U.S. Crypto Crackdown Makes Compliance a Growth Lever for Web3 Startups

As U.S. lawmakers continue to shape the Web3 industry, startups must balance rapid growth with resilience against sudden regulatory shifts.

Adapting to Web3 Legislation: Key Points

- Web3 is expanding fast, with over 3,200 startups and 17,000 companies worldwide.

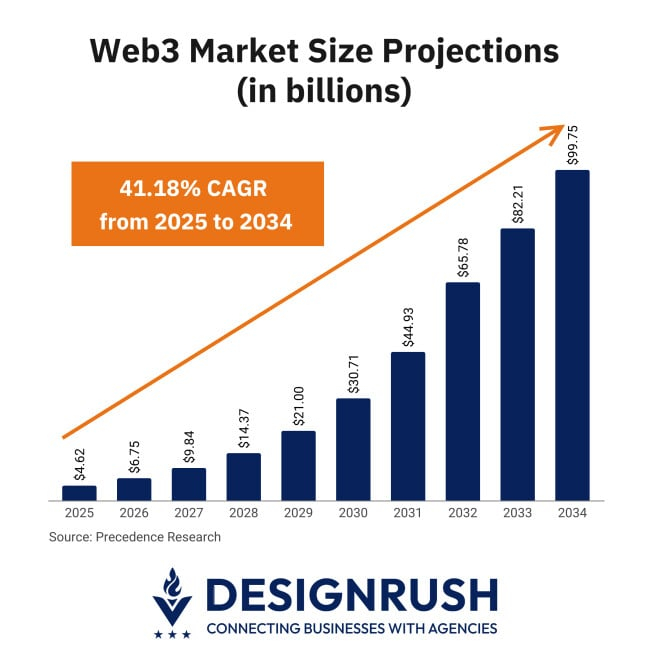

- Market forecasts project Web3 to hit $99.75 billion by 2034, growing at a 41.18% CAGR.

- Startups that embed compliance early reduce the risks associated with evolving U.S. regulations.

The U.S. is currently in the middle of a Web3 boom since the start of 2025, as lawmakers have been busy reshaping the industry with several bills designed to reduce friction.

According to USA Today, one bill that has cleared the House of Representatives proposes a shared oversight model between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

Likewise, another measure is set to expand the definition of “dealers” to include certain Decentralized Finance (DeFi) participants. More still seek to streamline reporting obligations.

These moves suggest that Washington is trying to craft a framework that can both protect investors and keep the U.S. competitive.

The timing of all these is fortuitous for Web3 startups and investors in the U.S.

StartUs Insights’ Web3 Industry report showed that the sector is experiencing rapid growth with over 3,200 startups and 17,000 companies globally, representing an annual growth rate of 28.54%.

Meanwhile, Precedence Research projects the Web3 market to reach $99.75 billion by 2034, representing a CAGR of 41.18% from 2025 to 2034.

These figures illustrate both momentum and progress. Yet, some uncertainties remain as federal agencies continue to wrestle over definitions, enforcement priorities, and jurisdictional turf.

This could lead to rules shifting overnight, leaving startups vulnerable to:

- Legal exposure

- Capital constraints

- Structural limits

These risks are why balancing growth and regulatory uncertainty has become a central concern for industry leaders.

Gurpreet Singh Walia, CEO of mobile app development company Suffescom Solutions, emphasized that the true winners in the industry will be those who embed compliance and transparency into their Web3 development solutions right from the design stage.

“Web3 development solutions and innovation can flourish only if they learn to live alongside regulation rather than apart from it. Founders who recognize this will not only reduce their risk, they will attract serious investors who need clarity before they commit capital," he says.

How Web3 Startups Should Prepare

Navigating regulations is like plotting a course through the high seas.

Just like a ship’s captain, savvy Web3 startup founders should use the shifting winds to gain speed. Otherwise, they risk running their company into the rocks.

Suffescom advises Web3 startups to follow these steps if they want to lay the right foundations for resilient growth:

1. Design With Compliance Embedded

Blockchain KYC, AML compliance, token classification, Web3 unit testing, and Smart contract testing should be built into the foundation of your product instead of being added as afterthoughts.

A compliance-first backbone reduces the risk of sudden rebuilds and signals to regulators and investors that you’re serious.

Embedding approaches like KYC and smart contract testing also sets the stage for scalability. When compliance is woven into the DNA of the business, every new feature or market expansion has a ready-made framework that doesn’t need to be reinvented.

2. Adopt Modular Governance

Governance should be built with interchangeable parts, like LEGO. Tokenomics, voting rights, and distribution systems need the flexibility to shift as rules evolve without shaking community trust.

By treating governance as a living system, founders can pivot without losing credibility.

At the same time, investors recognize this adaptability as a sign that the company can weather regulatory turbulence.

3. Develop Regulatory Toggles

Different markets demand different compliance functions. Building systems with switches for features like staking, stablecoin integration, or disclosure tools keeps expansion efficient.

This prevents teams from having to rebuild core architecture for every jurisdiction. Instead, they can scale globally with minimal friction, adapting at the flip of a switch.

4. Future-Proof With Scenario Planning

Regulatory landscapes shift overnight, often in ways that disrupt entire markets. Scenario planning forces teams to anticipate these pivots in advance.

Startups can stay agile by preparing for multiple outcomes, such as stricter securities oversight, new stablecoin rules, or privacy mandates.

This ability to respond quickly puts startups in a position to continue riding the momentum while their competitors take time to figure out how to adapt on the fly.

5. Maintain Active Regulator Relationships

Be active in creating a relationship with local and federal policymakers and regulators. Founders who participate in working groups and policy forums gain early visibility into regulatory changes.

This engagement also grants influence. Regulators are more receptive to startups that show up to the table, which helps shape friendlier frameworks.

6. Embed AI for Compliance Monitoring

AI-driven tools can scan transactions in real time and flag anomalies that regulators would otherwise detect later. Treating AI as a compliance partner keeps systems audit-ready.

This frees up teams to focus on innovation. Startups that use an AI integration service for monitoring not only reduce risk but also scale compliance more efficiently.

7. Integrate Sustainability and ESG Standards

Governments are increasingly tying ESG to finance and digital services regulations. Ignoring this link now risks future compliance issues and reputational damage.

Startups that embed ESG metrics into reporting, governance, and tokenomics gain an early advantage. Investors view these moves as forward-thinking and aligned with likely mandates.

Taken together, these steps show that regulatory readiness is not a defensive shield but an operating strategy.

By embedding compliance into governance, architecture, and culture, founders build companies that can expand without constantly looking over their shoulders.

Turn Regulatory Readiness Into A Strategic Advantage

Regulation does not have to be viewed as a roadblock to innovation.

Startups that complain about rule changes as burdens are often the same ones that burn capital retrofitting products after enforcement comes knocking.

That’s why Walia says the smarter play is to treat compliance as an integral part of both growth strategies and design principles:

“Regulatory shifts in software development are inevitable in a still-maturing and dynamic industry like Web3. Even as lawmakers aim to simplify the path forward, the landscape can turn overnight, which is why building both compliance and flexibility into your business models is needed for scalable growth.”

The startups that thrive now and in the future won’t be the ones that outrun regulation, but the ones that turn it into fuel.