfers to another country. This provides a better option than traditional banks that require users to pay for a huge cost.

Revolut offers a fair exchange rate. The app allows its users to quickly send and receive money.

Also Read: Banking App like Chime

Can Revolut Safeguard Users from the Risk of Frauds?

Revolut utilizes artificial intelligence to protect the users from any loss of money. Revolut business strategy keeps the user’s details secure when they make a payment. AI can go through the data to warn the users about any activities that are noticed. Custom AI app development for fintech companies can prevent fraud in these ways:

Keeps a Check in Real-Time

This app allows users to keep a close watch on their money. They can get the detailed information in real-time. AI can examine the user’s details. It can point out if there is any other person trying to misuse the information. This helps in protecting the users from frauds.

Protects from Card Thefts

Revolut is built with API Integration services and security features. This protects users from card thefts. AI gives an alert to the users before they make payments. The users can purchase online through virtual cards. These cards are only used once to keep user details secure. The app ensures that the payment takes place from the user’s location. The user can control the card even when it’s stolen.

Examines the Spending Habits

The neobank app can understand how the user is spending money over time. It can go through their payments in past. This provides clear information about how the user usually spends. It enables AI to find out if any other person is making payments. The app prevents these payments and ensures complete security.

Personalized Support

The users can get expert advice to keep their money safe. They can get personalized support and guidance at any time. The online platform has educational videos to help users learn how to identify frauds.

Adopt a Flexible Business Model for Your Fintech Company

Transform banking experience and drive earnings with a Revolut-like app.

What is the Business Model of Revolut’s Neobank App?

Business model of Revolut provides convenience and peace of mind to everyone. It allows users to get the benefit of services from the comfort of their home. The app is growing its reach to users around the world. People are turning their heads to this modern banking solution. Want to know why? Let’s see how the Neobank app development solutions work for an effortless user experience:

Solves the Problems of Traditional Banks

This app helps users manage their money easily. They don’t need to go through the pain of visiting traditional banks. The users can do the currency exchange online by paying lower fees. Revolut has advanced features to make payments and manage money. It provides complete control and security to the users.

Meets the Needs of Every User

Individuals and businesses can use the app for their needs. Revolut is for one and all. It is suitable for those who want to manage their study or travel expenses. A newly setup business can use the app to take control of its operations. They can open their accounts in different currencies.

Revolut Business Strategy

Revolut business strategy enhances the user experience. The fintech company has added new features and services. It is entering the markets in different regions. The app analyzes data to ensure secure and faster payments. It engages the users through personalized advice for managing money.

Revolut Cost Structure

Revolut spends money on maintaining the technologies, mainly on cloud services. A cloud-based app can handle the increasing number of users or vast data. The company provides benefits and salaries to employees. Another cost is for doing marketing to bring new customers. Revolut also pays for the cost of meeting the financial regulations.

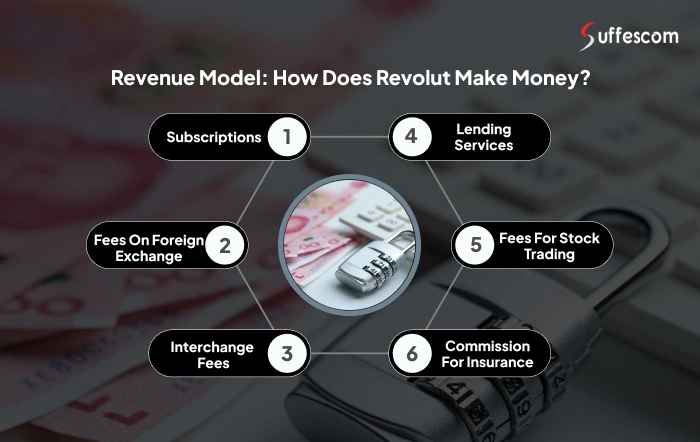

Revenue Model: How Does Revolut Make Money?

The customers of Revolut are expected to be more than 68 million by December, 2025. The increasing user base allows it to earn higher profits. The banking app provides a wide range of financial services. It earns revenue through different sources like:

Subscriptions

Revolut allows users to choose from different subscription plans. Every plan comes with features and benefits for the users. The free plan allows users to convert their money into foreign currency. They don’t need to pay any fees for this plan. Premium and metal plans enable users to exchange currency without any limits. These plans also offer insurance on travel, cashback and enhanced money withdrawal from ATM.

Fees on Money Transfers

The user needs to pay fees for sending money to a person in another country. The fees is calculated in real-time based on the currency. Those with a premium or metal plan don’t need to pay fees on the transfer of money in foreign currency. But the users need to pay if they go above their plan limit.

Interchange Fees

Revolut earns money through a commission on card payments. This is the interchange fees. Merchants pay this amount to Revolut for every transaction. The revenue increases when there are more users paying through a card.

Lending Services

This banking app offers personal loans and other types of loans to the users. The users need to pay interest on loans. The interest will depend on the loan amount and the user's credit score.

An Exciting Read for You: Loan apps like MoneyLion

Fees for Stock Trading

Revolut provides expert advice for trading in stocks and cryptocurrency like Bitcoin. The app earns through fees on stock trading. The members of the premium plan can do the monthly trading for free. But they need to pay for any extra stocks that are traded.

Commission for Insurance

The users can get insurance for device and medical expenses during travel. Revolut joins hands with the insurance providers. These insurance companies pay a commission to Revolut.

Create a Neobank App like Revolut for Low-Cost Banking

Build a banking app that provides personalized insights and cost-effective services.

Make Your Revenue Model Successful with Suffescom Solutions

Revolut is solving the challenges for users of the modern world. It allows the users to keep an eye on their money. Revolut business model analysis can help your business to meet the needs of global users.

It allows you to earn money through subscriptions and fees on foreign exchange. If you are running a FinTech business, Suffescom Solutions is your partner.

Suffescom Solutions offers financial software development services to create a smart banking app like Revolut. We create an online platform that provides insights in real-time.

Our team ensures a smooth integration with your systems. Build an app like Revolut that enhances efficiency and user satisfaction. Contact our expert team to get started.

FAQs:

1. How Long Does it Take to Develop a Fintech App like Revolut?

It can take 9 to 12 months to develop an app like Revolut. But the duration depends on the complexity and features of the app and the technology stack used for development. A white label digital bank platform can help to speed up the process.

2. How Does the Revolut App Work?

The business model of Revolut allows users to manage money easily. The users can create an account for free and get the financial services. They can do international money transfers and control their spending on the app. The app provides personalized suggestions and ensures convenience for the users.

3. Does Revolut Use Blockchain?

Yes. Revolut is an example of Fintech blockchain use cases. The app utilizes blockchain technologies to buy, sell or transfer cryptocurrencies. The transactions on the app are recorded on the blockchains.

4. Why is Revolut So Profitable?

Revolut is earning higher profits due to the increasing user base. It is adding new services and improving its global reach. The app earns revenue through subscriptions and fees on foreign exchange and card payments.

5. What Technology Does Revolut Use?

Revolut uses Google Cloud Platform. It also uses programming languages like Java. AI and machine learning are utilized for a personalized user experience.

6. Can I Benefit by Developing an App like Revolut?

Developing an app like Revolut can help your business to grow reach. It allows you to earn revenue in different ways. MVP app development can be a good option to reduce development costs.

7. What is the Best Alternative to Revolut?

Wise, iBanFirst and Airwallex are the best alternatives to Revolut in 2025.