Crypto Derivatives Exchange Development: Complete Guide to Build a Scalable Trading Platform in 2026

The global demand for crypto derivatives exchange development is increasing drastically in 2025. The average daily trading volume across the crypto derivatives market reached about USD 24.6 billion, rising nearly 16% compared to the previous year report by SQ Magazine. Derivatives continue to account for roughly 75–80% of total crypto exchange trading volume in 2025. Building a crypto exchange platform represents a major opportunity for firms aiming to serve the largest share of the market.

Building such an exchange requires more than adding leverage or margin trading. It needs a strong technical foundation, reliable risk and margin systems, and top-tier security. Even regulated giants like CME Group saw an average daily volume of 198,000 contracts (≈ $11.3B) in Q1 2025.

Whether you’re developing from scratch or choosing a white-label solution, staying aligned with these market shifts is key to building a competitive and scalable crypto derivatives exchange.

What is the Crypto Derivatives Exchange?

A crypto derivatives exchange is a platform where users trade financial contracts that derive their value from an underlying digital asset, such as Bitcoin, Ethereum, or stablecoins. Traders don't need to buy the cryptocurrency itself but instead speculate on the price movements through instruments like futures, options, and perpetual swaps. These products allow investors to hedge risks, leverage positions, and execute advanced trading strategies that aren’t possible on traditional spot exchanges.

Unlike a regular crypto exchange, which relies on immediate asset settlement for trading, a derivatives exchange relies on margin, risk engines, liquidation modules, and funding rate mechanisms. It makes the trading environment far more sophisticated and liquidity-driven.

Today, crypto derivatives account for nearly 75-80% of the total trading volume in the digital asset market, making derivatives exchanges the backbone of modern crypto trading ecosystems. For businesses considering entering this industry, understanding how these platforms work is the first step toward building a secure, compliant, and high-performance exchange.

Launch a Secure & High-Speed Exchange

Our trading engines support sub-millisecond execution and enterprise-grade security.

Why Building a Crypto Exchange Today Is a High-ROI Business Opportunity?

Suffescom empowers enterprises to capitalize on the booming crypto economy with custom exchange platforms that support seamless trading and sustainable growth.

Here’s why the move is strategically strong:

1. Increasing Market Demand

Daily cryptocurrency trading volume has surpassed $100 billion, indicating strong, consistent user participation across both centralized and decentralized platforms.

2. Multiple Monetization Streams

A modern crypto derivatives exchange platform can generate income through trading fees, funding fees, withdrawal fees, listing charges, market-making partnerships, and premium account models.

3. Higher Institutional Participation

Financial institutions, hedge funds, and prop trading firms are rapidly adopting digital assets. Their entry boosts liquidity, stabilizes markets, and increases the demand for professionally built derivatives exchanges.

4. Scalability for Future Products

Once the initial infrastructure is in place, it becomes much easier to expand into futures, options, perpetual swaps, leverage tokens, staking, and structured financial products, unlocking additional revenue channels.

5. Competitive Advantage for Early Builders

While new users continue to enter the industry, there are only a limited number of reliable exchanges. Launching early gives you a market edge before regulations and competition tighten.

Hire Our Crypto Derivatives Exchange Development Services

Suffescom stands as a trusted crypto exchange development company, delivering high-performance, secure, and scalable derivatives exchange solutions.

Premium Crypto Derivatives Exchange Development Services for Modern Trading Platforms

As a leading crypto derivatives exchange development company, we provide end-to-end services that help you launch, scale, and maintain a high-performance derivatives trading ecosystem.

1. Exchange Consulting & Strategy Planning

Every project begins with clarity. Our consulting team helps you refine your business model, choose the right trading modules, and understand market demand. From perpetual futures to multi-chain margin trading, we guide you on how to develop a crypto derivatives exchange that aligns with your long-term goals.

2. Custom Crypto Derivatives Exchange Development

No two platforms operate the same way, so we tailor each solution to your business. Whether you want to add advanced order types, multi-asset settlement, social trading, or institutional-grade features, we build a fully customized crypto derivatives exchange platform from the ground up.

3. Crypto Exchange Software Development

If you prefer a faster launch, our ready-made crypto exchange software gives you a pre-built foundation with matching engine, wallet system, admin panel, liquidity integration, and derivatives modules. You can deploy it as-is or enhance it with unique features.

4. Complete Exchange Security Solutions

Security is non-negotiable in derivatives trading. We implement multi-layer protection including cold wallet storage, anti-DDoS firewalls, encryption, two-factor authentication, smart contract audits, and automated risk monitoring systems to keep both your users and your platform safe.

5. API, Payment & Liquidity Integration Services

We enable seamless trading by integrating liquidity providers, fiat and crypto payment gateways, real-time market data feeds, and algorithmic trading APIs. These integrations ensure your exchange delivers the responsiveness and reliability modern traders expect.

6. Ongoing Maintenance & Platform Upgrades

A derivatives exchange needs continuous refinement. Our team provides 24/7 technical support, bug fixes, performance monitoring, feature upgrades, and compliance updates to ensure your platform runs smoothly even under heavy load.

7. Smart Contract Development & Auditing

For on-chain derivatives, margin vaults, or settlement engines, we create and audit smart contracts that are secure, efficient, and optimized for multi-chain deployment.

8. White Label Crypto Exchange

If you’re aiming for a faster launch, our white label crypto exchange software for crypto derivatives and perpetual trading helps you go live in weeks instead of months. You get a ready-built exchange framework that includes a trading engine, wallet system, risk modules, and liquidity integrations

9. Regulatory Compliance Assistance

We help you navigate KYC/AML implementation, licensing requirements, exchange compliance modules, and risk frameworks for global markets.

Key Features of a Crypto Derivatives Exchange Platform

Here’s a breakdown of the core features of a crypto derivatives exchange platform you must include to build a secure, scalable, and revenue-driven derivatives exchange.

1. High-Performance Matching Engine

A derivatives exchange requires extremely fast trade execution. The matching engine processes thousands of orders per second, supports advanced order types, and ensures low-latency trading even during extreme volatility.

2. Derivatives Contract Support

The platform supports futures, perpetual swaps, and options, allowing traders to hedge, speculate, or leverage positions. You can customize leverage limits, expiry cycles, and funding-rate logic based on your business model.

3. Real-Time Risk Management Engine

A dedicated risk system continuously monitors user positions, calculates margins, updates P&L in real time, and triggers safe liquidations. This prevents market manipulation and protects both the platform and its users.

4. Margin & Collateral Management

Traders can choose between cross-margin and isolated-margin modes. The system automatically manages collateral, issues margin warnings, and supports multiple crypto assets as collateral.

5. Multi-Layer Security Architecture

Security is built into every layer such as cold wallet, multi-sig fund storage, 2FA, device tracking, anti DDoS, KYC/AML, and AI-based fraud detection. These controls secure assets, accounts, and transactions.

6. Liquidity Aggregation & Market Making

The platform connects with external liquidity providers and integrates internal order books to reduce slippage. Automated market-making bots maintain spreads, ensuring smooth trading even during low-volume hours.

7. Professional Trading Dashboard

A user-friendly, customizable interface designed for both beginners and pro traders. Includes TradingView-style charts, depth graphs, order books, open positions, and quick trade execution panels.

8. Automated Settlement & Liquidation System

Fair-price-based liquidation prevents unnecessary losses. The system also handles automated settlements for contracts approaching expiry and ensures platform-wide risk neutrality.

9. Wallet & Payment Infrastructure

Supports multi-chain deposits, withdrawals, and internal transfers. On-ramp/off-ramp integrations allow users to enter the crypto ecosystem using cards, banks, or stablecoins seamlessly.

10. Admin & Compliance Back Office

Admins get full control over platform operations, including fee setup, leverage limits, dispute handling, compliance checks, reporting, and KYT/AML monitoring to meet regulatory requirements.

11. Mobile Trading Capabilities

The exchange can extend to iOS and Android apps with real-time alerts, biometric login, mobile charts, and lightning-fast trade execution for users who prefer on-the-go access.

12. API & Algorithmic Trading Support

Developers and institutional traders can connect using REST or WebSocket APIs. The low-latency endpoints support bots, HFT systems, and automated portfolio strategies.

13. Rewards, Staking & Referral Program

Loyalty features such as fee discounts, tier-based benefits, stakeholder programs, and multi-level referral bonuses help attract users and increase platform retention.

14. System Audit Trails & Redundancy

Every action is logged with time-stamped audit trails, ensuring transparency. Backup servers, failover systems, and disaster recovery plans safeguard operations during outages.

Business Benefits You Gain With Custom Crypto Derivative Exchange Development

Suffescom focuses on delivering real, measurable business benefits through secure, scalable, and high-performance crypto exchange solutions. Below are the benefits of crypto derivatives exchange development solutions:

1. Multiple Revenue Streams

A well-built crypto exchange isn’t limited to trading fees. You can generate income from deposit/withdrawal fees, maker/taker fees, listing charges, staking, futures funding rates, and even premium membership plans.

2. High Market Demand

More than 420+ million people now use crypto worldwide, and trading activity continues to rise each year. This steady demand makes crypto exchanges one of the most consistently profitable digital businesses.

3. Long-Term Profitability

Exchanges earn revenue even during market dips because traders actively hedge, short, or move funds, keeping liquidity and fee flow intact.

4. Global Scalability

Once the platform is live, you can scale instantly by adding new regions, tokens, trading pairs, and advanced modules like futures, options, and P2P trading.

5. Complete Brand Ownership

You control your branding, UX, UI, features, and revenue models, unlike aggregator or affiliate setups that limit customization.

6. Strong Competitive Advantage

Offering unique features like derivatives trading, copy trading, or multi-chain wallets helps you stand out in a crowded market.

7. Recurring User Engagement

Crypto exchanges naturally have high daily active usage because traders check markets constantly, boosting engagement and retention.

8. Opportunity to Attract Institutions

With advanced modules like multi-level security, risk engines, and high-speed matching, you can onboard institutional traders who bring significantly higher volume.

9. Future-Proof Business Model

As tokenized assets, RWAs (Real-World Assets), and stablecoins grow, exchanges will remain a core part of global digital finance.

Turn Volatility Into Opportunity

Derivatives trading volumes have grown 16% year over year, making it the fastest-growing sector in crypto.

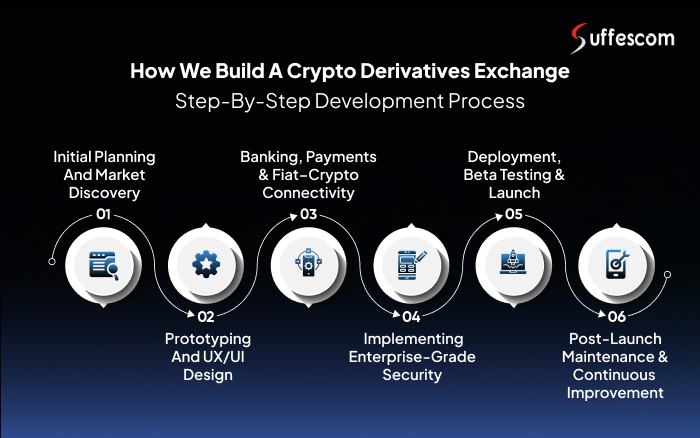

How We Build a Crypto Derivatives Exchange: Step-by-Step Development Process

To build a crypto exchange platform process moves from ideation to real-world deployment. Here’s a clean, step-by-step breakdown of how a derivatives exchange development cycle typically unfolds.

1. Initial Planning and Market Discovery

Everything starts with clarity. Before writing a single line of code, you need a grounded understanding of market demand, liquidity expectations, competitor offerings, and regulatory limitations.

This stage usually includes market studies, feasibility analysis, and defining what your derivatives platform should actually achieve. Whether it’s higher leverage options, low-latency trading, or a specific product line like perpetual futures. Once your goals are locked in, it becomes easier to shape the technical and business roadmap.

2. Prototyping and UX/UI Design

Once the vision looks solid on paper, the next move is to visualize it.

Prototypes, wireframes, and user-flow diagrams help you see how traders will interact with the platform It helps from opening positions to managing collateral.

During this phase, the focus shifts to:

- Creating intuitive dashboards,

- Designing clean order screens,

- Mapping complex tools like funding rates, leverage sliders, and liquidation warnings.

- A clear prototype minimizes future rework and ensures the final UI feels smooth even under heavy market activity.

3. Banking, Payments & Fiat–Crypto Connectivity

Now, to make your exchange usable, traders need a frictionless way to deposit or withdraw funds. This is where payment gateways, on/off-ramps, and banking APIs come into the picture.

Integration usually involves:

- KYC/AML-friendly payment partners,

- Multi-currency support for global users,

- Secure settlement flows for both fiat and crypto assets.

- These integrations must be stable, compliant, and latency-free because any delay in deposits during market volatility can cost users real money.

4. Implementing Enterprise-Grade Security

Security is non-negotiable in the development of crypto derivatives exchanges. Because leveraged trading involves high-volume transactions, even a small breach can result in significant losses.

To avoid that, platforms typically incorporate:

- Multi-layer encryption,

- Two-factor authentication,

- Cold wallet storage for funds,

- Automated risk monitoring,

- Regular third-party audits.

Some teams also partner with custodians such as Fireblocks, BitGo, or Gemini Custody for enhanced asset protection. The goal is simple: reduce vulnerabilities before the exchange goes live.

5. Deployment, Beta Testing & Launch

After integrating the trading engine, risk modules, liquidity frameworks, and APIs, your exchange enters the beta phase.

This stage helps you:

- Test order execution under different loads,

- Validate liquidations and leverage behaviour,

- Check integrations like Oracle feeds, KYC flows, and payment systems.

Once feedback is incorporated and everything runs smoothly, the platform is ready for a staged launch. It is typically a soft launch first, followed by a full public rollout. Real-time monitoring in the early days is crucial because even small optimizations can significantly improve user trust.

6. Post-Launch Maintenance & Continuous Improvement

Launching the platform isn’t the finish line it’s the starting point.

Derivatives exchanges require continuous updates, liquidity monitoring, bug fixing, risk system enhancements, and community-driven improvements.

This includes:

- 24/7 technical support,

- Continuous security patching,

- Feature upgrades based on trader behavior,

- UI/UX refinements,

- Performance scaling as user load grows.

Types of Derivatives Trading You Can Power With Crypto Exchange Platform

Suffescom delivers a versatile derivatives trading ecosystem where users can hedge risks, capture market swings to diversify their strategies effortlessly.

1. Futures Trading

Users lock in a price today for buying or selling a crypto asset on a future date. It helps traders manage risk and predict market movements with fixed, standardized contracts.

2. Forwards Trading

A private agreement where two parties customize the price, quantity, and settlement terms. It is ideal for businesses and OTC traders needing flexible, non-standardized deals.

3. Options Trading

Traders get the right, but not the obligation, to buy or sell an asset at a specific price. It offers more control because the trader can choose whether to execute the contract.

4. Perpetual Trading

It is similar to futures trading but without an expiry date. Traders can hold positions as long as they want, making it popular for continuous, high-leverage trading.

5. Crypto Swaps

Two parties exchange one asset or cash flow for another at an agreed date. It’s commonly used for shifting between tokens or managing portfolio risk.

6. Margin Trading

Traders borrow funds to open bigger positions with small capital. This increases potential profits but also requires risk-controlled execution.

7. Leveraged Tokens

Ready-made tokens with built-in leverage (like 2x or 3x). Users gain amplified exposure without manually handling margin, liquidation, or borrowing.

8. Binary Options

A simple “yes/no” prediction on price movement within a set time. Traders either earn a fixed payout or lose the stake, making it quick and straightforward.

9. CFDs (Contract for Difference)

Users trade price changes rather than owning the asset itself. It’s ideal for speculating on upward or downward movements with flexible leverage.

10. Basket Derivatives

Contracts built on a group of selected cryptocurrencies. They help users diversify risk and trade multiple assets through a single instrument.

Derivatives Trading Strategies Supported by Our Advanced Exchange Platform

Suffescom develops high-performance crypto derivatives exchanges designed to support modern trading behavior and institutional-grade strategies. As a trusted crypto derivatives exchange development company, we focus on delivering platforms that simplify complex trading mechanics while maintaining top-tier speed, stability, and security.

Our exchange framework is engineered to help traders operate confidently, manage risks better, and leverage multiple market opportunities. Below are the key strategy features our system supports:

- Smart Order Execution & Position Flexibility

- Lightning-Fast Trade Processing

- Reinforced Security Architecture

- Intuitive Operational Dashboard

Crypto Derivatives Platform Development Cost Breakdown

Building a crypto exchange isn’t a one size fits all project. The final crypto exchange development cost depends on the type of platform you want to launch, the features you prioritize, and the level of security and compliance required for long-term scalability. Below is a breakdown that helps potential investors understand exactly what they’re paying for.

Typical Cost Ranges Based on Complexity

Crypto exchange development generally falls into three broad cost brackets:

1. Basic / MVP Exchange (Entry-Level)

Ideal for startups testing the market or launching a pilot version.

Includes user onboarding, KYC, trading engine (spot), wallet integration, basic admin.

- Estimated Cost: $30,000 – $60,000

- Timeline: 6–10 weeks

2. Mid-Range Exchange (More Features & Better Scalability)

Includes liquidity management, advanced trading modules, security enhancements, and a cleaner front-end experience.

- Estimated Cost: $60,000 – $150,000

- Timeline: 10–16 weeks

3. Advanced Exchange (Derivatives, Perpetuals, High-Frequency Trading)

Suitable for companies planning to compete at the level of Binance, Bybit, or OKX.

It includes derivatives trading engine, multi-layered security, multi-asset support and high-load architecture

- Estimated Cost: $150,000 – $500,000+

- Timeline: 16–30+ weeks

For businesses looking to launch faster, white label solutions provide a cost-effective alternative. Understanding the white label crypto exchange cost helps teams compare budgets and choose the right development model.

Factors That Influence the Cost of Cryptocurrency Derivatives Exchange Development

(Features, Security, Compliance, Blockchain Integration, UI/UX)

Multiple factors can push the budget up or down. Here’s where the real cost difference comes from:

1. Features & Modules

Every additional feature adds development time and complexity.

Examples: Copy trading, futures, staking, multi-wallet support, P2P, analytics dashboards.

2. Security Architecture

Security is one of the most expensive components because exchanges are prime hacking targets.

Costs vary based on:

- Multi-sig wallets

- DDOS protection

- Cold storage integration

- Anti-market manipulation modules

- Smart contract audits

The more fortified your exchange, the higher the development cost but also the higher the trust.

3. Regulatory Compliance

Compliance can make up 15–25% of the project budget, depending on jurisdiction.

This includes:

- KYC/AML integration

- Transaction monitoring

- Licensing & legal alignment

- Reporting tools for regulators

4. Blockchain Integrations

Every chain added (BTC, ETH, BNB, TRON, Solana, etc.) requires separate wallet integration and testing.

More blockchains = more development cost.

5. UI/UX Design

A simple interface costs less. A high-end, polished, multi-panel trading UI (like Binance Pro) increases cost significantly.

Technologies Used for Crypto Derivatives Exchange Development

| Category | Technologies / Tools Used | Purpose |

| Frontend Development | React.js, Next.js, Vue.js, Angular | High-performance UI, trading dashboard, charts, user workflows |

| Backend Development | Node.js, GoLang, Python, Java, Rust | Core APIs, trading engine, wallet management, order routing |

| Database Management | PostgreSQL, MongoDB, Redis, Cassandra | User data, trades, caching, high-speed data retrieval |

| Blockchain & Wallet Integration | Web3.js, Ether.js, Bitcoin Core, Solana Web3, TronWeb | On-chain connectivity, deposits, withdrawals, token integrations |

| Smart Contracts (If Needed) | Solidity, Rust, Vyper | Perpetual contracts, settlement logic, multi-chain modules |

| Trading Engine Technologies | C++, Rust, Go, In-memory matching engine frameworks | Ultra-low latency order matching, high TPS performance |

| Security Tools | Multi-sig wallets, HSM modules, JWT, OAuth2, AES-256 | User security, transaction protection, authentication |

| Cloud & Infrastructure | AWS, Google Cloud, Azure, Kubernetes, Docker | Auto-scaling, load balancing, microservices deployment |

| Market Data & Price Feeds | Chainlink, Pyth Network, Binance/OKX APIs | Accurate price indexing, mark/funding rates for derivatives |

| Liquidity Integration | FIX Protocol, Liquidity APIs, Aggregators | Deep liquidity, faster order execution, reduced slippage |

| Monitoring & Analytics | Grafana, Prometheus, ElasticSearch, Kibana | Real-time metrics, system monitoring, fraud detection |

| Compliance & KYC/AML | Sumsub, Onfido, Chainalysis, TRM Labs | User verification, AML checks, regulatory compliance |

| Testing Tools | Jest, Mocha, Selenium, Postman | QA, performance tests, API validation |

How Derivatives Exchange Development Differs from Spot Exchange Development

| Aspect | Derivatives Exchange Development | Spot Exchange Development |

| Trading Instruments | Futures, perpetual contracts, options, leveraged products | Direct buy/sell of cryptocurrencies |

| Price Mechanism | Based on index price, mark price, funding rates | Based on real-time market price |

| Complexity Level | Highly complex (risk engine, liquidation module, margin system) | Comparatively simpler execution engine |

| User Funds Model | Margin-based (cross/isolated), collateral management | Users pay full asset price upfront |

| Risk Management | Advanced: auto-liquidation, insurance fund, risk monitoring | Basic: order limits, AML, price tolerance |

| Tech Stack Requirements | High-performance architecture with ultra-low latency | Standard matching engine and wallet system |

| Revenue Streams | Funding fees, leverage fees, liquidation penalties, maker/taker fees | Trading fees, listing fees, withdrawals |

| Security Requirements | Needs stronger protection against manipulation & high-volume attacks | Standard exchange-grade security |

| Target Users | Professional traders, institutions, and high-volume users | General crypto traders and retail users |

| Regulatory Complexity | Higher due to leveraged trading & derivatives laws | Lower, similar to standard crypto trading rules |

Multi-Chain Support for Our Crypto Derivatives Exchange Platform

A powerful crypto derivatives exchange platform must be flexible enough to support a diverse range of assets, deliver seamless trading experiences, and enable cross-chain operations. That’s why our crypto derivatives exchange development framework is designed to integrate with multiple blockchain networks. It ensures high performance, interoperability, and faster settlement cycles.

Whether you're planning to launch perpetual swap markets, multi-chain margin wallets, or asset-backed derivative products, our architecture supports a wide range of L1 and L2 ecosystems.

Supported Blockchain Networks:

Bitcoin (BTC)

Ideal for BTC-backed derivative products, long-term settlement, and high-liquidity trading pairs.

Ethereum (ETH)

The most popular chain for smart contracts, enabling seamless integration of futures, options, and custom derivatives.

BNB Chain (BSC)

Known for low fees and fast transaction finality. It is perfect for scalable derivatives trading.

Polygon (MATIC)

A Layer-2 chain offering ultra-low gas fees and high throughput for high-frequency derivatives markets.

Solana (SOL)

Extremely high TPS, making it suitable for real-time trading engines and advanced derivatives.

Avalanche (AVAX)

Built for sub-second finality and supports complex financial instruments at scale.

Tron (TRX)

Popular in emerging markets with fast, cost-efficient transactions for margin trading.

Custom L1/L2 Blockchains

For businesses wanting full control, custom consensus, and tailor-made derivatives exchange development solutions.

What Makes Suffescom the Smart Choice for Crypto Derivative Exchange Development?

Suffescom continues to lead as a top cryptocurrency exchange development company by delivering secure, scalable, and innovation-driven trading platforms.

1. Fast & Efficient Exchange Deployment

We accelerate your go-to-market journey with agile development, pre-built modules, and automated testing pipelines. You launch faster without sacrificing performance, security, or scalability.

2. Global Compliance & Regulatory Support

We guide you through licensing, AML/KYC regulations, data laws, and region-specific compliance requirements. Your exchange stays legally aligned whether you operate in the US, EU, UAE, or Asia.

3. Complete End-to-End Development Expertise

From initial strategy and UI/UX design to smart contract development, liquidity integration, QA, and post-launch support. We manage the entire lifecycle. You get a fully engineered exchange ready for global markets.

4. Ultra-Low Latency Trading Engine

Our matching engines handle millions of transactions per second with near-zero latency. Users enjoy instant order execution, stable performance, and uninterrupted trading during peak volatility.

5. Seamless Third-Party Integrations

We integrate KYC tools, payment gateways, custody solutions, analytics dashboards, and liquidity partners smoothly into your ecosystem. It reduces operational friction and boosts reliability.

6. Global Compliance & Regulatory Support

We guide you through licensing, AML/KYC regulations, data laws, and region-specific compliance requirements. Your exchange stays legally aligned whether you operate in the US, EU, UAE, or Asia.

FAQs

1. Is launching a crypto exchange still profitable in 2026?

Yes. With global crypto volumes crossing $2.3 trillion+ monthly, exchanges remain one of the most profitable blockchain businesses. High-frequency traders, perpetual markets, and derivatives products ensure consistent revenue even during volatile markets.

2. How long does it take to launch a fully functional crypto exchange?

A white-label launch takes 3–6 weeks, while a fully custom exchange may take 3–6 months, depending on features, liquidity modules, compliance, and integration requirements.

3. What is the typical budget required to build a crypto derivatives or spot exchange?

A basic white-label exchange starts around $20,000–$60,000, whereas a custom-built derivatives exchange ranges from $80,000–$400,000+ based on complexity, security, tech stack, and regulatory scope.

4. What tech stack do you use for crypto exchange development?

We use modern, scalable frameworks like Node.js, Go, Rust, Redis, Kafka, PostgreSQL, React, and microservices, along with high-speed matching engines optimized for derivatives markets.

5. Do you support multi-chain and cross-chain integration?

Yes. Your exchange can integrate multiple chains such as Bitcoin, Ethereum, BNB Chain, Solana, Avalanche, Tron, and custom L1/L2 networks along with flexible asset listing and settlement modules.

6. Can the platform handle high-frequency trading (HFT)?

Absolutely. The exchange supports low-latency APIs, FIX protocol, WebSocket streams, and scalable matching engines specifically optimized for HFT environments.

7. What security measures do you implement for crypto exchange development?

Features include multi-sig wallets, cold storage, DDoS protection, rate-limiting, WAF, transaction monitoring, encryption, custody integrations, and periodic security audits.

8. Can you help the exchange comply with global regulations?

Yes. We support compliance frameworks such as GDPR, MiCA, FinCEN, and FIU norms, and we can assist with licensing requirements for your target region.

9. What is white-label exchange software, and how fast can it be deployed?

It’s a ready-made platform with core modules built in. It can be customized and deployed within 3–6 weeks, enabling a faster, more cost-effective launch.

10. Can we add custom branding and UI changes?

Yes. You can redesign dashboards, themes, trading views, and mobile interfaces to fully align with your brand identity.

11. Do you offer custom-built crypto exchange development?

Yes. If you need unique workflows, risk engines, market logic, or specialized derivatives features, we build everything from scratch.

12. Can the exchange scale with my trading volume?

Yes. The platform is built on microservices, enabling horizontal scaling, load balancing, and distributed caching to support ultra-high throughput.

13. Can I add new tokens, blockchains, or features later?

Absolutely. The modular architecture allows you to add new markets, liquidity providers, or product lines without downtime.