Building a crypto banking solution in 2026 is a strategic move to be relevant in the digitized financial space. With users embracing a world of decentralized wallets, instant settlements, and borderless payments, companies are thinking of ways to build a crypto banking solution that balances security, usability, and compliance. The emergence of blockchain networks, coupled with increased demand for crypto-to-fiat payment tools.

Simultaneously, this has created a vast opportunity for any business that aims to launch a crypto banking app. Be it the facilitation of faster peer-to-peer transfers, the integration of multi-chain wallet infrastructure, or DeFi-driven earning modules, it is well beyond the simple storage of crypto since customer expectations are rising equally fast. Businesses often ask how to build a crypto banking solution that is secure, scalable, and compliant. Here is a step-by-step roadmap to build a scalable, compliant, and future-ready crypto banking platform in 2026.

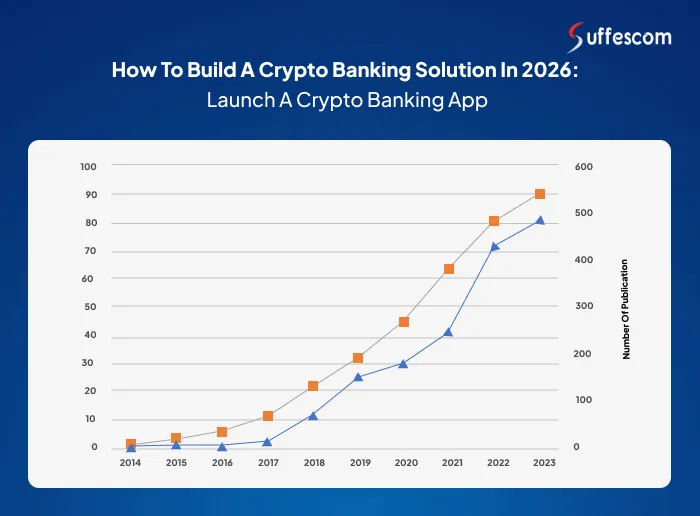

According to Globe Newswire, the blockchain in the fintech market underpins crypto banking solutions. It is projected to surge from around USD 7.6 billion in 2025 to USD 154.1 billion by 2033, growing at a CAGR of 45.7%.

A crypto banking platform is basically a modern alternative to traditional digital banking, built on decentralized blockchain networks rather than legacy banking rails. Instead of relying on a central authority to manage funds, these platforms enable users to store, transfer, and manage digital assets with secure blockchain protocols. As everything runs on distributed systems, businesses get to offer financial services faster, more transparently, and with greater flexibility.

Accelerate your plan to create a crypto payment app with enterprise-grade modules and a future-ready blockchain foundation.

A future-ready crypto bank starts with the right foundations. These essential features shape the core of crypto banking apps, helping brands deliver secure, seamless, and trustworthy digital finance experiences.

A crypto banking platform needs a secure multi-currency wallet to help users store, send, and receive different digital assets in one place. This makes the overall experience more seamless.

With built-in peer-to-peer payments and instant cross-border transfers, users can move funds globally without delays. This also supports smooth cryptocurrency payments for everyday transactions.

Adding integrated cryptocurrency exchanges enables users to buy, sell, and convert tokens inside the app. This reduces dependency on third-party platforms and keeps engagement within your ecosystem.

To make your app more competitive, DeFi-based staking and lending allow users to earn passive rewards. It naturally positions your platform as a complete decentralized finance (DeFi) solution.

Automated smart contracts handle transactions and service logic without manual work, improving efficiency and trust. This is crucial when you create a crypto payment app or scalable banking product.

A role-based admin panel helps teams manage users, monitor activities, and maintain compliance. It becomes the operational backbone when you launch crypto banking app solutions.

Built-in KYC/AML verification protects your platform from fraud and ensures regulatory compliance. This feature is essential when calculating the cost to build a crypto banking app.

Instant crypto-to-fiat conversion lets users switch between digital assets and traditional currencies based on live rates. It’s especially valuable for merchants and global users.

Providing easy analytics and tax-ready reports helps users track their activity without external tools. This improves transparency and financial planning.

Using cold storage and multi-signature authentication enhances asset protection and reduces hacking risks. These measures strengthen the security layer of any blockchain-based banking system.

With the expansion of the digital finance ecosystem, companies now have multiple ways to enter the market; each model serves a different type of user demand. Instead of treating "crypto banking" as one single category, therefore, it's more useful to look at the specific solutions companies. Here are the most common and commercially viable types available today.

Custodial apps manage users’ private keys, making crypto onboarding easier for beginners and regulated markets. On the other hand, non-custodial models give users full control over their keys and assets, appealing to privacy-focused, Web3-native audiences. Both models remain in strong demand depending on compliance goals and user expectations.

These apps bridge digital assets with everyday financial use. They enable instant conversions between crypto and local currencies, helping users spend, remit, or cash out without moving funds to an exchange. As a result, crypto-to-fiat features have become a core expectation in modern crypto banking app development.

In this model, exchanges take up the role of the liquidity engine. Indeed, users can sell, buy, manage portfolios, and view market insights, but they also have the ability to use banking features like savings or P2P transfers. Enterprises choose this route when they want strong revenue potential through trading fees, staking, or premium investment tools.

DeFi-driven platforms utilize smart contracts rather than intermediaries. They plug into protocols like Aave or Compound to offer lending, staking, and yield-generation services. This model is fitting for businesses targeting transparency-focused users who would want more decentralized, cross-chain, and non-custodial banking experiences.

These platforms enable the merchant to accept cryptocurrency payments for instant settlement, reducing reliance on card processors. With lower fees and the potential for global transfers, the solution is in high demand within eCommerce, retail, hospitality, and cross-border commerce.

Crypto neobanks blend digital banking with crypto-native tools, such as multi-currency wallets, crypto-to-fiat debit cards, P2P payments, staking features, and built-in exchanges. This model is ideal for challenger banks or brands that want to offer a fully integrated financial experience across both fiat and decentralized blockchain networks.

New FinTech teams use these platforms to skip long development cycles and launch basic banking features much sooner.

Modern challenger banks use crypto neobank app development to enable multi-currency accounts, faster settlements, and seamless crypto–fiat payment flows.

Crypto exchanges add banking rails to make deposits, withdrawals, and account verification easier for their users.

Companies with global transactions use them to simplify fund movement, automate settlements, and keep better records.

Remittance firms tap blockchain rails to reduce transfer fees and speed up payouts across regions.

Merchants use crypto-friendly banking tools to accept payments, manage wallets, and create smoother checkout experiences.

Most crypto banking platforms struggle with liquidity gaps, slow rebalancing, and poor treasury visibility. This section fills that missing piece.

Here’s how a well-designed architecture strengthens both regulated banking apps and DeFi-centric platforms:

Create stable liquidity pools that support real-time transactions, staking, swaps, and cross-border settlements without service delays.

Automated rebalancing ensures your platform never becomes over-exposed to a single asset.

This is especially useful when building white label crypto bank software, where stability and continuous uptime matter for enterprise clients.

Intelligent routing moves transactions through the most cost-efficient and fastest available exchange path.

Implement low-risk yield models such as short-term staking, liquidity provisioning, or off-chain treasury instruments. This ensures predictable returns without compromising regulatory alignment.

Whether you're creating a DeFi-driven product or a compliant, regulation-ready digital bank, this treasury layer ensures smoother liquidity flow, transparent tracking, and stronger financial management.

These are the practical steps any business must follow when learning how to build a crypto banking solution from scratch.

It starts by understanding the users' needs, business goals, and market trends. This allows defining the scope of crypto banking app development based on real demand.

Furthermore, you outline the essential modules, including wallet, exchange, and P2P transfer. This ensures that the blockchain-based banking system is scalable and future-ready.

Provides a smooth and intuitive interface for both the crypto payment application and the crypto-to-fiat application. Clean navigation increases trust and interest among users.

Here, developers create the foundation such as nodes, APIs, and wallet logic. This step defines how securely and efficiently you build a crypto banking platform properly.

Implement a crypto payment gateway that supports global transactions in real time, including merchant processing. This adds to the financial capability of the platform.

Adding cryptocurrency exchanges and peer-to-peer payment modules creates trading and instant transfer options for users. This will keep most activities inside your ecosystem.

A complete KYC/AML and licensing layer is set up to meet regulatory standards. It has safely onboarded customers and protects the platform against legal risks.

Deep testing and smart contract audits are carried out with the system before launching. This step identifies vulnerabilities and strengthens platform security. For a quicker, lower-risk launch, many teams validate an MVP using a white label digital banking app before investing in a full custom build.

Finally, the solution is deployed to live servers, payment nodes, and monitoring tools. This is the very stage where you officially launch the crypto banking app to real users.

Get a tailored roadmap for crypto banking app development and start your product build the right way.

| Category | Technologies / Tools |

| Blockchain Networks | Ethereum, Solana, Polygon, BNB Chain, Avalanche |

| Smart Contract Languages | Solidity, Rust, Vyper, Move |

| Backend Technologies | Node.js, GoLang, Python, Java Spring Boot |

| Frontend Frameworks | React.js, Next.js, Angular, Vue.js |

| Mobile App Frameworks | Flutter, React Native, Kotlin, Swift |

| Databases & Storage | PostgreSQL, MongoDB, Redis, IPFS, Amazon S3 |

| Wallet & Key Management | Web3.js, Ethers.js, WalletConnect, Fireblocks, MetaMask SDK |

| Infrastructure & Cloud | AWS, Google Cloud, Kubernetes, Docker, Terraform |

| Security Stack | HSM Modules, Multi-Sig Security, Cold Storage, PKI Infrastructure, Zero-Knowledge Proofs |

| Payment & Exchange Integrations | Crypto payment gateway integration APIs, Liquidity Aggregators, Fiat On-Ramp/Off-Ramp Providers |

1. VASP Licensing Requirements – Ensures your crypto banking platform legally operates as a Virtual Asset Service Provider in global markets.

2. Global AML/CFT Obligations – Aligns your app with anti-money laundering and counter-terrorism financing standards.

3. FATF Travel Rule Compliance – Enables secure data exchange between financial entities during crypto transfers.

4. GDPR + Data Localization – Protects user data while meeting region-specific privacy and storage laws.

5. Crypto Taxation Rules – Helps define how digital assets are reported, taxed, and reconciled across jurisdictions.

6. Cross-Border Compliance Examples – Shows how regulations differ in the EU, USA, UAE, and Singapore for global operations.

Choosing the right pricing model helps you estimate the true cost to build a crypto banking app and ensures your development roadmap stays predictable, scalable, and aligned with long-term goals.

Ideal for startups that already know the exact steps to develop a crypto banking platform and want predictable timelines and cost.

Best for enterprises building large ecosystems with exchanges, wallets, and AI modules. Offers complete control and ongoing iteration.

Combines fixed modules, such as wallet, KYC, and dashboard, with variable add-ons (DeFi, staking, and P2P). Ideal for brands scaling in multiple phases.

To build a modern crypto payment app, it should be a tightly connected system where every building block supports fast, secure, and global transactions. Here is a quick breakdown of the key modules that are needed for the whole architecture together:

Everything starts with the dedicated merchant dashboard, which provides the business with full visibility over its transactions, settlements, refunds, and payment activity. Such a dashboard serves as an operational backbone of the crypto payment app, enabling merchants to manage payments in real-time without having to rely on tools outside the application.

The platform has been designed with seamless billing in mind. It incorporates a crypto invoicing system that generates payment requests automatically in various tokens. This means merchants can easily accept cryptocurrency payments, while users receive timely, accurate invoices directly linked to blockchain confirmations.

Once the payments are confirmed, an automated settlement engine is activated. This module processes payouts in crypto or fiat, performs asset conversions if needed, and routes settlements to merchant wallets or bank accounts. It will keep the entire flow smooth.

Finally, global payment routing ensures that each and every transaction includes BTC, ETH, stablecoins, or altcoins. It will move through the fastest and most cost-efficient blockchain network available. This component enhances the system's scalability, enabling the creation of a crypto payment that supports cross-border transactions without delays.

Power your product with AI, RWA tokenization, and cross-chain infrastructure designed for future-ready banks.

Choosing the right pricing model gives businesses a realistic roadmap for budgeting, hiring, and planning every stage of crypto banking app development. It also clarifies how the cost to build a crypto banking app aligns with long-term product goals and operational scalability.

Earn commissions on every token trade processed within the in-app cryptocurrency exchange engine.

Charge a small percentage on staking rewards generated through your integrated DeFi or yield farming module.

Platforms can apply withdrawal fees for crypto and fiat transfers depending on network load and liquidity.

Offer premium banking tiers with features like faster settlements, priority support, or advanced analytics.

Profit from the interest spread between borrower APR and lender APY in lending/borrowing modules.

Collect fees on merchant withdrawals or crypto payment settlements via your white label crypto payment gateway.

As the sector evolves at lightning speed, businesses are relying on the right blockchain development company to stay ahead of upcoming innovations and regulatory shifts.

DID solutions will replace traditional logins with blockchain-backed identity verification. This reduces data theft risks and gives users full control over their digital identity.

Stablecoins and central bank digital currencies will become core payment assets in crypto banking apps. Their adoption will bring more stability and open the door for regulated financial use cases.

Embedded finance will merge with crypto banking, enabling apps to offer a range of services, including payments, lending, investments, and DeFi features. It is directly inside existing platforms without requiring separate financial apps.

As decentralized networks evolve, crypto banks will gain faster transaction speeds, lower fees, and improved interoperability. This opens new possibilities for large-scale enterprise adoption.

More businesses will adopt crypto-to-fiat app solutions to support global payments, merchant settlements, and treasury operations. This shift is driven by the need for faster, borderless transactions.

Financial institutions are expected to adopt staking-as-a-service and tokenized treasury management. This trend will bring traditional corporate finance closer to decentralized asset management.

At Suffescom, we empower companies to provide the building blocks for scalable and compliant digital finance products. Being one of the major crypto bank development company, we provide a modular and secure architecture that enables the enterprise to bring in crypto-to-fiat spending apps, multi-chain wallets, and modern banking workflows with no need to build everything from scratch.

Our framework serves as a frictionless integration point between blockchain networks and traditional financial rails. This enables your users to convert, manage, and spend their digital assets seamlessly, whether it is for everyday purchases, cross-border transfers, or portfolio diversification.

One can develop a crypto banking platform by defining features, choosing a blockchain network, integrating crypto wallets, adding compliance layers, and deploying secure payment modules. A development partner will help in streamlining the entire process of crypto banking app development.

The cost of creating a crypto banking app will depend on features such as KYC/AML, wallet integration, DeFi modules, and exchange engines. It ranges from $40,000 on average to more according to the level of complexity and personalization involved.

Core features include multi-currency wallets, P2P transfers, crypto-to-fiat conversion, staking, built-in exchanges, analytics, and strong security layers. These features are the backbone of a modern blockchain-based banking system.

Crypto wallet integration connects your application to blockchain nodes for the secure storage, sending, and receiving of digital assets. This provides complete control for users while maintaining transactions that are both transparent and verifiable.

Yes, you can include crypto payment gateway integration for merchant payments, cross-border transfers, and real-time settlement. It is necessary when you are planning to develop a crypto payment app or a merchant-focused solution.

You can initiate custodial apps, non-custodial wallets, DeFi-powered platforms, crypto-to-fiat apps, exchange-based banking systems, and full crypto neobank app models, among others, according to your business goals.

Yes, crypto banking platforms fully align with regional regulations when designed with KYC, AML, and licensing modules. Compliance is a very essential step as you launch crypto banking app services globally.

Absolutely, you can integrate cryptocurrency exchanges, enabling users to purchase, sell, and swap assets in real time. That keeps trading activity inside your ecosystem and boosts user engagement.

You can make use of Ethereum, Solana, Polygon, BNB Chain, or custom decentralized blockchain networks. It all depends on speed, cost, and the kind of features you want to build.

A basic crypto app would take 10–14 weeks, while more advanced platforms, including DeFi, exchange engines, and AI modules, may be ready in roughly 4–6 months. Timing varies according to specific customization needs.

Fret Not! We have Something to Offer.